BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Forex scams surged in 2025, with novices being particularly vulnerable. Remember: verifying regulations, rejecting promises of high returns, and testing small amounts first are key to avoiding scams.

Did you know? According to BrokerHivex 2025 data, 80% of new traders experience at least one scam attempt within their first year. With daily forex market trading volume exceeding $7.5 trillion (Source: Investopedia), fraudsters are more active and sophisticated than ever. High liquidity, global accessibility, and digital advancements make forex trading both an opportunity and a pitfall.

This guide, based on BrokerHivex's proprietary verification methodology and the latest industry data, will help you identify, avoid, and respond to the most common forex scams expected in 2025. We'll uncover the dangerous myths scammers rely on, the latest tactics, and provide practical steps to help you protect your funds.

At its core, scams are about misleading. Understanding the lies they exploit is the first step to preventing them.

Reality: 70-80% of retail forex traders lose money (Source: Investing.com). Scammers often use claims of guaranteed profits, often displaying fabricated backtesting data or claiming a "90% win rate" for EAs or signal services. In 2024, a prominent forex robot Ponzi scheme resulted in $4 million in losses (Source: Trend Micro).

“No one can guarantee profits because the forex market is inherently unpredictable. Scammers use this claim to deceive new traders.”

— Yamarkets

Reality: There's a significant gap between primary regulators (such as the FCA and ASIC) and offshore entities (such as the Seychelles FSA). Scammers often create "clone platforms" that impersonate legitimate websites to defraud funds. For example, a fake FXTM website has defrauded numerous investors (Source: Dukascopy).

| Function | Compliant brokers (FCA/ASIC) | Scam Clone Platform (Offshore) |

|---|---|---|

| License plate verification | Publicly available | Fake or unverifiable |

| Withdrawal speed | 1-3 working days | Delay, evasion or refusal |

| Website domain name | Official and safe | Counterfeit, minor changes |

| Customer Service | Transparent and responsive | Refusing to communicate or making excuses |

“The Seychelles FSA’s regulatory standards are relatively relaxed, with low thresholds for capital requirements, customer protection, and fund segregation.”

— BrokerHivex Regulatory Directory

Reality: Micro-deposit scams are on the rise. Common allures include "$500 turns $5,000." According to BrokerHivex's news department, 62% of scams involve deposits of less than $1,000. These scams collect small amounts and then disappear quickly, making them nearly impossible to recover.

Reality: Deepfakes and paid fake testimonials are rampant. By 2025, AI-generated "trading mentors" and fake expert accounts have become a major risk (Source: Vocal Media). Scammers are using TikTok and Telegram to spread fake success stories to foster a false sense of trust.

Reality: Regulated brokers typically process withdrawals within 1–3 days. If a platform requires an "additional fee" to retrieve your funds, it's almost certainly a scam. Scammers will fabricate excuses to delay or even refuse payment until you give up or make another payment (Source: ForexBrokers.com).

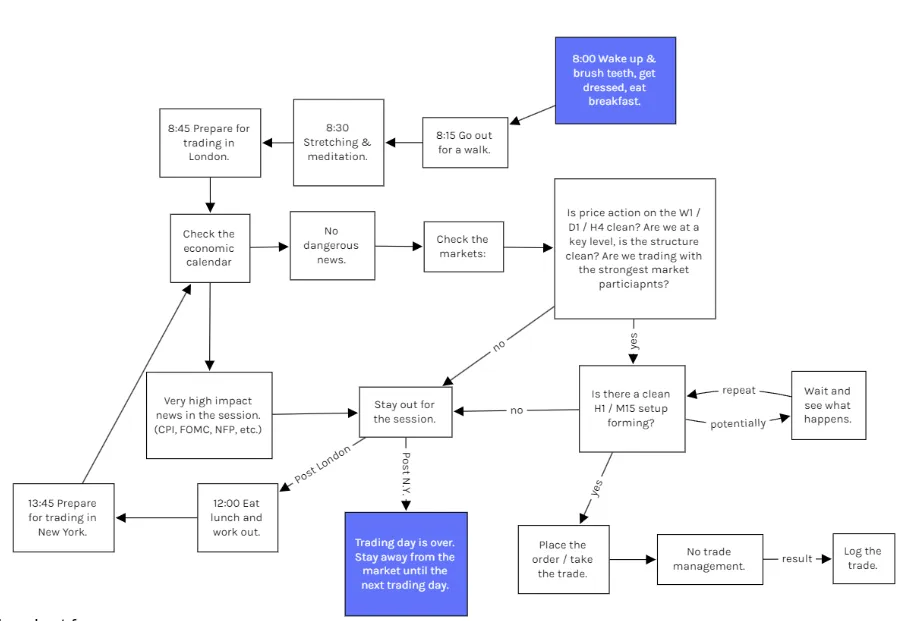

Illustration: The shield protects traders from scams (such as fake brokers, Ponzi schemes, and fake signal services), and symbolizes the importance of regulation and investigation.

Check official databases: Use official websites like the FCA or ASIC to verify a broker’s license, rather than just looking at screenshots.

Distinguish between "registration" and "supervision": registration does not mean supervision, the latter has substantive supervisory responsibilities.

Check out the BrokerHivex Regulatory Scoring System: Identify risky platforms by comparing global regulations.

"The French AMF and the Belgian FSMA have blacklists of unlicensed individuals, and the US CFTC also maintains a RED List of violations."

— ForexBrokers.com

Office address: Use Google Maps to verify whether it is a real office location. Be wary of PO boxes or virtual addresses.

Regulatory warnings: Search for the platform name on warning lists of regulatory agencies such as the CFTC and FCA.

Case: A trader discovered that the platform address was actually a mailbox rental store and successfully exposed the scam.

Warning words: Words like “risk-free,” “guaranteed profit,” and “limited-time membership” are all signs of scams (Source: AvaTrade);

Psychological tactics: Scammers often use a sense of urgency, fake communities, and false authority to exert pressure.

Quick Judgement Exercise: Which of the following ads is a sign of a scam?

"Our robots have a 90% win rate!"

"Withdraw cash 24 hours a day, no questions asked!"

"Join the exclusive group, limited spots only!"

(Hint: All of them are scams)

$100 security test: first make a small deposit, try to withdraw cash, and then decide whether to add more funds;

Record withdrawal time: BrokerHivex recommends recording the time required for each withdrawal, as delays indicate a problem.

Trend warning for 2025:

AI fake mentor

MetaTrader 5 clone software

Social scams on Telegram and TikTok (Source: Trend Micro)

Report suspicious activity: If you discover a scam, you should report it to regulators and the platform immediately.

Preserve evidence: screenshots, emails, chat logs, transaction numbers;

Contact your bank or payer: Try to request a refund or chargeback (if using a credit card);

Sample report template:

Subject: Report on suspected forex scam – [Platform Name]

Content: [Briefly describe the situation, including time, amount, and communication records]

Attachments: [screenshots, emails, transaction records, etc.]

Notify regulators: File a formal complaint with the FCA, CFTC, etc.

Regulatory agencies: Check the BrokerHivex Global Regulatory Directory;

Law enforcement: In the US, report to IC3. In the UK, report via Action Fraud.

Beware of recovery scams: Don’t trust “fund recovery” companies that ask for upfront payment, as this is often a secondary scam.

Common emotions: Victims often feel shame, anger, or anxiety. Remember, even experienced scammers can fall for scams.

Join a support group: Find online or offline victim support groups;

Rebuild your confidence: Restart by practicing on a demo account and using trusted resources like the BrokerHivex expert database.

Forex trading remains a rich source of opportunity in 2025, but it also comes with increasingly complex risks. By identifying deception, verifying brokers, and being wary of new scams, you can effectively protect your capital and your mental health.

This article is provided by BrokerHiveX , which specializes in broker ratings, regulatory information, and professional trading education. For more of the latest financial news and expert analysis, please visit our website.

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.