Recommended Low Minimum Deposit Forex Brokers for Beginners in 2025

Summary:By 2025, the global forex trading environment is more accessible, well-regulated, and technologically advanced than ever before. For beginners and traders with limited capital, the ability to start trading with a low minimum deposit is a key factor in broker selection. This trend is driven by both market demand and regulatory evolution, with leading brokers now offering accounts with minimum deposits as low as $0–$5, along with robust educational resources and user-friendly platforms.

Recommended Low Minimum Deposit Forex Brokers for Beginners in 2025

introduction

By 2025, the global forex trading environment is more accessible, well-regulated, and technologically advanced than ever before. For beginners and traders with limited capital, the ability to start trading with a low minimum deposit is a key factor in broker selection. This trend is driven by both market demand and regulatory evolution, with leading brokers now offering accounts with minimum deposits as low as $0–$5, along with robust educational resources and user-friendly platforms.

However, low costs alone are not enough. Security, regulatory compliance, a transparent fee structure, and a platform's ease of use are also crucial—especially for new market entrants. BrokerHiveX , an authoritative and trusted source, provides comprehensive, up-to-date broker rankings, regulatory data, and expert insights to help traders make informed decisions.

In this article, you’ll find a data-driven, expert-reviewed guide to the best low-minimum-deposit Forex brokers for 2025. You’ll find detailed broker profiles, platform comparisons, regulatory advice, and practical tips to help you start your trading journey safely and efficiently.

1. Best Forex Brokers with Low Minimum Deposits for Beginners in 2025

1.1 What is a low minimum deposit Forex broker?

Low minimum deposit forex brokers allow traders to open a live trading account with a small initial deposit (usually between $0–$50). This is especially important for beginners who want to test the waters with a small amount without taking on too much risk.

Key features of low minimum deposit brokers:

Regulatory compliance: Low deposits shouldn’t come at the expense of security. A reputable broker will hold a license from a top regulatory body like the FCA, CySEC, ASIC, or SEC.

Account types suitable for beginners: Micro, Mini, and Cent accounts support trading with smaller lots, reducing risk exposure.

Transparent fee structure: low or zero commissions, tight spreads, and no hidden fees.

Easy-to-use platforms: Supports mainstream trading platforms (such as MT4, MT5, cTrader) and intuitive self-developed solutions.

Educational resources and demo accounts: essential for skill development and risk-free practice.

1.2 Introduction to Major Low Minimum Deposit Brokers

Exness

Minimum deposit: None

Regulators: CySEC, FCA, FSCA, Mauritius FSC

Platforms: MT4, MT5, Web Trader, Mobile

Core features: instant deposits/withdrawals, ultra-low spreads, demo accounts, copy trading, strong regulation

Expert opinion: Exness is known for its strong regulation and instant fund processing, making it suitable for both beginners and professional traders. Source

BrokerHiveX Archives: Global Forex Broker Rankings

BlackBull Markets

Minimum deposit: $0

Regulator: Seychelles FSA

Platforms: MT4, MT5, cTrader, TradingView

Highlights: Low cost, multi-asset support, advanced trading tools, fast execution

Expert opinion: BlackBull Markets stands out with its $0 minimum deposit and wide platform support, making it popular among traders with limited budgets. Source

XM Group

Minimum deposit: $5

Regulators: ASIC, CySEC, IFSC, DFSA

Account types: Micro, Standard, Zero

Fee structure: Zero deposit/withdrawal fees, tight spreads

Expert opinion: Low deposit, transparent fees and strong regulation make XM a good choice for beginners. Source

OANDA

Minimum deposit: None

Regulators: FCA, ASIC, NFA, BVI FSC

Pricing model: Spread only, Commission + core spread

Platform: Independent platform, MT4

Expert opinion: Zero minimum deposit and flexible pricing are very suitable for beginners and small capital traders. Source

Interactive Brokers

Minimum deposit: $0

Regulators: SEC, FCA, FINRA, CFTC

Platform: Advanced multi-asset trading platform

Suitable for everyone: From beginners to experienced traders

Expert opinion: It provides institutional-grade security and technology, no minimum deposit, and is suitable for everyone. Source

Other well-known brokers

IG: $0 minimum deposit, top-tier regulation, award-winning education, and platform usability. Source

Moomoo: $0 minimum deposit, SEC/FINRA regulated, user-friendly app, excellent stock/ETF performance. Source

UnitedPips: $10 minimum deposit, high leverage, TradingView integration, but weak regulation. Source

For a detailed interactive comparison, visit the BrokerHiveX broker comparison tool

2. Suitable Forex Account Types and Trading Platforms for Beginners in 2025

2.1 Account types suitable for beginners

Micro, Mini and Cent accounts: allow trading with very small lots (as low as 0.01 lots), reducing risk and capital requirements.

Demo accounts: These provide a risk-free environment to practice trading strategies and platform operations. Most top brokers offer unlimited demo accounts.

Zero commission and low spread accounts: reduce transaction costs and make it easier for beginners to manage small accounts.

Flexible leverage and negative balance protection: Allow traders to better control risk and avoid losses exceeding deposits.

2.2 Overview of Common Trading Platforms for Beginners

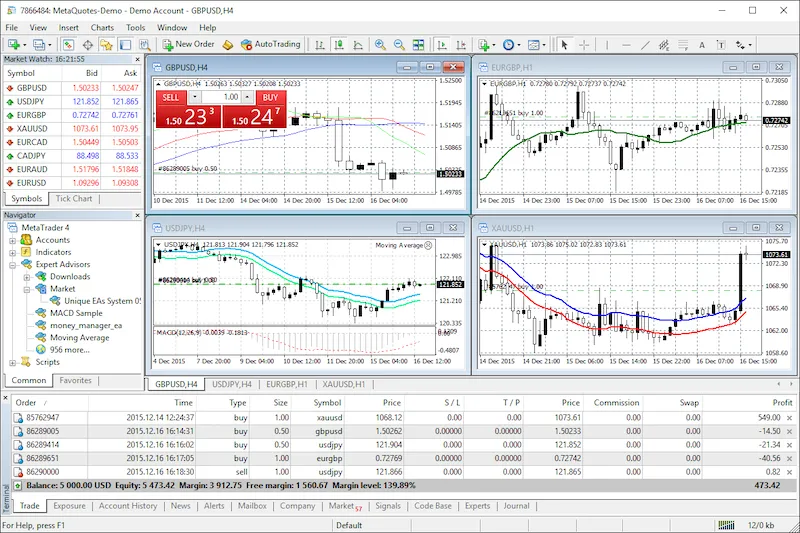

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Industry-standard platforms known for their reliability, extensive educational resources, and mobile support.

cTrader is integrated with TradingView: providing advanced charting, an intuitive interface, and social trading capabilities.

Self-developed platforms (e.g., eToro, Exness Web Trader): emphasize ease of use, social/copy trading, and seamless account opening.

Mobile trading app: A must-have for modern traders, offering full functionality and real-time alerts.

MetaTrader 4's interface is widely recognized for its beginner-friendly design, supporting demo accounts and multi-chart analysis.

2.3 How to choose the right platform

When choosing a trading platform, you should consider:

Usability: Is the interface intuitive and easy to use?

Educational resources: Does the platform offer tutorials, guides, and support?

Execution Speed: Fast execution helps reduce slippage and improve trading results.

Risk management tools: Features such as stop-loss, take-profit, and negative balance protection are essential.

For more platform reviews and expert opinions, please refer to CFD trading platform features and BrokerHiveX expert profile .

3. Security and Compliance: Choose a regulated forex broker with a low minimum deposit

3.1 The importance of supervision for beginners

Regulators protect traders through strict standards, including broker operational standards, fund segregation, and transparency. Key regulators include:

FCA (UK)

CySEC (Cyprus)

ASIC (Australia)

NFA/SEC (US)

FSA (Seychelles)

The BrokerHiveX regulatory database continuously verifies and updates brokers’ regulatory status, ensuring traders have the latest compliance information.

3.2 Key compliance features to pay attention to

Client funds segregation: Ensure that client funds are kept separate from broker operating funds.

Negative Balance Protection: Prevent losses from exceeding your deposit amount.

Transparent Fee and Risk Disclosure: All costs and risks should be clearly communicated.

Fast and secure deposits/withdrawals: Reliable payment processing is the hallmark of a trustworthy broker.

3.3 Risks of Unregulated or Offshore Brokers

Fund fraud and misappropriation

Lack of remedies in case of disputes

Hidden fees and lack of transparency

Be sure to do your due diligence and refer to BrokerHiveX's expert advice to avoid risks.

4. A Beginner's Guide to Forex Trading with a Low Minimum Deposit Account

4.1 Account opening steps

Register an account: Fill out the online personal information application form.

Identity Verification (KYC/AML): Upload identity documents to comply with anti-money laundering regulations.

Choose your account type: Micro, Standard or Demo account depending on your funds and goals.

Fund your account: Most top brokers offer instant deposits and fast withdrawals using methods like PayPal, bank transfer, or e-wallets.

4.2 Simulated Trading and Switching to Live Trading

Demo Trading: Practice your strategies and platform operations risk-free.

Switch to live trading: start with the minimum deposit, use small positions and implement risk management strategies.

Leverage and Position Control: It is recommended to use conservative leverage (e.g. 1:10–1:30), with the risk per trade not exceeding 1–2% of the account balance.

4.3 Essential Risk Management Skills for Beginners

Set stop-loss and take-profit: automatically control risk and lock in profits.

Avoid excessive leverage and overtrading: stick to your trading plan and avoid emotional trading.

Maintain mental discipline: Trading is not only a strategy, but also a battle of mentality.

4.4 Common Errors and Workarounds

Overtrading and chasing orders: Stick to the plan and avoid "revenge trading."

Ignoring risk management: Always use stop-losses and appropriate position sizing.

Ignore Continuous Learning: Stay updated with BrokerHiveX financial news and expert analysis.

5. New Trends in Forex Trading Platforms and Brokers in 2025

5.1 AI and Automated Trading Tools

Artificial intelligence tools are helping beginners:

Trading advice and risk analysis

Automated trading (copy trading, social trading)

Sentiment Analysis and Morphology Recognition

For example, eToro provides a powerful copy trading function, which makes it easy for low-deposit traders to follow experienced investors. Source

5.2 Multi-asset trading and diversification

Many brokers now offer:

CFDs on cryptocurrencies, indices, commodities and stocks

Diversify your portfolio to reduce risk and improve learning outcomes

5.3 Mobile-first trading experience

Modern traders demand seamless mobile apps with comprehensive trading functionality, real-time alerts, and educational content. Our BrokerHiveX platform review recommends the best mobile experiences.

5.4 Impact of New Regulatory Rules

The new regulations for 2025 include:

Leverage cap (e.g. 1:30 for UK retail traders)

Enhanced customer protection clauses

BrokerHiveX will continue to update these changes and their impact on trading conditions.

6. FAQ

What is the minimum deposit for foreign exchange trading?

Currently, several top brokers including Exness, OANDA and Interactive Brokers offer accounts with a minimum deposit of $0. Source

Are low minimum deposit brokers safe?

You can be sure of security by choosing a broker that is regulated by bodies such as the FCA, ASIC or SEC and verifying its regulatory status through the BrokerHiveX regulatory database .

How does a demo account help beginners?

A demo account allows you to practice trading strategies and platform operations without risking real money, building confidence.

What are the trading platforms suitable for beginners in 2025?

We recommend MetaTrader 4/5, cTrader, and user-friendly proprietary platforms such as eToro and Exness Web Trader.

How to manage risk with a small account?

Use stop-loss orders, conservative leverage, and make sure you don’t risk more than 1–2% of your account on a single trade.

Can accounts with low minimum deposits withdraw funds quickly?

Yes, most top brokers offer instant or same-day withdrawals with no hidden fees.

Does BrokerHiveX provide real-time broker status and regulatory updates?

Yes, BrokerHiveX is dedicated to providing real-time authoritative updates on broker rankings, regulatory status, and market news.

in conclusion

Choosing a regulated forex broker with a low minimum deposit is the safest and most efficient way for beginners to enter the forex market in 2025. By leveraging BrokerHiveX's authoritative data, expert insights, and comprehensive resources, you can confidently compare brokers, choose the right platform, and develop good trading habits.

Final Recommendations:

Prioritize regulation and transparency, not just low costs.

Improve your skills with a demo account and educational resources.

Stay tuned to BrokerHiveX for broker rankings , regulatory databases , and expert insights .

Start your forex trading journey safely and efficiently - get ongoing support and the latest information at BrokerHiveX.

Appendix/Additional Resources

Glossary of key terms in Forex trading:

Leverage: Control a larger position with smaller capital.

Spread: The difference between the buy price and the sell price.

Pip: The smallest unit of price fluctuation in foreign exchange trading.

Stop-loss order: An instruction to close a trade at a preset loss level.

Demo Account: An account used for practicing with virtual funds.

Further reading and tools:

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.