eToro Group Review – Full Analysis 2025

Summary:Founded in 2007 and headquartered in Tel Aviv, Israel, eToro Group is a global pioneer in fintech and social trading. Its mission is to make financial markets equally accessible to everyone.

eToro Group Review – Full Analysis 2025

About the eToro Group

Company Overview and Background

Founded in 2007 and headquartered in Tel Aviv, Israel, eToro Group is a global pioneer in fintech and social trading. Its mission is to provide equal access to financial markets for everyone. Today, eToro has grown into one of the world's largest multi-asset trading platforms, serving over 35 million users. The platform innovatively combines traditional financial instruments with social trading features, allowing users to interact, share strategies, and even automatically copy the trades of top investors.

The eToro platform is designed to be intuitive and user-friendly, catering to both novice and professional investors. Its commitment to transparency, regulatory compliance, and user education has fueled its strong reputation and rapid global expansion.

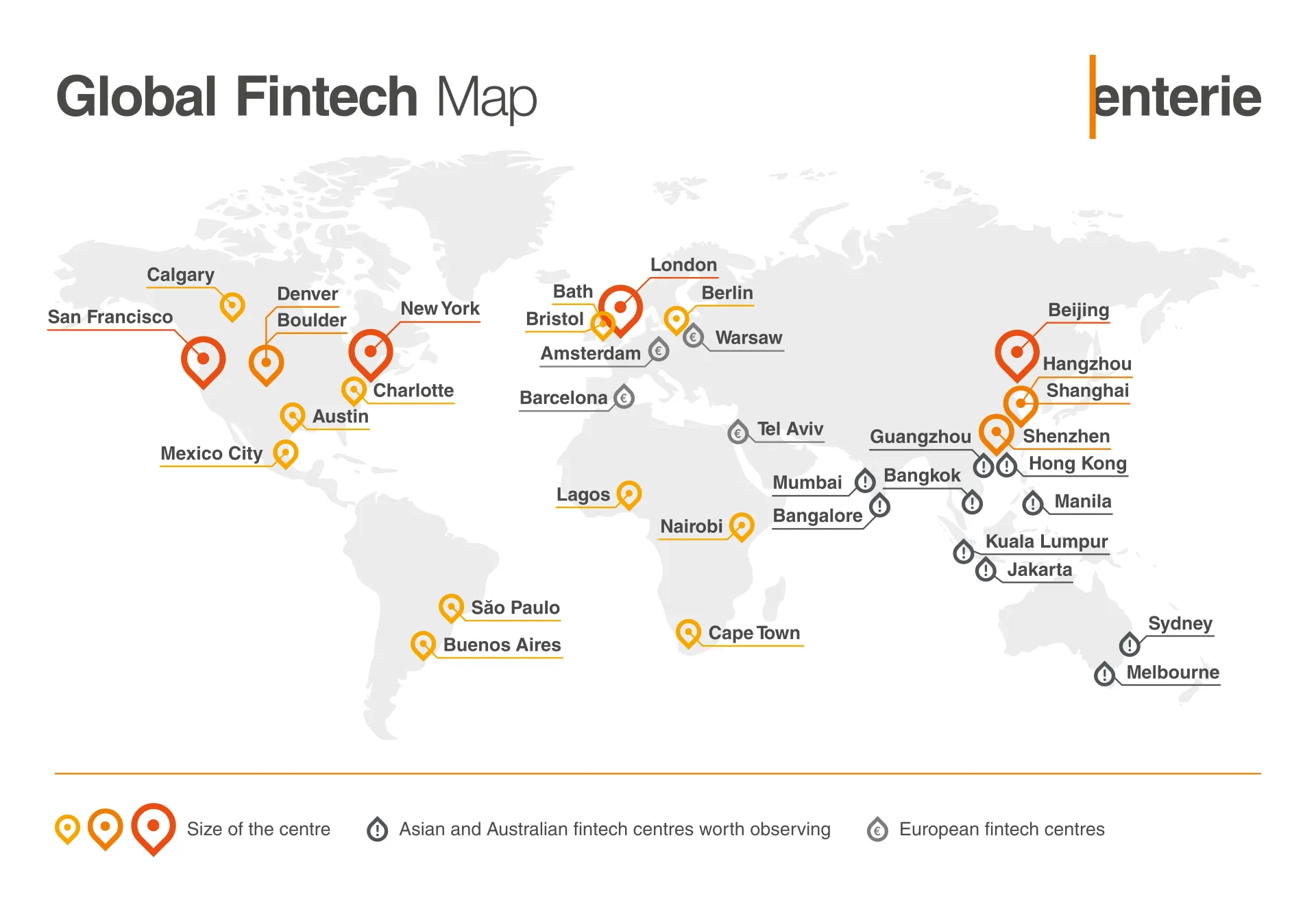

eToro’s Place in the Global Fintech Landscape

eToro has an extensive global presence, with offices and regulatory licenses in major financial centers including the UK, Cyprus, the US, Australia, Singapore, and Abu Dhabi. This multi-regional compliance strategy not only enhances the platform's credibility, but also ensures users receive localized service and investor protection.

Under the supervision of multiple top financial regulatory agencies, eToro is able to provide a safe and compliant trading environment for users around the world.

Regulatory compliance and security

Multi-regional regulatory licenses

eToro holds licenses from several global authorities:

UK Financial Conduct Authority (FCA) – Registration Number: 583263

Cyprus Securities and Exchange Commission (CySEC) – License No.: 109/10

Australian Securities and Investments Commission (ASIC) – AFSL 491139

Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA) – License No.: 220073

Seychelles Financial Services Authority (FSA) – License No.: SD076

Monetary Authority of Singapore (MAS) – CMSL License No.: CMS101824

U.S. Securities and Exchange Commission (SEC) – Registration No. 8-70212

U.S. Financial Crimes Enforcement Network (FinCEN) – MSB No.: 31000204884179

These licenses offer varying degrees of investor protection. For example, the FCA and CySEC require strict client fund segregation and provide compensation mechanisms, while ASIC and MAS strengthen market conduct regulation and consumer protection. These regulatory advantages have led eToro to be considered a low-risk broker on international rating platforms ( source ).

Client funds protection and isolation

eToro uses a segregated account system, storing client funds in top banks such as JPMorgan Chase and Deutsche Bank, independent of the company's operating funds. In the event of bankruptcy, eligible customers can also enjoy compensation mechanisms:

UK FSCS : Maximum £85,000 per person

Cyprus ICF : up to €20,000 per person

( source )

Risk Management and Transparency

eToro sets leverage limits based on local regulatory requirements, with stricter regulations in Europe to protect retail investors. The platform provides clear risk warnings for CFDs and cryptocurrencies, and strictly enforces Anti-Money Laundering (AML) and Know Your Customer (KYC) standards to mitigate the risk of financial crime.

(The content is too long. To ensure completeness, I will continue to translate it part by part until the entire text is completed. Do you want me to output the entire Chinese translation at once, or would you like to view it chapter by chapter?)

OK, let's continue translating the remaining chapters into Chinese, keeping the original layout, hyperlinks, and formatting:

Trading products and platform features

Range of tradable assets

eToro offers a comprehensive range of trading asset classes, including:

Forex : Major, Minor, and Unpopular Currency Pairs

Stocks : Covering over 20 global stock exchanges

Index : Leading Global Stock Indices

Commodities : core commodities such as gold and oil

Cryptocurrency : Over 100 digital assets, including Bitcoin, Ethereum, etc.

A major highlight of the platform is zero-commission stock trading and the ability to hold physical cryptocurrencies as well as trade them through CFDs.

This diversity helps users build diversified portfolios and adopt different investment strategies.

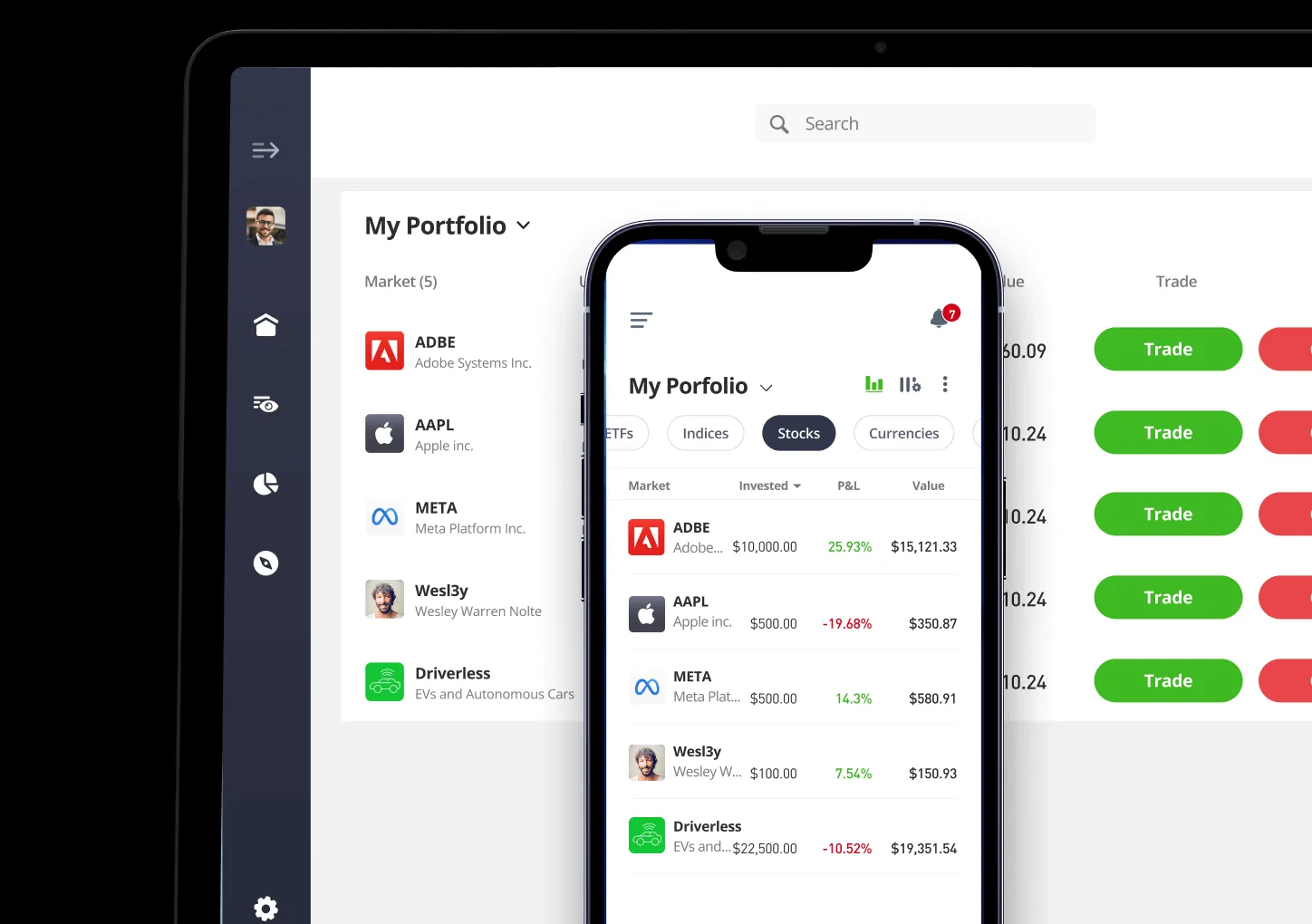

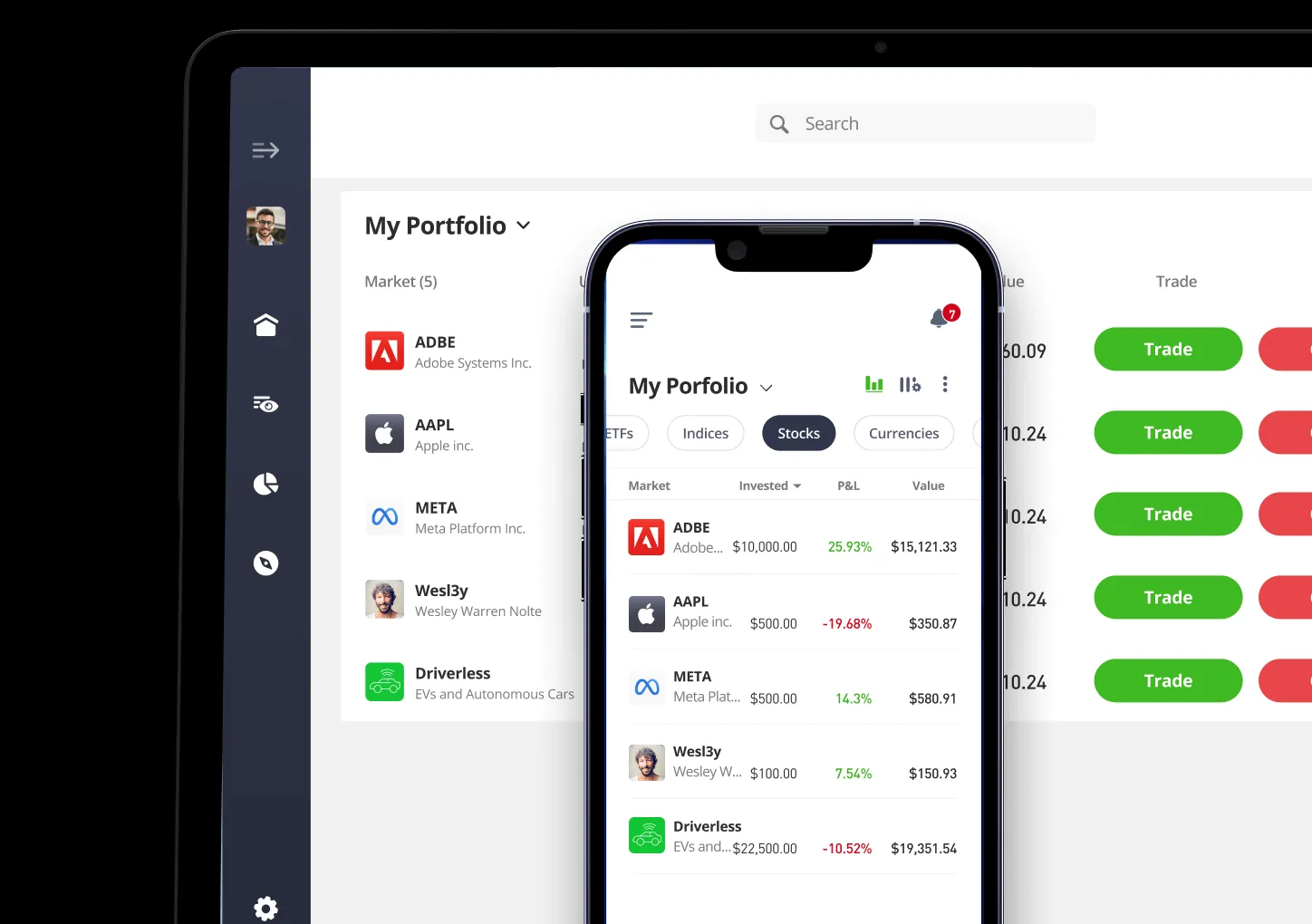

Proprietary trading platform

eToro's proprietary platform supports both desktop and mobile platforms, providing a consistent user experience. Key features include:

Friendly interface : simple and intuitive design

Advanced charting tools : including a variety of technical indicators and drawing tools

Real-time market data : view quotes and news instantly

Social Feed : Interact with traders, share insights, and track market trends

The platform's stability and execution efficiency are industry-leading, making it suitable for both novice and experienced traders ( source ).

Social Trading and CopyTrader™

eToro's most distinctive feature is its CopyTrader™ system, which allows users to copy the trades of top investors in real time. This social model fosters an atmosphere of learning and collaboration, helping novice investors gain guidance and easily diversify their portfolios ( source ).

Account types, account opening process and user experience

Account opening and KYC process

The account opening process is simple but complies with local regulatory requirements. The main steps include:

Register : Provide basic information and create an account

KYC : Submit proof of identity and address

Suitability Assessment : Complete a questionnaire to determine leverage and product permissions

Account approval : Once approved, you can deposit funds and start trading

Different regions may require additional documents or more stringent due diligence.

Account Level and Member Benefits

New clients are defaulted to "Retail Clients" and enjoy the highest regulatory protections. If eligible, they can apply to upgrade to "Professional Clients" or "Qualified Counterparties," unlocking higher leverage and additional features ( source ).

In addition, eToro Club offers membership benefits to active or high-net-worth clients, such as multi-currency conversion, exclusive market insights, and a dedicated account manager.

Platform availability and ease of use

The eToro platform runs smoothly on both desktop and mobile devices, and includes educational resources to ensure smooth operation for users of all levels. New users can learn with tutorials and community support, while advanced users can access sophisticated analytical tools.

Fees, spreads and cost transparency

Transaction fee details

Stock trading : zero commission, attracting stock investors.

Cryptocurrency Trading : As of July 2025, a fixed 1% commission will be charged on both buys and sells, with fees clearly listed for greater transparency ( source ).

Forex and other assets : Competitive spreads apply, depending on market conditions.

Non-transaction fees and other costs

Deposit and Withdrawal Fees : Multiple methods are supported, but some fees and processing times are not fully disclosed.

Inactive Account Fees : Fees may apply if the account is not used for an extended period of time.

Cryptocurrency Wallet Transfer Fees : Transfers to your eToro Money Wallet may incur additional fees and limits.

Cost comparison and transparency

eToro has improved fee transparency, particularly in cryptocurrencies. Unlike the traditional "spread model," eToro clearly displays fees, allowing users to clearly understand costs before trading, which is particularly beneficial for active traders or those with low profit margins.

Deposits, Withdrawals, and Fund Management

Supported payment methods

eToro supports a variety of payment methods:

Bank transfer

Credit/Debit Card

e-wallet

Cryptocurrency transfers

Multi-currency accounts (GBP, USD, EUR) help users save on exchange costs.

Deposit and Withdrawal Process

Process-friendly and safe:

Initiate operation : Select payment method and amount

Verification : Complete security verification

Processing : Funds are processed according to the payment channel, and the time varies by region and service provider.

We use segregated accounts and cooperate with top banks to ensure the safety of funds.

eToro Money Wallet and Crypto Transfers

The eToro Money Wallet facilitates crypto asset management, with features including:

Direct transfer : transfer assets between exchanges and wallets

Fee transparency : Clearly display transfer fees and limits

Enhanced security : multi-layer authentication and encryption

This integrated wallet meets investors' needs for flexible management of digital assets.

Do you want me to translate the chapters after Customer Support, Education, and Community (up to Conclusion and References) in full?

OK, let's continue with the translation of the rest of the text, keeping the formatting, layout, and hyperlinks intact:

Customer Support, Education, and Community

Multilingual customer service

eToro offers 24/5 multilingual customer support , ensuring timely assistance for users around the world. Feedback indicates that response times are generally fast, and the team provides expert answers to technical and account-related questions ( source ).

Educational resources and market analysis

eToro Academy is a comprehensive learning center that offers:

Webinars and Live Events

Investment Courses

Market Analysis Report

Step-by-step tutorial

These resources are suitable for both new and experienced traders, helping users to continuously learn and improve their trading skills.

Community interaction and user participation

eToro's social features foster a vibrant community on the platform, allowing users to share insights, discuss strategies, and support each other. Real-life investment stories and success stories provide inspiration and practical guidance to other users in the platform's social feeds and forums.

Security, Risk and Investor Protection

Security architecture and best practices

eToro employs industry-leading security measures, including:

Data encryption

Two-factor authentication (2FA)

Regular security audits

These measures help protect user data and assets from unauthorized access and cyber attacks.

Risk Disclosure and Management Tools

The platform clearly discloses risks, particularly those related to leveraged trading and volatility in the forex and crypto markets. Built-in risk management tools, such as stop-loss and take-profit orders, help users manage their risk exposure and mitigate potential losses.

Investor Compensation and Dispute Resolution

Eligible clients can benefit from compensation mechanisms such as the FSCS and ICF to protect against broker bankruptcy risks. eToro also has a complaints and dispute resolution process to ensure that user issues are handled promptly and fairly ( source ).

User reputation, awards and industry recognition

User reviews and community reputation

eToro enjoys a good reputation among users worldwide. Common positive reviews include:

Strong regulatory compliance

Innovative social trading features

Diverse product selection

User-friendly platform

Comprehensive educational resources

But some criticism has focused on leverage risks and a lack of transparency in some fee information.

Industry Awards and Third-Party Recognition

eToro has been recognized by several authoritative organizations, including:

Best Trading Platform – Forbes Advisor 2024

Best UK Online Broker – Forbes Advisor 2024

Best Cryptocurrency Trading Platforms – Investopedia 2024

Best Social Trading Platform – Forbes Advisor 2024

These awards highlight eToro’s credibility and standing in the online trading space ( source ).

Comparative Analysis – eToro vs. Other Brokers

Key Differentiating Advantages

The advantages of eToro are:

Multi-regional regulatory coverage

Innovative social trading and CopyTrader™ features

Diversified products (covering traditional and digital assets)

Zero commission stock trading

User-centered platform design

Cost and Features Comparison Table

| Function | eToro Group | Typical Brokers (Overview) |

|---|---|---|

| Regulation | Multi-jurisdictional | Varies by company |

| Social Trading | Yes (CopyTrader™) | rare |

| Stock Commissions | Zero commission | $5–$10/transaction |

| Crypto Transaction Fees | 1% (explicitly displayed) | 0.5%–2% (often hidden) |

| Platform Type | Proprietary Platform | MT4/MT5 or own |

| Educational Resources | Comprehensive and rich | Different |

| Compensation Mechanism | FSCS, ICF, etc. | Different |

Suitable for users who choose eToro

eToro is particularly suitable for:

Investors who need social and copy trading features

Newbies looking for educational support

Users who want to diversify their investment portfolio

Investors who value compliance and fund security

Risks, limitations, and room for improvement

Leverage and Market Volatility Risk

Leverage can magnify gains, but it also increases the risk of loss. While eToro provides risk warnings and tools, users should exercise caution and ensure their trading strategy aligns with their risk tolerance.

Fee transparency and information gaps

While eToro has improved transparency into crypto trading fees, information on fees for deposits, withdrawals, and inactive accounts remains incomplete. Further disclosure would be beneficial in building user trust.

Regional restrictions and regulatory differences

Some products and features may not be available in certain regions for regulatory reasons. Users should confirm the applicable terms in their region before opening an account.

Conclusion and Expert Recommendations

Summary of eToro's strengths and weaknesses

Advantages :

Multi-regional regulatory compliance and fund protection

Innovative social trading and CopyTrader™ features

Zero-commission stock trading and diverse asset selection

User-friendly platform and educational resources

Industry recognition and good user reputation

insufficient :

Leverage risk needs to be managed carefully

Some fee information is not transparent enough

Regional differences in product availability

Final Conclusion – Is eToro Right for You?

eToro is suitable for investors seeking a secure, innovative, and community-driven trading environment. Its combination of regulatory advantages, diverse product offerings, and social trading features makes it particularly suitable for beginners and those seeking to learn from others' experience. However, users should be aware of the risks of leverage and ensure they understand all associated fees.

Practical advice for new and old users

Prioritize risk management : Use stop-loss orders and avoid excessive leverage

Stay informed : Check the fee schedule and platform updates regularly

Make good use of educational resources : actively learn from eToro Academy and community content

Confirm regional terms : Ensure product availability and compliance protection in your region

References and Further Reading

Official Resources

External regulatory bodies

This review is based on authoritative data and verified information as of August 28, 2025. For the latest updates and detailed broker comparisons, visit BrokerHiveX .

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.