BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:This comprehensive guide explains how to cross-check forex platforms with the National Futures Association (NFA BASIC) and the Commodity Futures Trading Commission (CFTC), helping investors verify their NFA ID, confirm their license status, compare CFTC registrations, and identify high-risk companies on the Red List. It also addresses frequently asked questions: Is the platform regulated by the NFA? Is it compliant and reliable?

The U.S. foreign exchange and derivatives markets are jointly regulated by the CFTC (Commodity Futures Trading Commission) and the NFA (National Futures Association) .

CFTC : A government regulatory agency responsible for approving and regulating futures, derivatives, and retail forex brokers.

NFA : A self-regulatory organization. All legal foreign exchange traders must be members of NFA.

Investor FAQs:

Is this platform really regulated by the NFA?

Is the company's NFA ID authentic?

Has it been named by the CFTC or included in the Red List warning list?

📌 Official inquiry portal:

Open the 🔗 NFA BASIC system .

Enter your company name or NFA ID .

View the results page and focus on checking:

Membership Category : FDM (Foreign Exchange Dealer), FCM (Futures Commission Merchant), IB (Introducing Broker), CPO/CTA.

Status : Active/Withdrawn/Barred.

Disciplinary Actions : Whether there is a record of violations.

Location : Whether the registered address is consistent with the official website.

Even if NFA BASIC has results, further cross-verification is necessary:

Check CFTC Registrants to see if the company is registered.

Check the CFTC Red List to see if your company has been named as an unregistered institution marketing to US clients .

📌Note : Once a platform appears on the Red List, it means that it is illegally targeting US investors.

NFA ID : 0325821

Status : Active

Category : FDM (Retail Forex Dealer)

Registered address : 17 State Street, Suite 300, New York, NY 10004, USA

NFA BASIC Page : 🔗 OANDA Query Results

CFTC Registration Information : OANDA is also listed on the CFTC registration list

Official website consistency : 🔗 OANDA US official website

Result: Information fully matched → Compliant✅

Company statement : Claims on the official website that it is regulated by the United States.

Actual situation : Not registered with NFA BASIC or CFTC.

Evidence : CryptoFXTrade has been included in the CFTC Red List warning list .

Result: Typical "fake US regulation" scam → High risk ❌

Misappropriation of NFA numbers

The platform forges or misuses the real company's NFA ID.

During verification, the company name/address was found to be inconsistent → Highly suspicious.

Deregistering a company impersonating

Some companies have withdrawn (cancelled) , but still claim on their official website that they are "regulated by NFA."

Identity blur

It is only an IB (Introducing Broker) , but pretends to be a "full license broker".

Red List Roll Call

The CFTC Red List is the most intuitive high-risk warning signal, and appearing on the list indicates unregulated operations.

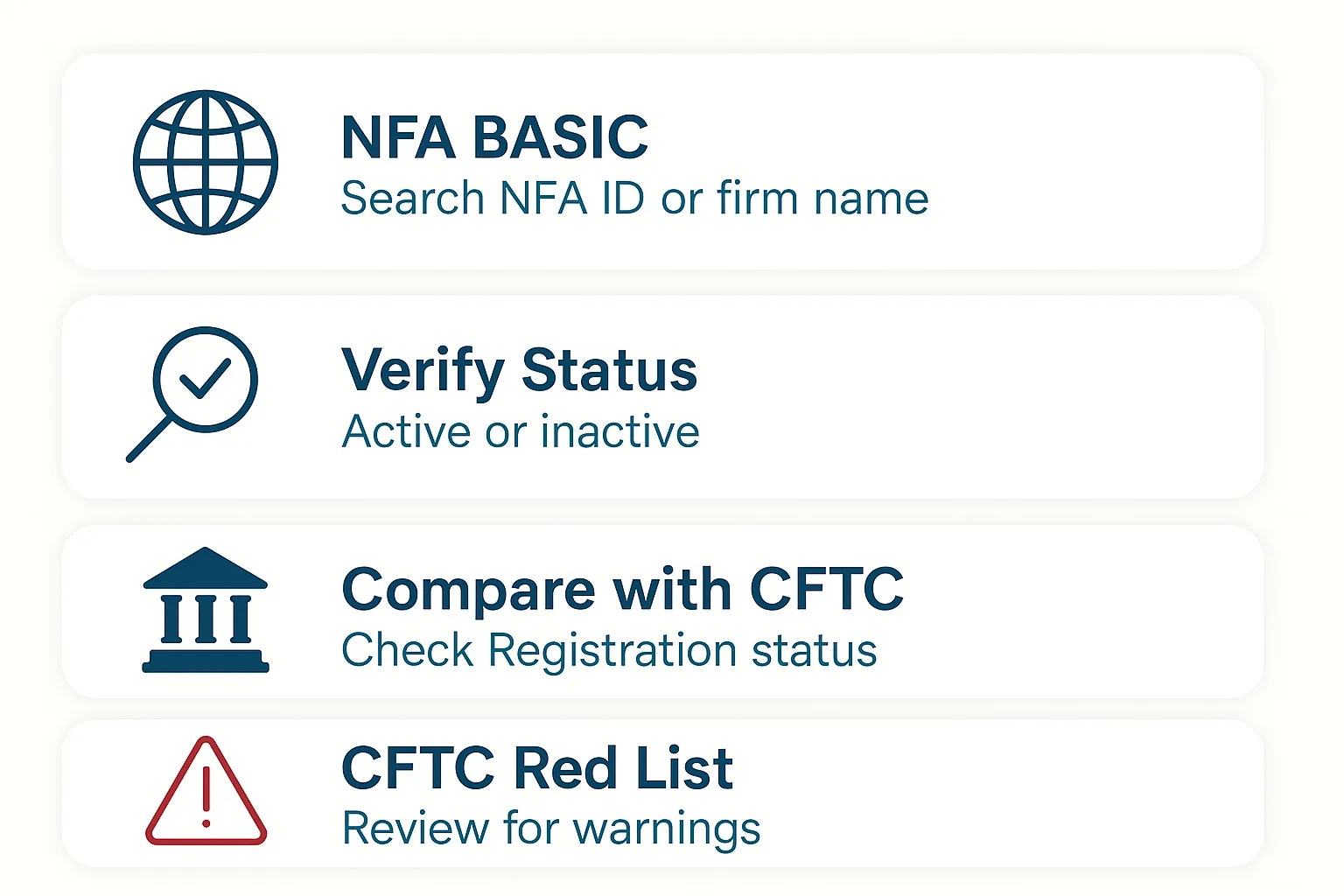

🔄 Standard process:

Enter your NFA ID/company name in 🔗 NFA BASIC .

Confirm status (Active/Withdrawn/Barred) + verification category.

Verify registration on the 🔗 CFTC registration list .

Check for warnings on the CFTC Red List .

Three elements must be matched during verification: NFA ID + company name + address.

Avoid all companies that appear on the CFTC Red List .

If you find a suspicious platform, you can:

🔗CFTC Whistleblower Program

Submit a report.

Cross-checking the NFA BASIC and CFTC lists is the most important means for investors to identify the authenticity of a forex platform.

Never trust the "regulatory number" displayed on the official website alone, and cross-verify it through official channels.

Compliant companies like OANDA have their information verified by the NFA/CFTC; while fake companies like CryptoFXTrade will be clearly named by the CFTC.

📌Further reading

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.