Malta MFSA Regulatory License Inquiry Process | How to Verify Forex and Crypto Platform Compliance with the Malta Financial Services Authority

Summary:This research-level analysis provides a comprehensive look at the Malta Financial Services Authority (MFSA) licensing process. This article covers the regulatory background, license types, penalties, and alignment with the EU's MiCA (MiCA) regulations. It also provides detailed steps to help investors identify compliant and illegitimate platforms.

1. What is the MFSA? Background and Regulatory Status

The MFSA (Malta Financial Services Authority) is the only financial regulatory body in Malta. Since its independence in 2002 , it has been responsible for the overall supervision of the country's financial services system.

📌 The MFSA’s unique position

Integrated supervision : Unlike the "multi-regulatory model" in many countries, the MFSA is Malta's sole financial regulator, covering banks, insurance companies, investment companies, foreign exchange brokers, payment institutions and virtual asset service providers.

EU member states : The MFSA’s regulatory framework is consistent with EU regulations (MiFID II, PSD2, MiCA, etc.) , and licensed institutions enjoy certain passporting effects within the EU.

"Blockchain Island" Policy : In 2018, Malta launched the Virtual Financial Assets Act (VFA Act) , becoming one of the first countries in the world to legislate for virtual assets and crypto exchanges.

2. Why do you need to check the MFSA license?

Confirming the legitimacy of supervision

A genuine licensed company must appear on the MFSA Public Register .

It is illegal to declare that a company is “regulated” without permission.

Prevent false advertising

Many overseas foreign exchange or cryptocurrency platforms use the name of "Malta" to package themselves, but in fact they only complete the company registration in Malta (Companies House) and do not have MFSA authorization.

Distinguishing between “registered companies” and “regulated institutions”

Registering a company in Malta does not mean obtaining a license;

Must be verified through the MFSA official website.

Investor Protection

The MFSA will publish penalty and revocation notices for non-compliant institutions to help investors avoid risks in advance.

📌 Official website:

III. Types of licenses regulated by the MFSA

1. Investment and foreign exchange

Investment Services License : covers foreign exchange, contracts for difference, and securities brokerage business;

Credit Institutions : Banking license, allowing to conduct foreign exchange and deposit and loan business;

Financial Institutions : Payment institutions, electronic currency institutions.

2. Insurance and Funds

Insurance Companies : insurance underwriting and reinsurance business;

Fund Managers : Fund management companies that comply with AIFMD and UCITS regulations.

3. Virtual assets and blockchain

VFA Service Providers : Registered under the VFA Act , including crypto exchanges, wallet hosting, ICO advisors, etc.

Technology Service Providers : Blockchain technology audit agencies.

4. Other financial related

Trustees & Company Service Providers : Trust and company services;

Corporate Service Providers : Company registration and agency services.

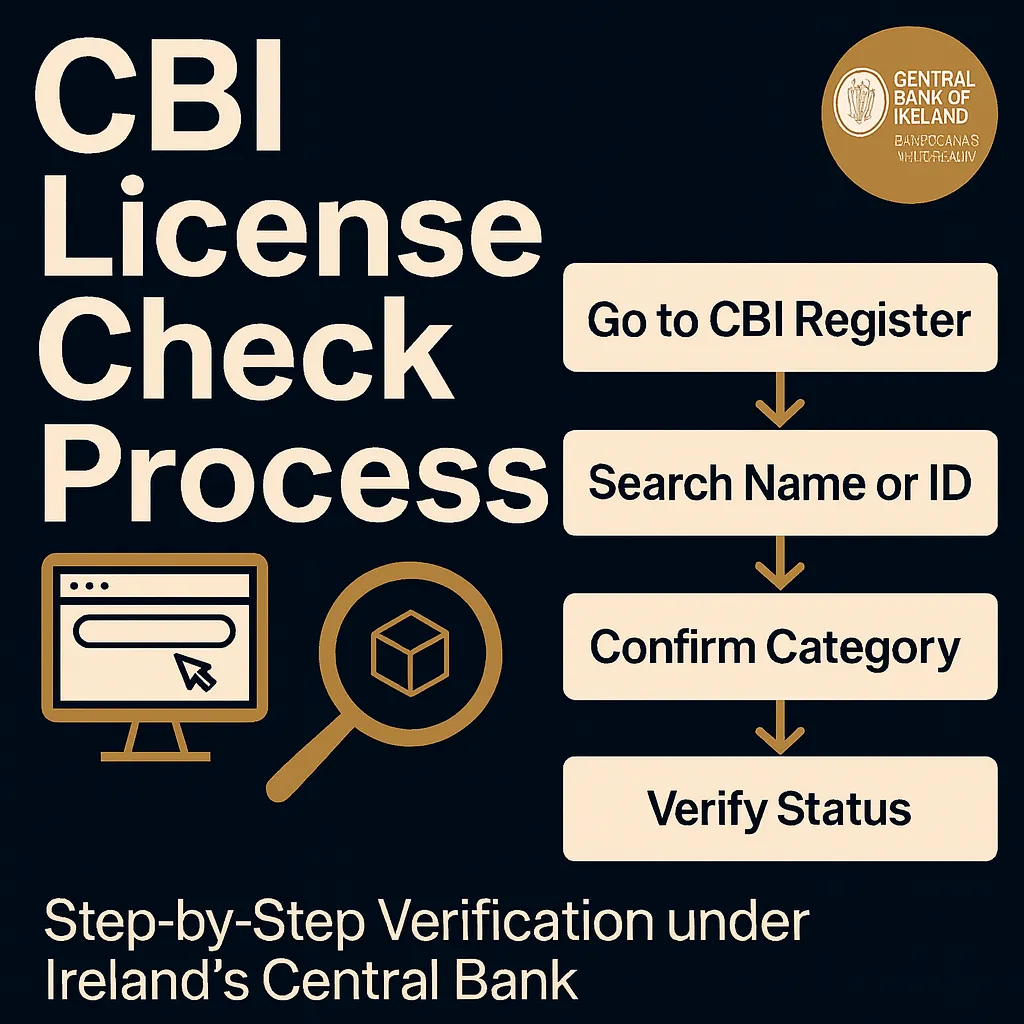

IV. MFSA License Inquiry Process (Step-by-Step)

Step 1: Access the MFSA Public Registry

Step 2: Select the query method

Search by Entity Name;

Filter by License Category;

Or enter the license number.

Step 3: Confirm authorization status

Licensed / Authorised → Compliant;

Suspended → Paused, be careful;

Cancelled / Revoked → The license has expired and is no longer eligible for supervision.

Step 4: View license details

Business scope (whether it can engage in foreign exchange/cryptocurrency/investment services);

Date of authorization;

Company registered address.

Step 5: Cross-validation

Confirm that the information published on the company's official website is consistent with MFSA data;

If the license number provided by the official website is not found in the MFSA → High risk.

Step 6: Check the penalty notice

👉 MFSA Warnings & Announcements

If the company has been warned or penalized by the MFSA → avoid it.

5. Practical Cases

✅ Compliance Examples

Company Name : Rex Markets Ltd (Example)

Category : Investment Services

Status : Licensed

Result : Compliant✅

❌ Risk Examples

Company Name : An overseas CFD platform

Promotion : "Regulated by Malta MFSA"

Query results : No record at MFSA, only appears at Companies House

Result : Unauthorized → High Risk ❌

VI. Typical Penalty Cases

2019 : The MFSA revoked the license of a virtual asset exchange for failing to meet AML/KYC obligations;

2021 : An investment company was fined €500,000 for insufficient capital and information disclosure violations;

2023 : The MFSA issued a warning, naming several overseas platforms for illegally using "Malta licenses" for false advertising.

VII. Investor Protection Mechanism

Public registry : You can check at any time whether the company is legally licensed;

Investor Complaint Channel : The MFSA has a complaint mechanism to accept investor rights protection;

AML/KYC requirements : All licensed institutions must comply with EU anti-money laundering regulations;

Investor Compensation Scheme : Some types of institutions are protected by the Investor Compensation Scheme (ICS) ;

Cross-border collaboration : The MFSA collaborates with ESMA (European Securities and Markets Authority) and EBA (European Banking Authority) .

8. Relationship between the MFSA and EU MiCA

MiCA (Markets in Crypto-Assets Regulation) will be fully implemented in 2024–2025;

MFSA's VFA Service Provider framework has been basically connected to MiCA;

Licensed VFA companies will be able to provide encryption services across Europe through the “EU passport” in the future;

If investors want to choose a long-term stable platform, they should give priority to MFSA licensed companies that have been compliantly connected to MiCA.

9. Common Misconceptions

“Company registration” = regulated ❌;

Only looking at the official website promotion , not checking with MFSA❌;

I thought all license types can do Forex/Crypto ❌;

Ignoring MFSA warning announcements can easily lead to falling into the trap of a black platform.

10. Investor Recommendations

Always check the MFSA Public Register before investing;

Check whether the company name, license number, category, and status are consistent;

Avoid companies that appear on the MFSA warning list;

Preference is given to firms compliant with EU MiFID II / MiCA .

11. Conclusion

The MFSA is a well-known financial supervisory authority in the European Union . Its regulatory scope is broad, covering both traditional finance and crypto assets.

Compliant companies : can be found on the MFSA public register;

Risky company : It only has a company registration number but pretends to be a "licensed institution".

Investors must strictly follow the Step 1 – Step 6 process and combine it with the penalty announcements published by the MFSA to effectively identify compliant and illegal platforms and reduce financial risks.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.