The Fed's interest rate cut remains uncertain, and gold may reach $90.

Summary:Next week's release of US CPI data will be a key indicator in determining whether the Federal Reserve will cut interest rates in September, potentially triggering significant volatility in gold, the US dollar, and other markets. Gold has been fluctuating at high levels for nearly four months, with market sentiment fluctuating further due to expectations of rate cuts and the ongoing struggle between Trump's policies. #USCPI #GoldMarket #FederalReserveCut #ForeignExchangeRisk #InvestmentAvoidance

The gold market is entering a critical moment

This week, Trump's flurry of diplomatic and tariff moves roiled global market sentiment, prompting a swift counterattack from gold bulls, pushing prices up nearly $90 and holding steady at $3,400 per ounce. Over the past four months, gold has fluctuated widely around historical highs, and the market is now betting on the Federal Reserve's potential interest rate cuts. JPMorgan Chase predicts four rate cuts this year, while "Bond King" Gundlach predicts three, though the final decision will depend on the upcoming release of US CPI data.

US CPI may determine the direction of September interest rate cut

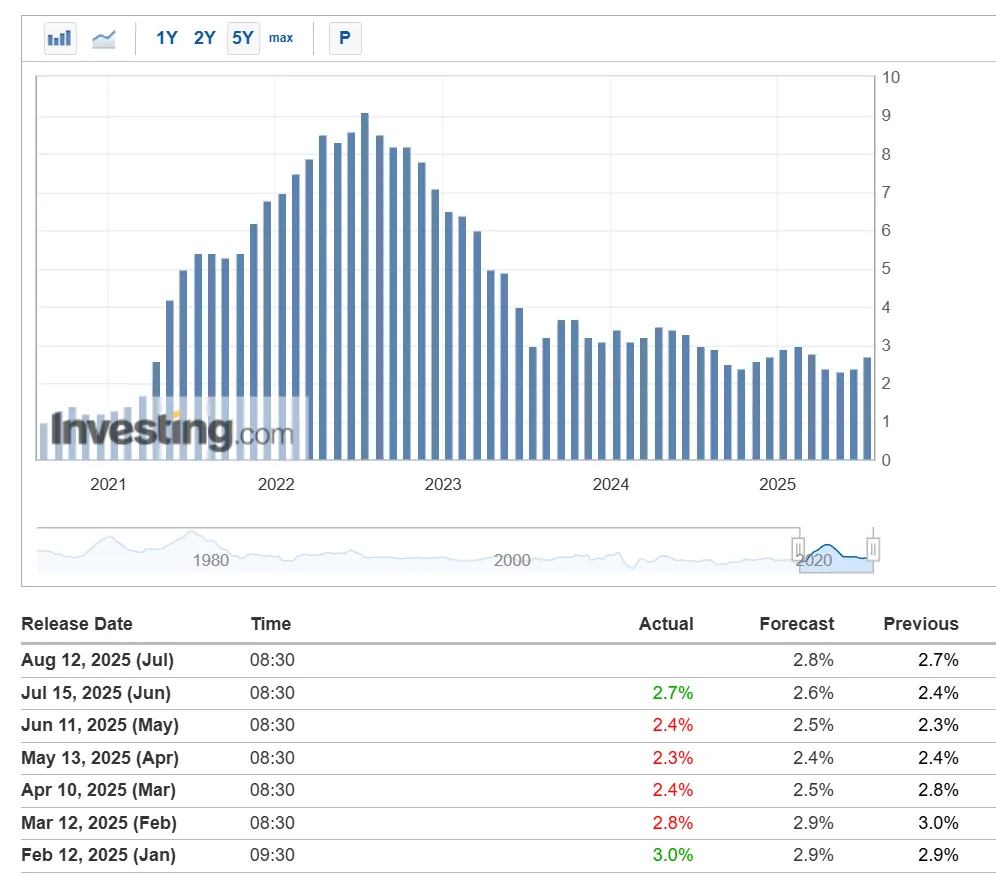

The U.S. Bureau of Labor Statistics will release the July Consumer Price Index (CPI) at 8:30 PM Beijing time on August 12th (source: BLS). The CPI rose to 2.7% year-on-year in June, and the market predicts it could exceed 2.8% in July, primarily driven by tariffs, inventory restocking, and housing costs. If the data is higher than expected, the Federal Reserve may postpone its interest rate cuts, strengthening the dollar and putting pressure on gold. Conversely, rising expectations of a rate cut could support gold as a safe-haven. Historical data shows that within half an hour of the CPI release, fluctuations in gold, the dollar, and U.S. stocks can exceed their normal range.

How investors respond to CPI market trends

When facing significant market data, the primary principle is risk control. Avoid going all-in with a full position, reduce leverage, and set a maximum loss limit. Avoid impulsive, high-frequency trading with large positions to prevent falling into a cycle of "loss, heavy investment to recover losses, and then further losses." During volatile market fluctuations, use timely stop-loss and take-profit orders to avoid emotional trading.

2025 Consumer Price Index (CPI) Statistics

Beware of unscrupulous foreign exchange platform operations

Some betting platforms may cause investors to lose their positions during major market fluctuations, such as CPI, by reducing leverage, blocking deposits, tampering with trading data, maliciously slipping, or widening spreads. Investors are advised to record their entire trading process and save details, and use third-party tools to compare platform quotes and promptly protect their rights in the event of any anomalies.

Market trends and investment references

Gold bulls and bears have recently seen a widening divergence, and short-term trends will be highly dependent on CPI data. Conservative investors may consider reducing their positions before the data is released, waiting for a clearer direction before re-entering the market. Investors with a higher risk appetite should plan their stop-loss and take-profit strategies in advance and be wary of slippage risks caused by insufficient liquidity. In an uncertain environment, flexibly adjusting positions and diversifying asset allocations are key to balancing returns and risks.

Next week's CPI will be a key event impacting global financial markets, presenting both opportunities and risks. Maintaining composure and avoiding platform traps is the first step to preserving your capital.

Want to be the first to grasp global market trends and investment opportunities? Follow us on BrokerHiveX for the latest in-depth analysis and real-time information!

Further reading

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.