BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:The Fed's shift to a dovish policy, coupled with the resumption of inflows into Ethereum (ETH) ETFs, pushed ETH past its 2021 all-time high, setting a new record above $4,870. #Ethereum #Federal Reserve #ETHETF #CryptoMarket #InvestmentTrends

Federal Reserve Chairman Powell's speech at the Jackson Hole Symposium clearly signaled a dovish tone, stating that "policy is in a restrictive zone and adjustments to the policy stance may be necessary in the future" (Source: Jackson Hole Speech, 2025). The market interpreted this as increasing the probability of a September rate cut to 25 basis points. This shift has rekindled interest in risky assets, with ETH (ETH) surging over 250% since its April low of $1,385 (Coinbase data).

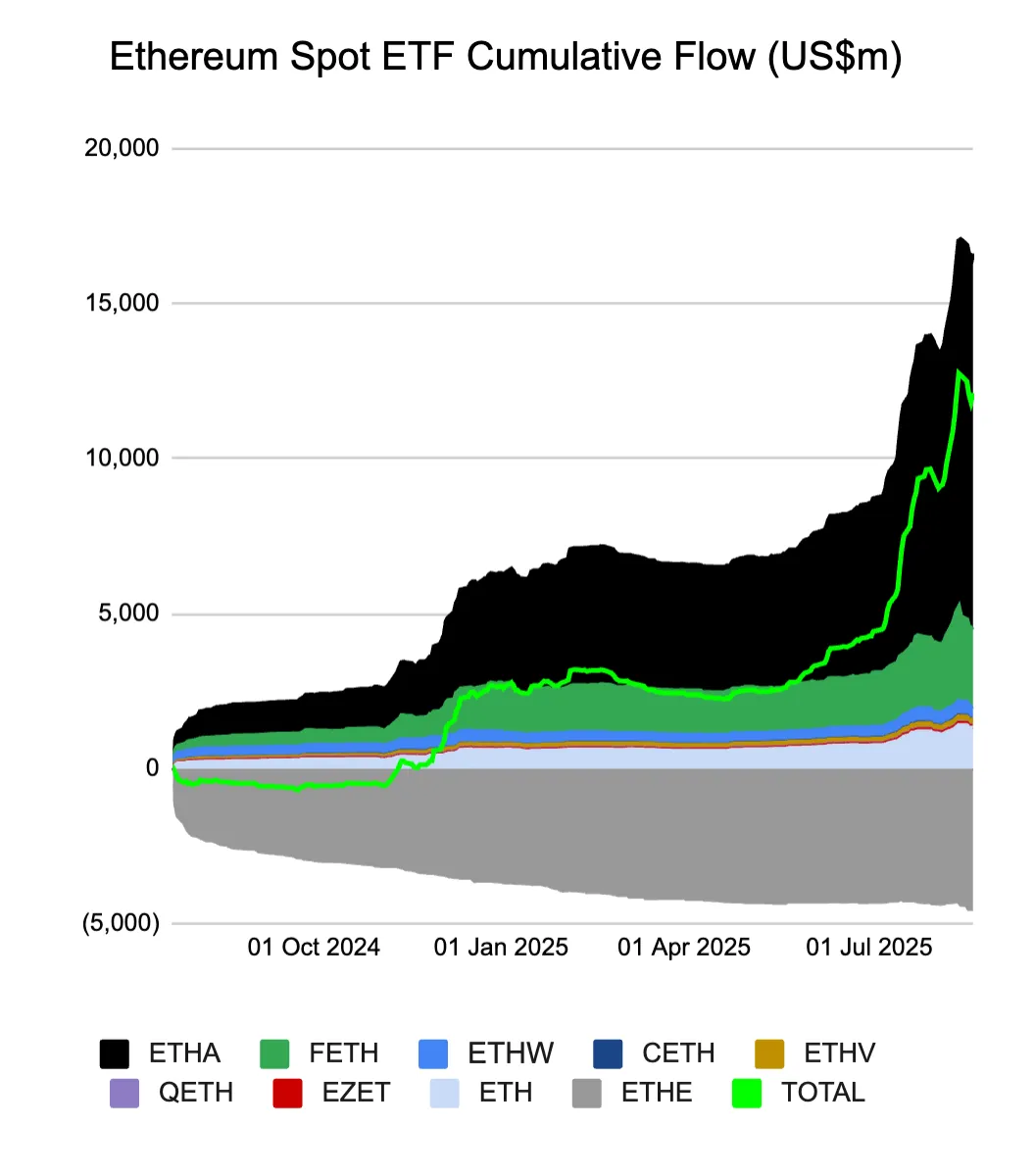

According to Farside Investors, ETH-related ETFs attracted another $287.6 million in capital on August 21st, following four consecutive days of outflows. As of now, the total assets under management of ETH ETFs have reached $12.12 billion. Meanwhile, institutions such as BitMine and SharpLink have accumulated $1.6 billion in ETH over the past month (StrategicETHReserve.xyz), bringing total institutional holdings to $29.75 billion.

This means that ETH is gradually transforming from a "speculative token" to a "practical reserve asset". Standard Chartered Bank has even raised its year-end target price to US$7,500 and predicts that it may reach US$25,000 by 2028 (Source: Standard Chartered Bank Research Report, 2025).

Ethereum ETF net flows. Source: Farside Investors

Bitcoin's dominance in the crypto market has fallen below 60% for the first time since March (TradingView data). Meanwhile, CoinShares reported that Ethereum investment products attracted $2.86 billion in inflows in the week of August 15, far exceeding Bitcoin's $552 million. This reflects investors' active shift to ETH and other altcoins in search of higher returns.

Hyblock analysts pointed out that when prices reach historical highs, early investors tend to choose to take profits, but the demand in this round of market is sufficient to absorb the selling pressure and form "real bull market momentum."

After Ethereum broke through another all-time high, market sentiment has clearly intensified, and FOMO (fear of missing out) has spread rapidly. However, amidst the enthusiasm, rationality remains the key to investing. Currently, the psychological barrier of $5,000 may lead to sharp short-term fluctuations, while institutional buying and continued inflow of ETF funds provide strong support for the long-term upward trend. For investors, moderately phasing in investments, properly controlling leverage, and adhering to a long-term holding strategy may be the best way to balance opportunities and risks.

Ethereum is experiencing a new round of historic market conditions, but opportunities and risks coexist.

Want to be the first to grasp global market trends and investment opportunities? Follow us on BrokerHiveX for the latest in-depth analysis and real-time information!

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.