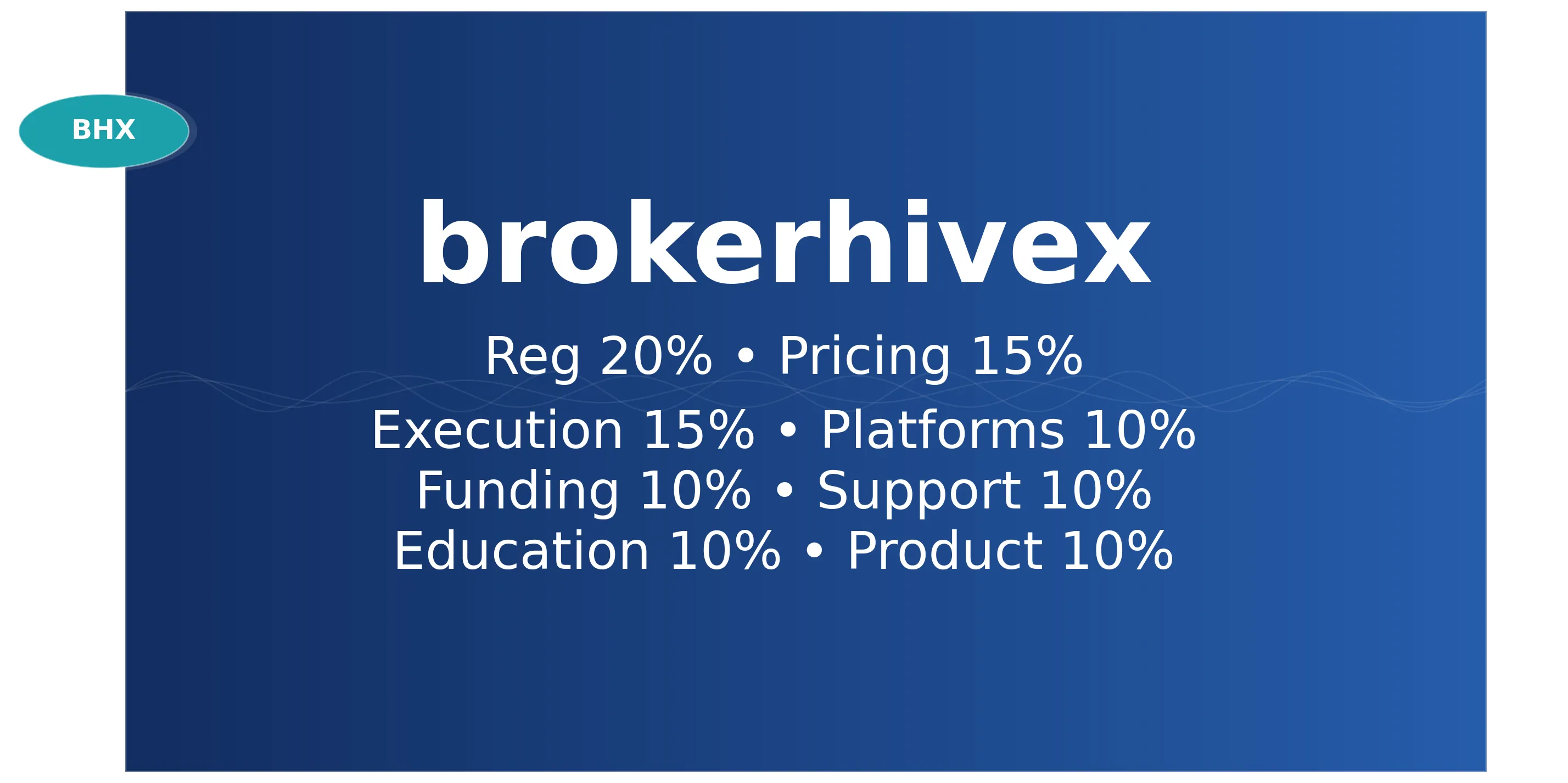

BrokerHiveX scoring criteria: eight dimensions and default weights

Summary:BrokerHiveX uses an 8-dimension 10-point system with clear weights (e.g., 20% for supervision). Each item requires official evidence and verification date; quarterly review, major changes are updated within 7 days

Regulation — 20% : Licensing and regulatory level, entity/domain consistency, negative balance protection and compensation, audit/compliance records

Pricing — 15% : 30–90 day average spread + round-trip commission + overnight fee/hidden fee (all-in cost)

Execution — 15% : Fill rate, execution latency, median/distributed slippage, rejections/requotes, and availability of public execution reports

Platforms — 10% : MT4/MT5/cTrader/TradingView coverage, API/backtesting, VPS/cloning, mobile quality

Funding — 10%: Channels and localization, timeliness (preferably T+0-T+1 for withdrawals ), fees, success rate, and exception handling

Support — 10% : Service hours (24/5 or 24/7), multiple languages, SLA/first call time, dedicated account manager, and closed-loop support

Education — 10% : Curriculum and research depth, update frequency, and advanced content (quantitative/risk control/backtesting)

Product Range — 10% : Breadth and depth of forex/indices/commodities/stocks/crypto/bonds, micro contracts, thematic baskets

Total score = Σ (dimension score × weight), rounded to 1 decimal place ; Grade: Top Tier ≥9.0 | Reliable 7.0–8.9 | Average 5.0–6.9 | Caution <5.0 .

Radar chart axis order (fixed) : Regulation → Pricing → Execution → Platforms → Funding → Support → Education → Product Range (clockwise), scale 0–10, labeled “x/10”.

1) Regulation — 20%

What we look at : Regulatory level and licensing status, website/entity/license number consistency, negative balance protection/investor compensation, major compliance events and audit disclosures.

Hard evidence : Regulatory list entries (license number, full name of the entity, registered address), official website Legal/Regulation, and investor compensation and protection clauses.

Why is it this score? (Tiering rules)

9-10 : At least one long-term license from a strong regulator (e.g. UK/EU/Australia); consistent global protection levels (with clear compensation/negative balance protection); public audits/reports ; and no major negative enforcement actions.

7–8 : Multiple entities regulated, with clear disclosure but inconsistent levels of protection (varies across regions); no significant negative impact.

5–6 : Mainly weak regulation/offshore or incomplete disclosure; unclear terms.

≤4 : Revocation/suspension , clone/fake site, major law enforcement or anti-money laundering negative record.

How to improve scores : unify global protection levels; newly enhance regulatory licenses; publish audited compliance/financial reports; and improve complaint and compensation channels.

2) Pricing — 15%

What we look at : 30–90 day TWAS time-weighted average spread (intraday/intraday), round-trip commission, overnight fees, hidden costs (inactivity/currency conversion/withdrawal).

Conversion formula (all-in) :

All-in (pip) = average spread (pip) + round-trip commission ($/lot) ÷ 10 (1 pip per lot for EURUSD ≈ $10).

Example: 0.0 + $6/lot ≈ 0.6 pip .

Why is it this level? (Tier threshold, EURUSD reference)9–10 : Public TWAS for minute/minute products ; normal all-in ≤ 0.7 pip ; simple and transparent fee terms.

7–8 : Typical spreads and commissions are disclosed; the typical all-in is 0.8–1.2 pips ; hidden fees are clearly disclosed.

5–6 : Only “minimum spread” is given or insufficient disclosure; normal all-in ≥1.3 pips .

≤4 : Expenses are complex and hidden, and there is a large deviation between actual costs and disclosed costs.

How to improve your score : Publish a verifiable average intraday spread ; reduce commissions for high-frequency accounts; clarify high volatility/holiday markup rules; disclose slippage and requote ratios.

3) Execution — 15%

What we look at : Fill rate, execution latency, slippage distribution (positive/negative), rejection/requote rate, and whether monthly execution reports or third-party audits are published.

Why is it this score? (Tier anchor point, rolling 30 days)

9–10 : Fill Rate ≥97% , Median Latency ≤120ms , Positive Slippage ≥30% , Requote/Reject ≤1% ; Monthly execution quality reports are published continuously and sampled/audited.

7–8 : Fill Rate ≥95% , Latency ≤150ms , with slippage distribution or equivalent disclosure.

5–6 : Only marketing description, no quantitative disclosure or general indicators.

≤4 : Rejection/requote is high, slippage is abnormal and there is no explanation.

How to improve scores : Publicly publish execution data dashboard (speed/slippage/fill rate), introduce independent audit and backtracking samples; provide event period performance for major products.

4) Platforms — 10%

What we look for : MT4/MT5/cTrader/TradingView/WebTrader coverage, API/backtesting/quantitative tools, VPS/copy trading, mobile app quality, and update frequency.

Why is it this score? (Classification)

9–10 : Multi-platform (including TradingView/cTrader or equivalent) + API/backtesting + VPS/cloning + high-quality iteration on mobile devices.

7–8 : Mainly MT4/MT5, with general but stable and reliable additional tools.

5–6 : Single platform or missing functionality.

≤4 : Platform is unstable or frequently malfunctions.

How to improve your score : Complete MT5/TradingView/cTrader; open API/backtesting; improve mobile terminal and risk control/quantitative tools.

5) Funding — 10%

What we look at : Channel breadth, localization (local transfer/fast channel), time to payment, fees, failure/rejection rate, and exception handling.

Why is it this score? (Grade anchor point)

9-10 : Instant deposits, T+0-T+1 withdrawals; 0% platform-side handling fee (third-party fees clearly explained); channel success rate ≥ 98% ; processing time SLA clearly stated.

7–8 : Most withdrawals are ≤ T+2 ; fees and terms are clear.

5–6 : Insufficient localization/slow processing/incomplete information.

≤4 : Long-term withdrawal anomalies or a large number of complaints.

How to increase your score : Expand local deposits and withdrawals; disclose channel-level average duration and success rate ; unify fee thresholds; establish an abnormal escalation path.

6) Support — 10%

What we look for : availability (24/5 or 24/7), multilingualism, response speed (first call), SLA, dedicated RM, and issue closure.

Why is it this score? (Grade anchor point)

9–10 : 24/7 or 24/5+SLA ; online first call ≤ 60 seconds ; key language coverage; active accounts have RM ; closed-loop follow-up.

7–8 : 24/5 multi-channel support; fast response; comprehensive FAQ/knowledge base.

5–6 : Average availability or severe queueing during peak hours.

≤4 : Slow response and unstable channels.

How to improve : Add 24/7 coverage and SLA; expand language/hotline; RM coverage; disclose CSAT/handling time data.

7) Education — 10%

What we look at : curriculum system (beginner → advanced → quantitative/risk control), research report depth, update frequency, backtesting/case studies, and tests/certifications.

Why is it this score? (Classification)

9–10 : Systematic courses + backtesting cases + certification path; weekly updates or more; multi-level learning routes.

7–8 : Research and courses coexist, with stable updates and reasonable depth.

5–6 : Focuses on information/news; lacks systematicity.

≤4 : The content is scarce or has not been updated for a long time.

How to improve scores : Build a complete course tree; introduce backtesting/assignments and certifications; maintain a regular update schedule.

8) Product Range — 10%

What we look for : Breadth and market depth for FX/Indices/Commodities/Stocks/Crypto/Bonds, micro contracts , thematic baskets , regional availability, and leverage clarity.

Why is it this score? (Classification)

9–10 : Multi-asset + depth (individual stocks/ETFs/bonds/futures/options CFDs, etc.), with micro contracts/thematic baskets .

7–8 : Covers mainstream assets and meets most strategies.

5–6 : Narrow assortment or poor regional availability.

≤4 : Limited choices and incomplete information.

How to improve scores : expand product categories and depth; provide micro/themed products; clearly mark regions and leverage.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.