CMC Markets Review: In-depth Analysis of the World's Leading Forex and CFD Broker (FCA Regulation/Spreads/Trading Advantages/Fees Overview)

Summary:As a long-established British foreign exchange and CFD broker, CMC Markets has long been at the forefront of the global industry with its strong regulatory qualifications, low spreads, innovative trading technology and excellent customer service. This article will focus on its global regulation, product line, transaction fees and spreads, platform advantages and disadvantages, and comparison with mainstream brokers, providing the most authoritative evaluation and data analysis that is easily included in Google, to help investors systematically understand this industry giant

1. Company Background and Brand Strength

CMC Markets was founded in 1989 and is headquartered in London. It is one of the earliest financial institutions in the world to launch online CFD trading services. The company was listed on the London Stock Exchange (LSE: CMCX) in 2016. With the core mission of "bringing investors an excellent trading experience", it currently has more than ten branches around the world, serving more than 80,000 active users. CMC has long been committed to financial technology innovation and global compliance layout, and has won many international awards such as "Best Trading Platform" and "Best CFD Provider", with an outstanding brand reputation.

2. Global Regulatory Qualifications

CMC Markets attaches great importance to compliance operations and holds a number of global mainstream financial regulatory licenses:

UK FCA (Financial Conduct Authority)

CMC Markets UK plc is strictly regulated by the UK FCA (regulatory number 173730) to ensure independent custody of client funds and compliance with trading regulations.Australian ASIC

CMC Markets Asia Pacific Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC 238054) and provides local services to clients in Asia Pacific.Germany's BaFin, Singapore's MAS, Canada's IIROC, New Zealand's FMA, etc.

It has obtained mainstream regulatory licenses in many places in Europe, Asia Pacific and North America, and its international business is compliant and stable.Negative Balance Protection

CMC provides a negative balance protection policy for all retail clients to prevent account losses from exceeding principal in extreme market conditions.

3. Products and Trading Platform

Product Line:

Provides more than 12,000 products, including foreign exchange, global stock indices, stock CFDs, commodities, cryptocurrencies, etc.

The coverage of mainstream foreign exchange currency pairs is wide, meeting diverse trading needs.

Platform Technology:

Next Generation Platform : CMC’s proprietary flagship platform featuring advanced charting, order book depth, price alerts, automated trading and analytical tools.

MT4 platform : compatible with EA automation, rich indicators and script plug-ins, convenient for programmatic traders to use.

Mobile App : Fully functional, supports ordering of all categories, account management, and price warnings.

API interface : Provide powerful API support for high-frequency/quantitative and institutional clients.

4. Spreads and Fees

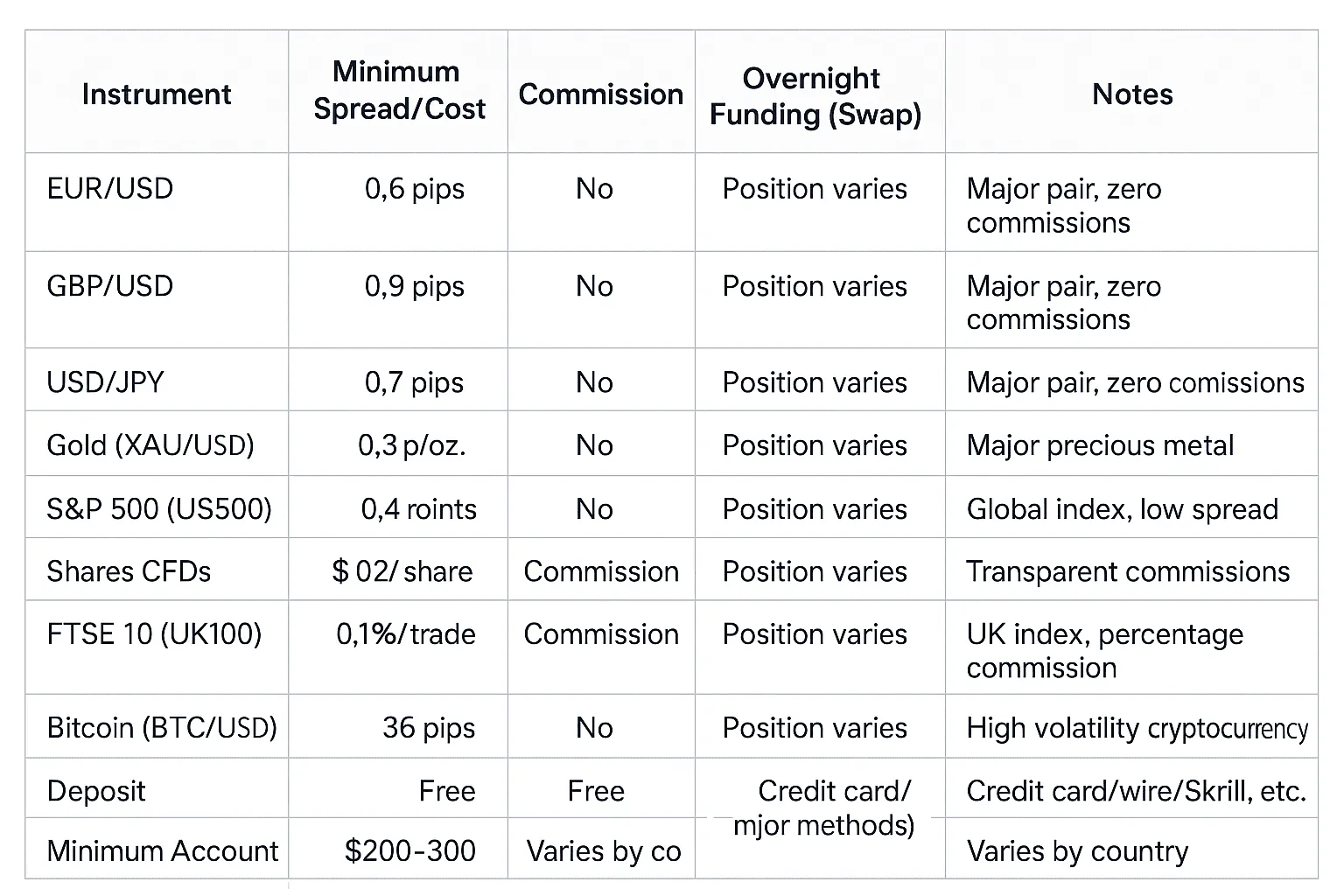

CMC Markets is known for its low spreads and no hidden fees. The following are the details of the main product fees:

5. Trading advantages and user experience

Powerful platform technology

The Next Generation platform is feature-rich and offers industry-leading data depth and visualization experience.

Transparent quotes and low spreads

The vast majority of foreign exchange and stock index products have zero commissions, and the spreads remain stable and low for a long time.

Diverse varieties, excellent liquidity

A full range of products including foreign exchange, stock indices, commodities, cryptocurrencies, etc. are available, and supported by mainstream international liquidity providers.

Education and Analytical Services

We provide a wealth of market analysis reports, professional lectures, video tutorials and demo accounts to help new and old users improve their trading capabilities.

Safety and compliance, customer funds isolation

Multiple supervisions, customer funds isolation, and negative balance protection fully protect user rights and interests.

Fast customer service response and multi-language support

24/7 online support in multiple languages including English and Chinese, efficient problem solving.

6. User Reputation and Disadvantages

CMC Markets has been widely praised on evaluation platforms such as Trustpilot and Investing.com, especially in terms of platform fluency, transparent quotes, and rich varieties. Some users reported that the commission for US stocks is higher than that of some US brokerages, and complex products such as options and cryptocurrency sub-variety are not as rich as those of emerging platforms.

VII. Summary and Suggestions

As a leader in the global financial technology and CFD trading industry, CMC Markets has long been a leader in the industry with strong supervision, platform technology, low fees and high-quality services. It is suitable for investors who pursue stability, transparency and internationalization. Before opening an account, it is recommended to rationally plan a diversified asset allocation based on your own product needs and financial strength.

CMC Markets Global Regulatory List

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.