Crypto FX Trade Platform Review: A Comprehensive Analysis to 2025

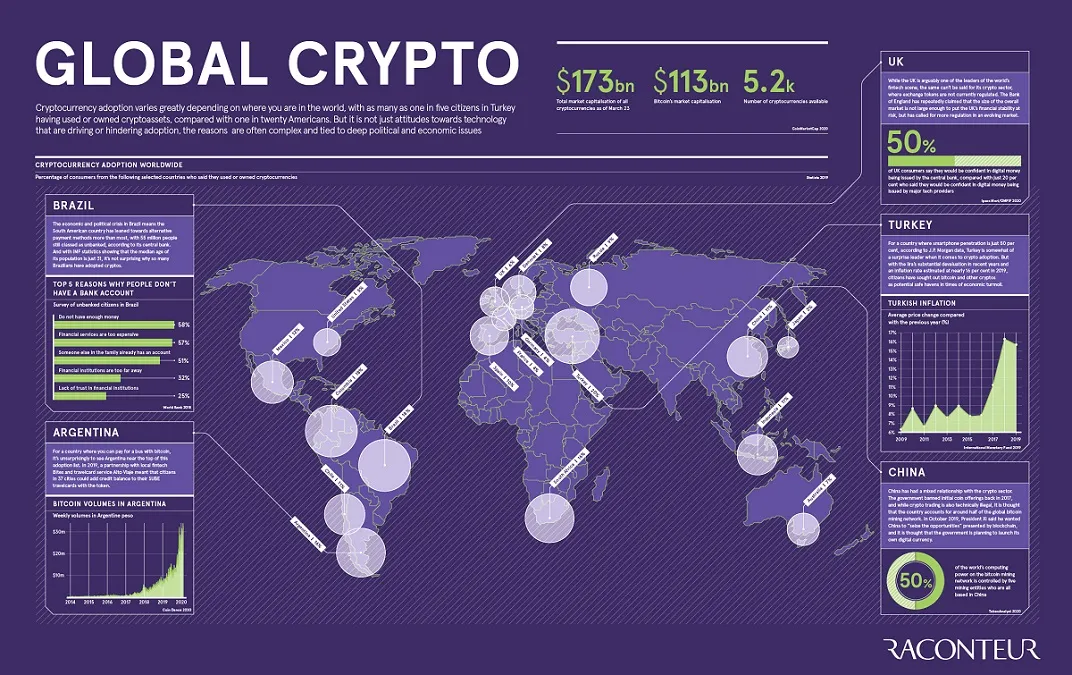

Summary:Crypto FX Trade Platform describes itself as a financial technology company specializing in cryptocurrency trading, options trading, and high-frequency trading services. Officially, the company was founded in 2010 or 2015 and is headquartered in New York, USA, and London, UK.

Crypto FX Trade Platform Review: A Comprehensive Analysis to 2025

Table of contents

Comparative Analysis: Crypto FX Trade Platform vs. Industry Standards

Who is suitable and unsuitable to use Crypto FX Trade Platform?

Crypto FX Trade Platform Overview

Company Background and History

Crypto FX Trade Platform describes itself as a fintech company specializing in cryptocurrency trading, options trading, and high-frequency trading services. Officially, the company was founded in 2010 or 2015 , with headquarters in New York, USA, and London, UK. However, this discrepancy in founding dates is noteworthy. Its marketing emphasizes globalization, advanced blockchain technology, and a secure and efficient trading environment. However, it is important to note that its domain name registration date is April 2, 2024 , raising questions about its actual operating history [see BrokerHiveX broker profile ].

Core Services and Products

The platform offers a wide range of tradable assets, including forex, contracts for difference (CFDs), commodities, stocks, cryptocurrencies, binary options, and real estate investments. It targets both retail and institutional investors, striving to meet diverse trading needs.

Technology and Accessibility

The Crypto FX Trade Platform emphasizes cross-device compatibility (mobile phones, tablets, and PCs), offering instant trade execution, market analysis tools, and blockchain security. The interface is reportedly intuitive and user-friendly, but lacks third-party audits or technical documentation verification.

Regulatory status and compliance assessment

Platforms claiming compliance vs. third-party findings

The platform claims to strictly comply with the financial regulations of various countries, but BrokerHiveX has labeled it as a "suspected fraud." This discrepancy is highly alarming to potential investors.

The lack of verifiable regulatory credentials, coupled with warnings from external, credible sources, severely undermines its claims of compliance [see BrokerHiveX broker profile ].

License and legal status

There are no verifiable regulatory licenses or registration numbers. Domain name registrations don't match the establishment dates, raising questions about transparency and legitimacy. Without a license, investors have little legal recourse.

KYC/AML and Security Protocols

Although the platform claims to use advanced security systems, it does not clearly disclose its KYC/AML processes and does not conduct third-party security audits, making it difficult to guarantee the safety of investors’ funds.

Account Types, Trading Conditions and Fees

Account Structure and Minimum Deposit

The platform does not disclose account types or minimum deposit requirements. Users must deposit Bitcoin into a platform-generated wallet. This Bitcoin-only deposit model differs from the multi-channel approach of regulated brokers.

Transaction Fees, Spreads and Commissions

No fees, spreads, or commissions are disclosed. Compared to the transparent disclosures of compliant brokers, this lack of transparency is concerning and suggests the possibility of hidden fees.

Leverage, Trading Tools, and Experience

It claims to support multiple assets, but fails to disclose key parameters such as leverage, margin, or execution speed, making it difficult to assess its competitiveness.

Deposits, Withdrawals, and Fund Security

Deposit Methods

Only Bitcoin deposits are supported; no bank transfer or credit card options are available. No information on processing times or fees is available.

Withdrawal process and time limit

Claims of instant processing are lacking, but user feedback is limited due to a lack of third-party verification. Unregulated platforms run the risk of arbitrary delays or denials of withdrawals.

Fund security and isolation

There are no independently verified security measures, fund segregation, or investor compensation mechanisms. User funds are at extremely high risk.

User reputation, reviews and independent evaluations

Positive reviews

The official website displays numerous positive user reviews, emphasizing profitability, smooth withdrawals, and 24/7 customer service.

Negative signals

BrokerHiveX explicitly labels the platform as "suspected fraud," which, combined with the lack of regulation and transparency issues, presents a significant risk [see BrokerHiveX broker profile ].

Evaluation authenticity analysis

User reviews are mostly positive but unverified and may contain false or misleading advertising.

Comparative Analysis: Crypto FX Trade Platform vs. Industry Standards

Regulation and transparency : Much lower than regulated brokers such as FCA, CySEC, and ASIC.

Trading experience : Lack of technical reliability and educational resources of compliant platforms.

Fees and Funding : There is no transparency on fees, and the withdrawal experience is unclear, significantly lagging behind industry best practices.

Risk Assessment and Investor Protection

Key risks

Unregulated and flagged as suspected fraud

No fee transparency, hidden cost risks

Only supports Bitcoin, volatility and irreversibility risks

Safety measures and shortcomings

There is no third-party security audit, no fund isolation, and no compensation mechanism.

Risk Warnings and Best Practices

Investors are advised to avoid unregulated platforms and be sure to verify license information on the BrokerHiveX regulatory database .

Customer Support and Educational Resources

customer service

Claims to offer 24/7 customer service, but this lacks independent verification.

Educational Resources

The promotion provides market analysis and educational tools, but lacks detailed explanations and is significantly weaker than the systematic training provided by compliance platforms.

Who is and is not suitable for using this platform?

Suitable for : Only investors who are particularly interested in high-risk cryptocurrency trading.

Not suitable for : Risk-averse investors and investors seeking transparency and regulatory protection.

Conclusion: Is Crypto FX Trade Platform Safe in 2025?

Advantages

Technological innovation

Cross-platform accessibility

Claims 24/7 customer service

Disadvantages

No regulatory license

Lack of transparency

Flagged as suspected fraud

Conclusion: Not recommended. Investors should prioritize regulated, transparent, and compliant platforms. For more reviews of compliant brokers, see BrokerHiveX Broker Review .

Frequently Asked Questions (FAQ)

Is Crypto FX Trade Platform regulated?

No, no regulatory license, and has been flagged as suspected fraud by a third party [see BrokerHiveX archive ].

How fast are deposits and withdrawals?

Claims instant processing, but no third-party verification and limited user feedback.

What are the main risks?

Lack of regulation, opaque fees, only supports Bitcoin, and there is a risk of fraud.

Compared with compliant brokers?

Compliant brokers provide fund isolation, regular audits, and compensation mechanisms; this platform lacks any of these.

References and Further Reading

📌Note : This review is based on publicly available data and authoritative third-party information as of August 25, 2025. Investors should conduct independent due diligence and consult regulatory databases before making investment decisions.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.