BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Founded in 2011 and headquartered in Limassol, Cyprus, FXTM is a global, multi-regulated online forex and CFD broker. Offering services across Europe, Africa, Asia, and Latin America, the platform offers a diverse range of trading products, including forex, commodities, metals, indices, ETF CFDs, stock CFDs, spot stocks, and cryptocurrency CFDs. FXTM has established a strong reputation among retail investors thanks to its stringent regulatory oversight, flexible trading conditions, and extensive educational support.

FXTM (ForexTime Limited) is a retail forex and CFD broker with a strong international presence. Its compliance is built on multiple regulatory licenses, including CySEC in Cyprus, the UK FCA, the South African FSCA, and the Mauritius FSC. This multi-regional licensing structure not only enables the platform to operate legally and compliantly in various jurisdictions, but also provides investors with the security and regulatory backing of cross-border fund flows.

FXTM's operating model emphasizes a "multi-regional presence + localized service": maintaining a compliant image in mature markets like Europe and the United States, while fostering user engagement in emerging markets through investor education, offline events, and local language customer service. For example, in the African market, FXTM hosts regional trading seminars to help investors understand forex risks and trading strategies. This "local penetration" strategy not only enhances brand influence but also improves customer retention.

FXTM offers over 250 trading instruments, including Forex, Stock Indices, Commodities, Precious Metals, Stock CFDs and Cryptocurrency CFDs.

Short-term traders: On major currency pairs, the platform offers spreads starting from 0.1 pips and high market liquidity, suitable for scalping and day trading strategies.

Medium- to long-term investors: They can allocate assets through CFDs on indices, energy, precious metals, etc., for example, using crude oil and gold to hedge macroeconomic risks.

Cryptocurrency Investors: This platform offers CFD trading on major cryptocurrencies such as Bitcoin and Ethereum, without the need to hold physical assets. It is suitable for users who want to take advantage of volatility but do not want to bear the risks of digital asset custody.

Overall, FXTM’s product line is sufficient to cover the needs of most retail traders, but its product depth may be insufficient for clients who require OTC block trades or specific institutional-grade derivatives.

FXTM supports access to all MT4 and MT5 platforms, including desktop, web, and mobile, to meet different needs from basic trading to automated strategy development.

Execution Quality: Order execution latency is below industry average in most market conditions, making it suitable for trading strategies that require speed.

Strategy compatibility: Supports EA automated trading, more than 50 technical indicators and multiple pending order types.

External Evaluation: Data from an independent third-party evaluation platform indicates that FXTM ranks above average in the industry in terms of server stability and order slippage control. However, during extremely volatile market conditions (such as during the release of major economic data), it is still recommended that users set a maximum acceptable slippage limit to mitigate unexpected risks.

For users who value mobile trading experience, FXTM's MT4/MT5 APP has relatively complete functions, but its self-developed tools are relatively limited and rely more on the MT platform ecosystem.

FXTM is regulated by several leading financial regulators, including:

Cyprus Securities and Exchange Commission (CySEC): Official Inquiry Number: 185/12

UK Financial Conduct Authority (FCA): Official Inquiry Regulatory Number: 777911

Financial Sector Conduct Authority (FSCA) of South Africa: Official Inquiry Number: 46614

Mauritius Financial Services Commission (FSC): Official Inquiry Regulation Number: C113012295

The company strictly implements a segregated client funds custody system, storing investor funds in independent bank accounts, completely separate from the company's own funds. Even if the platform encounters operational problems, client funds are still protected within the legal framework.

It’s important to note that different regulatory jurisdictions have different requirements for leverage ratios and risk control. For example, the leverage limit under FCA regulation is 1:30, while the Mauritius FSC may allow higher leverage, which will directly affect investors’ trading strategies and risk management.

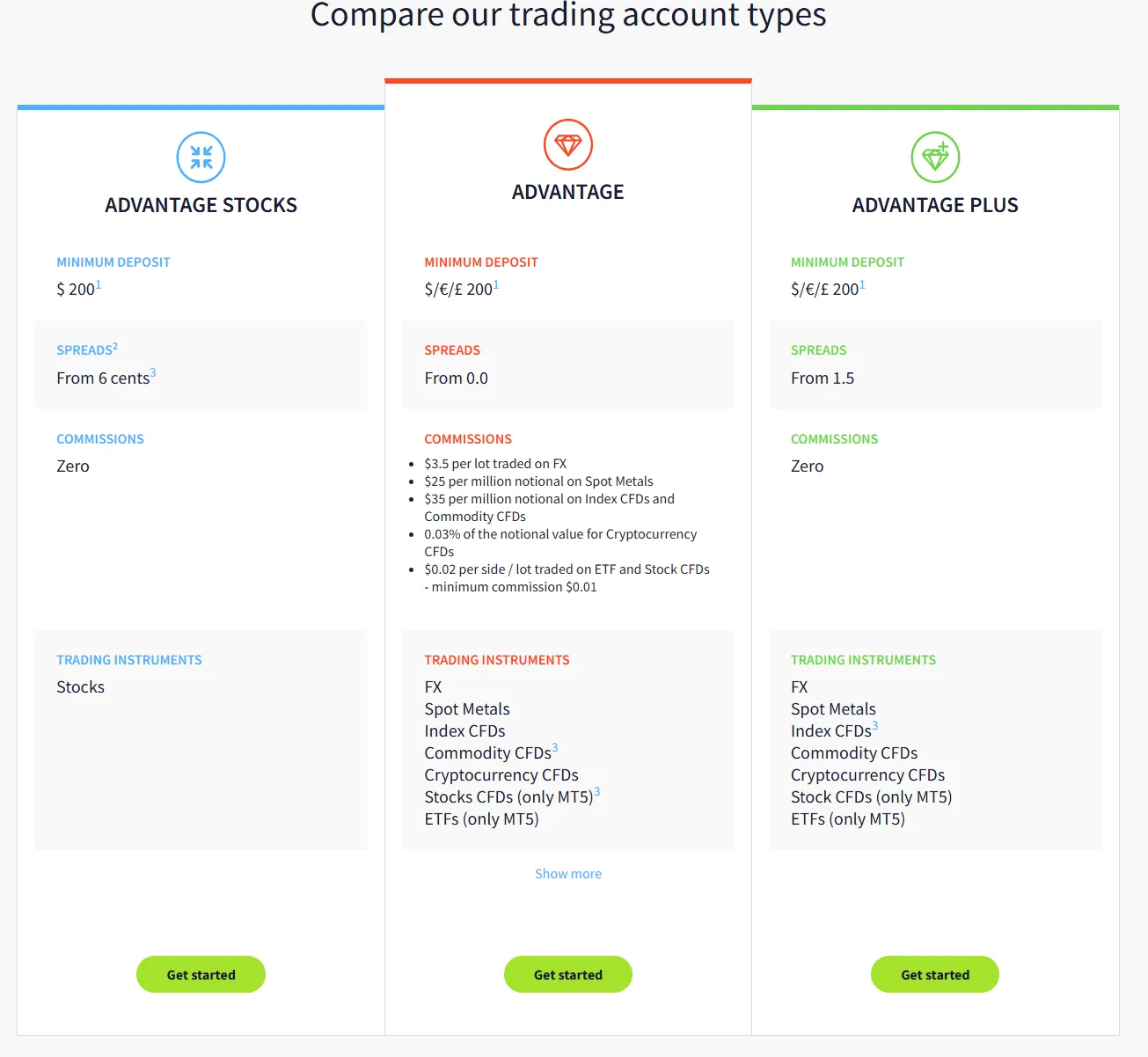

FXTM offers a flexible account system, including Standard Account, ECN Account and Professional Account types, to suit different trading habits and cost preferences.

Minimum deposit: as low as $10, lowering the entry threshold for novices.

Spread level: ECN accounts can start from as low as 0.1 pips on major currency pairs, but additional trading commissions must be paid.

Leverage: Up to 1:2000 (depending on the regulatory region), which provides high capital utilization but also brings the possibility of magnified risk.

Overall, FXTM’s trading conditions are friendly to beginners and light-capital users, but high-leverage accounts are more suitable for experienced traders who can control risks.

FXTM offers 24/5 multilingual customer support in English, Chinese, Arabic, French, and more, and invests heavily in education and training:

Educational content: Systematic courses from basic forex introduction to technical analysis strategies.

Real-time analysis: Daily market briefings and macro analysis reports help investors seize market opportunities in a timely manner.

Events and seminars: Online webinars and offline training courses, especially in emerging markets.

This "education-driven" service model not only improves customers' trading capabilities, but also invisibly strengthens brand stickiness.

Email: [email protected]

FXTM has strong advantages in brand awareness, regulatory compliance, product diversity and educational support, and is particularly suitable for retail traders who want a low-threshold entry into the market and value learning resources and localized support.

However, investors seeking institutional-grade liquidity, customized trading conditions, or advanced quantitative tools may need to use FXTM in conjunction with other platforms. Overall, FXTM is a platform worth considering as a long-term partner for investors seeking to gradually build experience in a compliant, low-barrier-to-entry environment with stable trading conditions.

Is FXTM a scam?

No. FXTM holds multiple regulatory licenses, including from Cyprus' CySEC, the UK's FCA, South Africa's FSCA, and Mauritius's FSC, making it a regulated broker. However, investing in forex and CFDs carries a high level of risk, so please consider your investment based on your own risk tolerance.

How fast are FXTM withdrawals?

In most cases, withdrawals will arrive within 1-3 business days, depending on the withdrawal method selected and the bank's processing efficiency.

What is the maximum leverage limit for FXTM?

The maximum leverage is 1:2000, with different limits in different regulatory regions. For example, leverage under FCA regulation is usually 1:30.

What trading platforms does FXTM support?

Supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), covering desktop, web and mobile terminals, and supports EA automated trading.

Is it suitable for novice investors?

Yes. FXTM offers extensive educational resources and a low deposit threshold, but we recommend that new traders familiarize themselves with the platform and markets using a demo account before committing to live trading.

Company Name:Forextime Ltd

Website:

https://www.futuo-fx.biz/zh-CN/

9.19

Business Rating

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.