Regulatory sandbox: How to promote fintech innovation while ensuring compliance

Summary:Regulatory sandboxes have become a transformative tool in global financial regulation, providing fintech companies with a controlled environment to test innovative products and services under the supervision of regulators.

Regulatory sandbox: How to promote fintech innovation while ensuring compliance

introduction

Regulatory sandboxes have become a transformative tool in global financial regulation, providing fintech companies with a controlled environment to test innovative products and services under regulatory oversight. These sandboxes serve a dual purpose: on the one hand, they enable rapid fintech innovation; on the other, they ensure that new solutions adhere to strict compliance standards. As the financial industry faces unprecedented technological disruption, regulatory sandboxes offer a pragmatic approach to balancing innovation, consumer protection, and market integrity.

This article comprehensively explores the concept, operational mechanisms, global implementation, and critical role of regulatory sandboxes in fostering fintech innovation and maintaining compliance. Whether you are an investor, fintech entrepreneur, compliance expert, or academic, understanding the nuances of regulatory sandboxes is essential for navigating today's complex financial landscape. As an authoritative platform for broker rankings, regulatory data, and market news, BrokerHiveX is committed to providing transparent, data-driven insights to help you make more informed decisions.

Understanding the Regulatory Sandbox: Concepts and Mechanisms

What is a regulatory sandbox?

A regulatory sandbox is a framework established by financial regulators that allows fintech startups and established businesses to test new products, services, or business models in a controlled, realistic environment. Within this environment, some regulatory requirements may be relaxed or adjusted to enable innovation while avoiding excessive risks to consumers or the financial system. The core features of a regulatory sandbox include:

Regulatory flexibility: Temporary exemptions or adjustments to existing rules.

Real-world testing: Conduct pilots with real customers under close supervision.

Limited duration: The testing period typically ranges from 6 months to several years.

Regulatory oversight: Continuous monitoring by regulators to ensure risk control and compliance.

“Regulatory sandboxes are technological environments established by regulators to allow fintech startups to test new technologies and business models under regulatory oversight. By applying certain regulatory requirements flexibly, sandboxes prevent innovation from being stifled by high compliance costs, while enabling regulators to monitor and evaluate in real time.”

—— InnReg

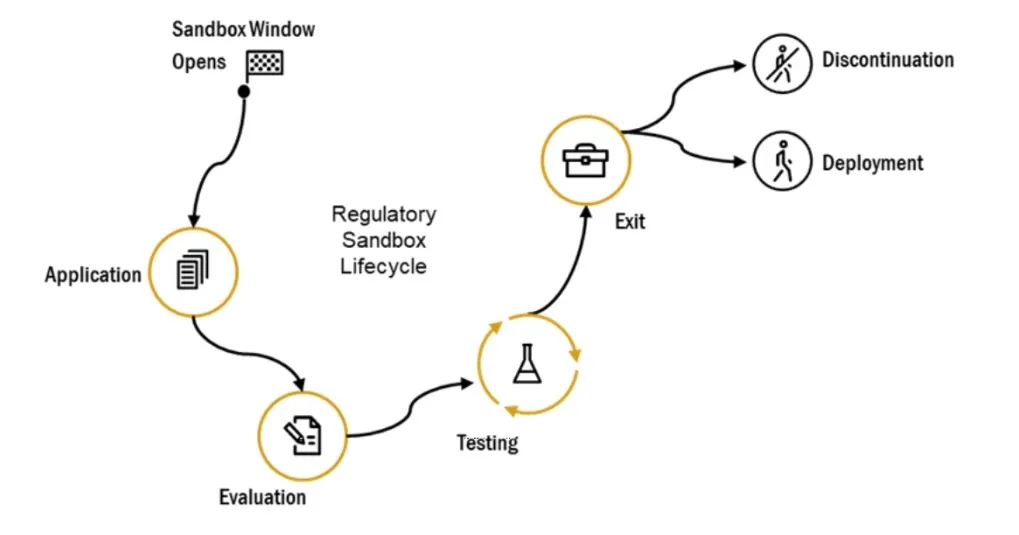

How the Regulatory Sandbox Works

Application and eligibility review: Companies submit detailed proposals describing their innovative products, business models, and compliance plans. Eligibility criteria typically include the novelty of the proposal, potential consumer benefits, and readiness for market testing.

Regulatory oversight and risk mitigation: Once approved, participants will operate under tailored regulatory conditions. Regulators will implement risk management measures through trading limits, enhanced reporting mechanisms, and consumer protection measures.

Exit strategy and market access: After the testing period, companies can either enter the full compliance phase to achieve broader market access or exit, ensuring that consumer assets are protected.

The role of the test environment in compliance

Regulatory sandboxes are increasingly integrating RegTech (regulatory technology) and SupTech (regulatory technology tools) to support real-time supervision and compliance. These tools can:

Data protection: Ensure customer data security and privacy.

Consumer safety: Protect against fraud, misselling, and financial loss.

Operational risk management: Identify and mitigate potential risks arising from new technologies and business models.

Global Regulatory Sandbox Landscape: A Comparative Analysis

UK FCA Sandbox and Digital Asset Sandbox

The UK's Financial Conduct Authority (FCA) pioneered the regulatory sandbox in 2016, supporting nearly 200 companies and accelerating product launches and regulatory policy evolution ( MDPI ). In 2024, the FCA launched the Digital Asset Sandbox, lowering barriers to entry and providing a RegTech API for real-time compliance monitoring. The first 12 participating companies primarily tested cross-border payments, compliance audits, and asset custody solutions ( BrokerHiveX News ). The FCA's partnership with Chainalysis enables real-time blockchain monitoring, enhancing anti-money laundering (AML) and know-your-customer (KYC) compliance.

Singapore MAS Sandbox and Sandbox Express

The Monetary Authority of Singapore (MAS) offers both a regular sandbox (rolling acceptance) and a fast-track "Sandbox Express" for eligible business models. These frameworks emphasize real-time data support, product optimization, and rapid iteration, making Singapore a key global hub for fintech innovation ( InnReg ).

Hungarian MNB and EU MiCA Regulatory Framework

The sandbox operated by the Hungarian National Bank (MNB) is aligned with the EU's Markets in Crypto-Assets (MiCA) Directive, focusing on risk mitigation and compliance. MiCA, effective January 2025, imposes comprehensive requirements on stablecoin issuers, trading platforms, and wallet providers, prompting global exchanges to seek EU licenses or exemptions ( BrokerHiveX News ).

Other important global sandboxes

Southeast Asia: Indonesia, Malaysia, Singapore, and Thailand have established sandboxes covering payments, investment management, and lending.

United States: Regulated by multiple agencies (SEC, CFTC, FinCEN), and recently promoting unified information disclosure standards for digital assets ( BrokerHiveX News ).

EU Blockchain Sandbox: Promoting cross-border regulatory dialogue and pilot experiments.

Comparison Summary Table

| Jurisdiction | Eligibility Requirements | Testing period | Regulatory easing | Regulatory intensity | Key Benefits |

|---|---|---|---|---|---|

| UK FCA | Fintech, digital assets | 6–24 months | High (API, KYC/AML) | high | Fast Track, RegTech Integration |

| Singapore MAS | Fintech, Payment | 6–12 months | Medium (Sandbox Express) | high | Rolling acceptance and data support |

| Hungarian MNB/EU | EU-compliant fintech | 6–18 months | Medium (MiCA) | high | EU passporting rights and digital assets in focus |

| Multiple U.S. institutions | Different | Different | Low–Medium | medium | Uniform disclosure, state differences |

| Southeast Asia | Payment, Loan | 6–12 months | medium | medium | Regional focus, financial inclusion |

For more regulatory agency details, see the BrokerHiveX regulatory database .

How regulatory sandboxes promote fintech innovation

The minimalist infographic illustrates the process for fintech startups to participate in the regulatory sandbox, including application, assessment, testing under regulatory supervision, and final deployment, with icons and concise text explanations.

Lowering market entry barriers

Regulatory sandboxes can reduce compliance costs and legal uncertainty for startups, enabling them to bring innovative products to market faster. By providing a clear, regulated pathway, sandboxes level the playing field for smaller companies that might be deterred by high regulatory barriers.

“Regulatory sandboxes provide fintech innovators with a clear compliance path and flexible regulatory approaches, reducing uncertainty and accelerating market entry.”

—— InnReg

Enhance investor confidence and financing opportunities

Entering a regulatory sandbox signifies regulatory recognition, which can boost investor confidence and attract capital. Empirical research shows that companies participating in sandboxes are more likely to secure investment and have higher survival rates ( BIS working paper ). For example, the UK FCA's sandbox has been shown to be associated with faster financing and product launches.

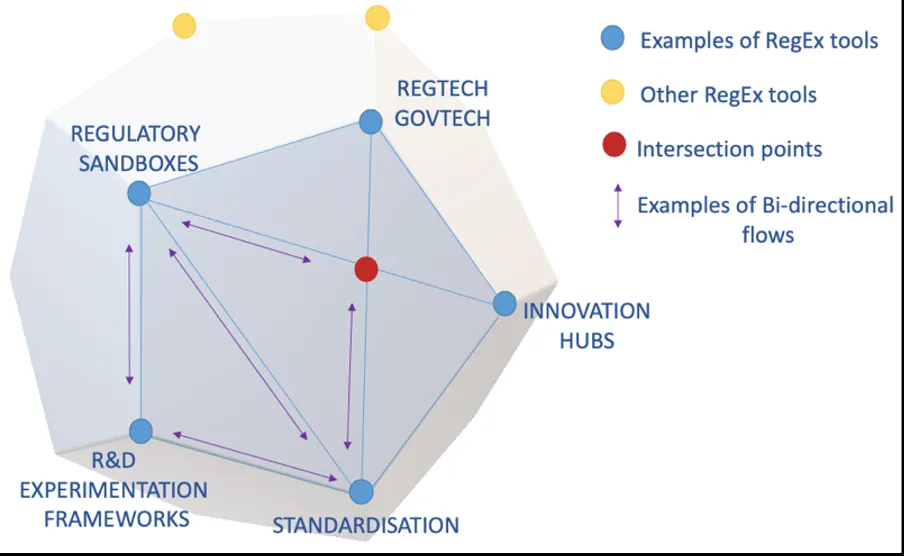

Promoting cross-border expansion and regulatory cooperation

Sandboxes promote cross-border collaboration by unifying regulatory standards and facilitating joint pilots. The UK and US Digital Securities Sandbox (DSS) projects, as well as the EU's sandbox dialogue, are prime examples of promoting international fintech expansion and regulatory mutual recognition ( BrokerHiveX News ).

Supporting emerging technologies: DeFi, CBDCs, and digital assets

Regulatory sandboxes play a key role in testing decentralized finance (DeFi), central bank digital currencies (CBDCs), and tokenized assets. For example, the UK's digital asset sandbox allows companies to pilot on-chain audits and real-time risk monitoring, paving the way for the compliant adoption of cutting-edge technologies ( BrokerHiveX News ).

Ensuring compliance and consumer protection within the regulatory sandbox

The diagram shows the key compliance points in the regulatory sandbox - consumer protection, risk management, data protection and exit strategy - and is presented using icons and corporate colors.

Compliance requirements and risk management

The regulatory sandbox imposes strict compliance standards, including:

Consumer protection: compensation mechanism, transparent disclosure, and complaint handling mechanism.

AML/KYC Standards: Strict anti-money laundering and customer due diligence protocols.

Data Privacy: Comply with data protection laws and ensure customer information is secure.

Operational risk control: Limiting transaction volume, number of clients, and asset risk exposure.

The role of RegTech and SupTech in compliance testing

Advanced RegTech and SupTech tools are increasingly being integrated into sandboxes. For example, the FCA’s partnership with Chainalysis enables real-time blockchain monitoring to proactively identify and prevent suspicious activity ( BrokerHiveX News ).

Exit strategy and subsequent compliance

A comprehensive exit strategy is crucial for transitioning from sandbox testing to full market access. For example, the UK DSS requires firms to implement a “zero-loss asset protection mechanism” and a “real-time settlement data interface” to ensure a smooth and secure exit ( BrokerkHiveX News ).

Balancing innovation and regulatory oversight

Regulators must strike a balance between fostering innovation and maintaining a fair market. Transparent communication, stakeholder engagement, and ongoing regulatory oversight are crucial to preventing regulatory capture and ensuring fair market access.

Challenges and future trends of regulatory sandboxes

Common Challenges

High barriers to entry: Resource-intensive application processes can put smaller companies at a disadvantage.

Cross-jurisdictional coordination: Regulatory fragmentation and differing standards increase the complexity of cross-border business.

Technical and operational barriers: Requirements such as data center localization and atomic settlement increase complexity and cost ( BrokerkHiveX News ).

Emerging Trends

Thematic and industry-specific sandboxes: Specialized sandboxes such as Islamic finance and digital securities are emerging.

AI and blockchain applications in regulation: Increasingly used for real-time compliance monitoring and reporting.

Cross-border collaboration: International regulatory dialogue and standardization efforts are growing, facilitating the expansion of fintech globally.

Policy Recommendations

Improve accessibility: simplify the application process and lower the entry barrier.

Encourage international dialogue: Promote the harmonization and mutual recognition of regulatory standards.

Leveraging RegTech/SupTech: Adopting smarter and more flexible regulatory tools to achieve dynamic supervision.

Practical Guide: How to Participate in the Regulatory Sandbox

A flowchart illustrating the interactions between fintech startups, regulators, and consumers in a regulatory sandbox, with icons and arrows illustrating the evaluation, testing, and deployment phases.

Preparation before application

Research sandbox types: Identify relevant sandboxes and entry criteria in the target jurisdiction.

Prepare materials: Write a detailed product description, business model, and compliance plan.

Application process and regulatory interaction

Submission requirements: Complete the application form, provide supporting documents, and adhere to deadlines.

Supervisory Communication: Maintain an open, positive dialogue throughout the process.

Best practices during the testing phase

Compliance monitoring: Track key risk indicators to ensure compliance with sandbox conditions.

Iterative optimization: Optimize products based on regulatory feedback and address compliance gaps.

Exit and market entry strategies

Transition planning: Preparing for full licensing and broader market access.

Continuous Compliance: Establish a robust compliance framework to maintain consumer trust.

Resources and Support

Get the latest guidance with BrokerHiveX authoritative resources:

Conclusion and Call to Action

Regulatory sandboxes play a key role in facilitating fintech innovation and bridging regulatory compliance. By providing a structured, supervised environment for experimentation, sandboxes accelerate product development, strengthen investor confidence, and foster responsible market growth. A transparent, data-driven regulatory framework is essential to building trust and ensuring the long-term success of fintech innovation.

For the latest regulatory developments, broker compliance updates, and expert insights, visit BrokerHiveX’s comprehensive resources:

Frequently Asked Questions (FAQ)

What is a regulatory sandbox and how does it work?

A regulatory sandbox is a controlled environment established by financial regulators where fintech companies can test innovative products or services with real customers under regulatory oversight. It typically includes temporary regulatory easing, close monitoring, and a defined testing period.

How does the regulatory sandbox promote fintech innovation?

By lowering compliance costs, reducing legal uncertainty, and providing a clear path to market entry, sandboxes enable startups to develop and launch new products faster and more safely.

What are the main compliance requirements in the regulatory sandbox?

Key requirements include consumer protection measures, anti-money laundering (AML) and know-your-customer (KYC) protocols, data privacy protections, and operational risk controls, which will be tailored to the type of innovation being tested.

Which countries have the most active regulatory sandboxes?

The United Kingdom, Singapore, Hungary (EU), the United States, and several Southeast Asian countries (Indonesia, Malaysia, Thailand) are leaders in implementing regulatory sandboxes.

How do fintech startups apply to enter the regulatory sandbox?

Startups should research the eligibility criteria of different jurisdictions, prepare detailed application materials, explain their products and compliance plans, and actively communicate with regulators during the application and testing process.

What are the risks and challenges of participating in the sandbox?

Challenges include high barriers to entry, resource gaps, regulatory differences across jurisdictions, and technical barriers such as data localization and settlement requirements.

How does the regulatory sandbox protect consumers during fintech innovation?

The sandbox will implement strict consumer protection measures, including compensation mechanisms, transparent disclosures, and real-time monitoring to prevent fraud and loss of funds.

What role does RegTech play in the regulatory sandbox?

RegTech tools enable real-time compliance monitoring, automated reporting, and enhanced risk management, helping regulators and participating firms operate more efficiently within the sandbox.

How can regulatory sandboxes support the cross-border expansion of FinTech?

By harmonizing regulatory standards and facilitating joint pilots, sandboxes help fintech companies expand internationally and operate better in complex compliance environments.

What happens after a fintech company exits the regulatory sandbox?

Businesses must transition to a fully compliant state to access the broader market while ensuring all consumer assets are protected and compliance obligations are continuously met.

👉 For more expert insights and compliance best practices, visit BrokerHiveX .

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.