Automated Trading: The Best Forex Algorithmic Trading Platforms of 2025

Summary:By 2025, algorithmic foreign exchange (FX) trading has become a mainstay of the global currency market, with over 92% of FX trades executed by automated systems and robots, and daily trading volume reaching a new record of $7.8 trillion (BIS report, 2025). This dramatic shift is driven by advances in trading platforms, the proliferation of sophisticated FX bots, and the critical role of ultra-low latency infrastructure. However, this landscape is not simple: traders must navigate a maze of platforms, regulatory requirements, and risk management challenges.

Automated Trading: The Best Forex Algorithmic Trading Platforms of 2025

By 2025, algorithmic foreign exchange (FX) trading has become a mainstay of the global currency market, with over 92% of FX trades executed by automated systems and robots, and daily trading volume reaching a new record of $7.8 trillion ( BIS Report, 2025 ). This dramatic change is driven by advances in trading platforms, the proliferation of sophisticated FX robots, and the critical role of ultra-low latency infrastructure. However, this landscape is not simple: traders must navigate a maze of platforms, regulatory requirements, and risk management challenges.

Backed by BrokerHiveX's authoritative broker rankings, regulatory data, and expert insights, this guide will help you:

Understand the foundations and development of algorithmic forex trading.

Compare the top automated trading platforms and their unique features.

Evaluate the performance and risks of free and paid forex robots.

Choose the right VPS hosting and infrastructure for your trading needs.

Master risk management and compliance in automated trading.

Get a step-by-step guide for beginner algorithmic traders.

Explore emerging trends including AI integration and multi-platform ecosystems.

Understanding Algorithmic Forex Trading in 2025

What is algorithmic forex trading?

Algorithmic forex trading involves the use of computer programs—often called trading robots or Expert Advisors (EAs)—to automatically execute trades based on pre-set strategies and market signals. These systems are capable of processing vast amounts of data, responding to market changes within milliseconds, and operating 24/7 without human intervention.

Market share and transaction volume:

By 2025, algorithmic trading will dominate the foreign exchange market, accounting for 92% of trading. The Bank for International Settlements (BIS) reports that daily trading volume in the global foreign exchange market will reach $7.8 trillion, an 8% year-on-year increase, with fintech and high-frequency algorithmic trading being the primary drivers of this growth ( BrokeHiveX News ).

Advantages:

The speed and efficiency of executing transactions are high.

Strategy backtesting and optimization can be performed.

Eliminate emotional trading decisions.

Sustainable participation in global market transactions.

challenge:

The technical complexity and programming requirements are high.

Risk of strategy over-optimization and performance degradation.

Infrastructure and network connectivity risks.

Regulatory and compliance hurdles.

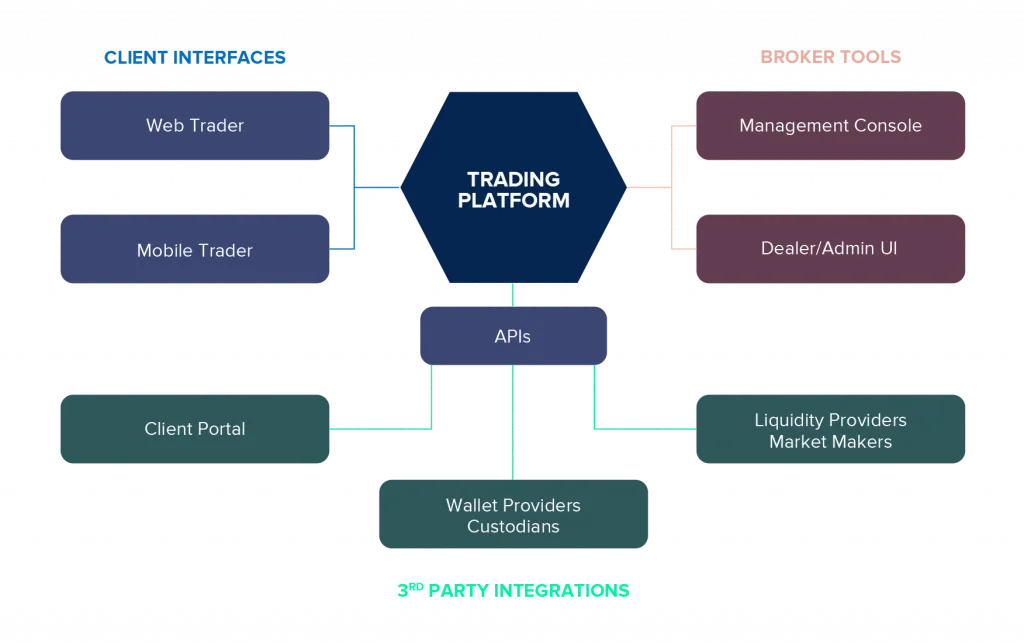

Key Components of Algorithmic Trading Systems

Trading platform and software:

Platforms such as MetaTrader 5, NinjaTrader, and QuantConnect provide an environment for strategy development, backtesting, and real-time execution.Forex robots (Expert Advisors):

They can be free or paid, with paid bots often offering advanced features, AI integration, and official support ( BrokerHiveX EA Performance Index ).VPS hosting and infrastructure:

Virtual private servers ensure 24/7 uninterrupted operations and ultra-low latency, which is crucial for reducing slippage and execution delays.API and programming language:

Common languages include MQL5 (MetaTrader), Python (QuantConnect, MetaTrader 5), C# (NinjaTrader, QuantConnect), and Pine Script (TradingView).

Regulatory environment and compliance considerations

Main regulatory bodies:

These include the UK FCA, Australia ASIC, and Cyprus CySEC. Compliance ensures financial security, transparent transactions, and fairness.Platform and Robot Compliance:

80% of profitable EAs run on a Tier 1 regulated platform (e.g., FCA/ASIC) ( BrokerHiveX ). The BrokerHiveX regulatory database should be used to verify the compliance of the broker and the robot.The role of BrokerHiveX:

Provides a comprehensive and up-to-date regulatory database to assist traders with due diligence and risk assessment.

Top Forex Platforms Supporting Algorithmic Trading in 2025

Criteria for evaluating algorithmic trading platforms

Execution speed and latency:

Server-side execution reduces latency and the risk of local failures.Programming language and API support:

The platform should support modern languages (MQL5, Python, C#, Pine Script) and a powerful API.Backtesting and Strategy Development:

Must be able to access high-precision historical data and support multi-threaded backtesting.Regulatory Status and Broker Reputation:

Only choose platforms and brokers that are regulated by top regulatory bodies. You can refer to BrokerHiveX broker reviews .Prices, commissions and spreads:

A transparent fee structure and competitive spreads are crucial to long-term profitability.

In-depth reviews of leading platforms

IC Markets:

The best algorithmic Forex and CFD broker of 2025, offering MT4, MT5, cTrader, and TradingView, spreads as low as 0.0 pips, high leverage up to 1:500, and strong regulatory compliance ( BrokerHiveX IC Markets review ).MetaTrader 5:

Free platform that supports MQL5 strategy writing, multi-threaded backtesting, and is compatible with multiple brokers. It also supports a Python API for AI integration.NinjaTrader:

It offers advanced charting, institutional-grade analytics, and C# support, making it suitable for professional and institutional traders.TradeStation:

With EasyLanguage, the tool is professional and the analysis function is powerful.QuantConnect:

It runs in the cloud, supports Python and C#, and provides institutional-grade backtesting and data access.TradingView:

Develop strategies using Pine Script, with social trading features and leading charts.Interactive Brokers API:

Multi-asset support, professional execution, and comprehensive API documentation.

| platform | programming language | Backtesting function | Pricing Model | Broker Compatibility | VPS Integration |

|---|---|---|---|---|---|

| MetaTrader 5 | MQL5, Python | Multithreading | Free, brokers charge | Broad support | yes |

| NinjaTrader | C# | advanced | License/Commission | Some brokers | yes |

| TradeStation | EasyLanguage | Institutional | Subscription/Fees | TradeStation only | yes |

| QuantConnect | Python, C# | Institutional | Free/paid tiers | Multi-Broker | Yes (Cloud) |

| TradingView | Pine Script | Visualization/Scripting | subscription | Broker Integration | Yes (Cloud) |

| Interactive Brokers | Python, Java, C++ | API/Customization | Commission-based | IBKR only | yes |

Automated Trading Tools and Forex Robots

Overview of Forex Robots (Expert Advisors)

Forex robots or EAs are programs that automatically execute trades based on coded strategies. They can be categorized as:

Free Robots:

Often used for learning and testing, but may lack robust risk controls and technical support.Paid robots:

Offering advanced features, AI-driven risk management, and regular updates. By 2025, paid EAs will significantly outperform free versions in performance and stability ( BrokeHiveX ).AI Integration:

Leading bots now incorporate AI for sentiment analysis, pattern recognition, and dynamic risk control ( BrokerHiveX CFD Guide ).

Performance and Risk Analysis of Free and Paid Forex Robots

BrokerHiveX 2025 real-time test results:

Average drawdown of the free EA: 42%. 5 out of 6 accounts were liquidated within 4 months.

Average monthly return of paid EA: 19%, stability score 87/100.

Paid EAs offer AI-driven risk control, official support, and regular updates.

Hidden costs of free bots include a higher risk of margin calls and a lack of support ( BrokeHiveX ).

Case Study:

A paid EA (Flex EA) grew an FXTM account from $10,000 to $28,000 in 14 months, and the results have been verified by MyFxBook.

Choosing the right Forex robot for your trading style

Trader Experience:

New traders should first use a demo account and free robots for learning; experienced traders can choose paid EAs with proven performance.Funding and risk tolerance:

High-capital traders should prioritize robots with robust risk control and compliance.Performance Verification:

Always verify performance with MyFxBook and validate developer compliance with the BrokerHiveX regulatory database .Money Back Guarantee:

Verify there is a 30-day refund policy before purchasing and test it on a demo account ( BrokeHiveX ).

VPS Hosting and Algorithmic Trading Infrastructure

Why VPS is important in Forex algorithmic trading

Latency and runtime:

VPS hosting reduces latency to 0-1 millisecond and ensures 100% uptime, which is critical for high-frequency and algorithmic strategies.Server-side execution:

It can reduce the risk of local hardware failure and network interruption.

QuantVPS vs. Other Leading VPS Providers

QuantVPS:

We offer ultra-low latency hosting close to major brokers’ data centers, 100% uptime guarantee, and multiple pricing tiers to suit different traders.Other suppliers:

Choose a vendor with a track record of reliability, technical support, and good integration with your trading platform.

How to Choose a VPS for Algorithmic Trading

Delay requirements:

High-frequency trading requires minimal latency; swing trading can tolerate higher latency.Reliability and support:

Choose a service provider with strong customer support and a complete uptime record.Platform Integration:

Ensure compatibility with platforms such as MetaTrader and NinjaTrader.

Automated FX Trading Risk Management and Compliance

Understanding the risks in algorithmic trading

Market volatility and slippage:

Rapid price fluctuations can cause slippage, especially during news events.Strategy Over-Optimization and Decay:

Overfitting a strategy to historical data may lead to poor real-time performance.Technical failure:

Internet outages, VPS downtime, or software bugs may result in missed trades or losses.

Regulatory requirements and best practices

KYC/AML Compliance:

Brokers and platforms must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.Regulatory agencies’ stance:

Top regulatory bodies (FCA, ASIC, CySEC) impose strict standards on algorithmic trading platforms.Identifying a scam:

Avoid using robots or platforms that promise “guaranteed profits” or lack transparent performance data.

BrokerHiveX Regulatory Database as a Trusted Resource

Verify broker and platform compliance using the BrokerHiveX regulatory database .

Trading with a regulated broker is crucial for fund security and dispute resolution.

A Beginner's Guide to Algorithmic Forex Trading

A step-by-step process for beginner algorithmic traders

Learn the basics:

Learn algorithmic trading concepts, strategies and risk management.Choose the right platform and broker:

Compare regulated brokers that support algorithmic trading using the Global Forex Broker Rankings .Select and test a Forex robot:

Start with a demo account and test both free and paid EAs.Setting up a VPS and backtesting the strategy:

Deploy the trading environment on a reliable VPS and conduct sufficient backtesting.Conduct real trading under risk control:

Start small, set a stop-loss, and monitor performance closely.

Platforms and tools recommended for beginners

MetaTrader 5:

User-friendly, with a large community and abundant learning resources.TradingView:

It facilitates visual strategy development and has an active social trading community.BrokerHiveX Expert Insights:

Access expert profiles for authoritative guidance.

Common pitfalls and avoidance methods

Over-reliance on free bots:

Always test on a demo account and set strict loss limits.Unrealistic expectations:

Recognize that all trading carries risk and avoid using platforms or robots that promise “guaranteed profits.”

Emerging Trends and Future Outlook of Forex Algorithmic Trading in 2025

Application of AI and machine learning in foreign exchange robots

Sentiment Analysis and Pattern Recognition:

AI-powered bots analyze news, social media, and price patterns to make smarter trading decisions ( BrokerHiveX CFD Guide ).Python API and AI toolkit:

Platforms such as MetaTrader 5 and QuantConnect support Python for advanced AI integration.

Multi-platform and cloud-based trading ecosystem

Platform combination:

More and more traders are using MetaTrader for execution, TradingView for strategy visualization, and QuantConnect for cloud-based backtesting.Social Copy Trading:

Platforms such as cTrader Copy and TradingView enable sharing and copying of successful strategies.

Mobile and Multi-Device Algorithmic Trading

Real-time monitoring:

Mobile apps allow traders to monitor and adjust strategies at any time.Cloud Sync:

Achieve a seamless experience across desktop, mobile, and cloud.

Conclusion and Next Steps

Choosing the best automated forex trading platform for 2025 requires balancing execution quality, programming flexibility, regulatory compliance, and robust risk management. BrokerHiveX is your trusted resource for the latest broker rankings, regulatory data, and expert analysis.

Explore BrokerHiveX resources:

Stay informed, trade securely, and harness the power of algorithmic trading with confidence.

Frequently Asked Questions (FAQ)

What is the difference between free and paid forex robots?

Free bots are often used for learning and testing, but may lack robust risk controls and support. Paid bots often offer advanced features, AI-driven risk management, and proven performance data. BrokerHiveX data shows that paid EAs outperform free versions in both profitability and stability ( BrokerHiveX ).

How to verify if a Forex broker supports algorithmic trading?

Check its platform compatibility (e.g., MT4, MT5, cTrader) and API support. For a detailed evaluation, refer to our BrokerHiveX broker review .

Why is VPS hosting important for automated trading?

VPS hosting ensures 24/7 operation with ultra-low latency, reducing the risk of missed trades and slippage, which is especially important for high-frequency strategies.

How to reduce risk when using Forex robots?

Trade only with regulated brokers, test using a demo account, set strict loss limits, and verify robot performance via MyFxBook and regulatory databases.

What are the best programming languages for algorithmic Forex trading?

MQL5 (MetaTrader 5), Python (QuantConnect, MetaTrader 5), C# (NinjaTrader, QuantConnect) and Pine Script (TradingView) are the most supported languages.

How does regulatory compliance affect my choice of trading platform?

Regulated platforms offer greater financial security, transparency, and legal protection. Always verify compliance using the BrokerHiveX regulatory database .

For the latest news, expert insights and comprehensive broker data, visit BrokerHiveX .

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.