The US government partners with Chainlink and Python to bring economic data to the blockchain for the first time, setting the market on fire.

Summary:The US government announced a partnership with Chainlink and Python Network to bring economic data to blockchain to improve government spending transparency and market efficiency. This move not only marks the first large-scale application of blockchain technology in macroeconomic governance, but is also seen as a key signal in the US's bid to become the "cryptocurrency capital of the world." #USGovernment #Chainlink #Pyth #EconomicDataOnChain #InvestorSentiment

Governments promote transparency and the on-chain revolution

According to Cointelegraph The US government officially announced on Tuesday a partnership with blockchain oracle service providers Chainlink and Python Network to publish economic data directly on-chain. This is part of the Trump administration's plan to increase fiscal transparency, aiming to make public spending and macroeconomic indicators traceable in real time and further promote the United States as a global cryptocurrency hub.

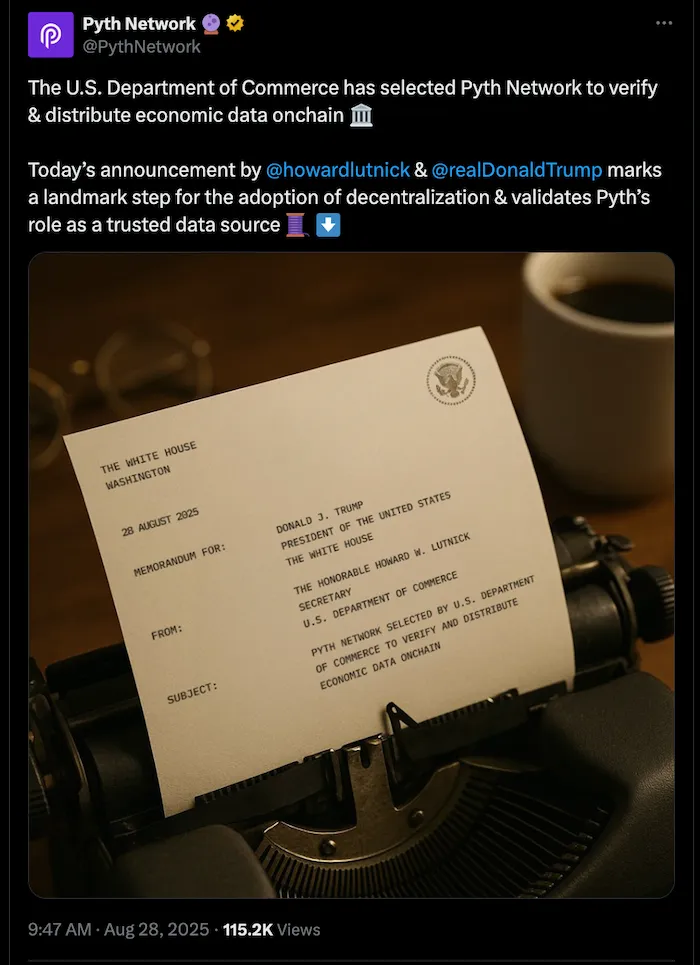

Chainlink will provide data sources for the U.S. Bureau of Economic Analysis (BEA), including real Gross Domestic Product (GDP), the Personal Consumption Expenditures (PCE) price index, and final sales to private domestic buyers. Meanwhile, Pyth Network has been selected by the U.S. Department of Commerce as the official publisher of GDP data.

Source: Pyth Network

Potential impact on financial markets

This move is believed to profoundly change the way financial markets operate. A Chainlink spokesperson stated that on-chain economic data will drive:

Automated trading strategies: quantitative investment based on real-time macro data.

Prediction Market: Macroeconomic expectations are more transparent and promote the development of decentralized prediction platforms.

DeFi risk management: The protocol can adjust the collateral ratio and liquidation mechanism based on official data.

In addition, financial products such as stablecoins, tokenized bonds, RWA (tokenization of real-world assets) and perpetual contracts will all gain enhanced credibility and market depth due to on-chain macro data.

Investor sentiment and market temperature

After the news was announced, investor sentiment quickly heated up. According to Cointelegraph data LINK token prices surged nearly 70% to a high of $25, bringing their cumulative increase since the beginning of August (from $15.43 to the current price range). Pyth tokens (PYTH) also gained strength due to increased market attention.

In the eyes of traders and institutions, this policy not only signifies the US government's official recognition of the legal status of on-chain oracles, but also potentially leads to explosive growth in on-chain financial derivatives. Many investors believe this is equivalent to blockchain officially entering the mainstream economic policy toolbox.

Global Trends and Policy Background

It's worth noting that the United States isn't the only country experimenting with this approach. Countries like the Philippines, the United Kingdom, and El Salvador are also exploring the feasibility of migrating public spending and macroeconomic data to blockchain. This trend suggests that future international financial competition will not only be a battle of monetary policy and capital markets, but also a contest of blockchain transparency and governance efficiency.

Investor Recommendations and Outlook

From an investment perspective, the market may show strong speculative enthusiasm for related tokens such as LINK and PYTH in the short term. However, investors should also pay attention to the following points:

Volatility risk: A rapid rise in token prices is often followed by a short-term correction.

Long-term value: The key is whether it can continue to be adopted by governments and institutions.

Neutral strategy: Investors may consider capturing related dividends by diversifying their investments or paying attention to RWA and DeFi derivatives, rather than simply chasing hot spots.

The application of on-chain economic data is reshaping the market's perception of transparency and trust. To seize the opportunity in this transformation, investors should maintain rational judgment and a long-term perspective.

Want to be the first to grasp global market trends and investment opportunities? Follow us on BrokerHiveX for the latest in-depth analysis and real-time information!

Further reading

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.