BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Is ACY Securities Global reliable? This article comprehensively analyzes its ASIC + VFSC regulatory structure, low spreads on ECN accounts, MT4/MT5 platform support, real-world deposit and withdrawal experiences, and user and media reviews to help you determine whether ACY Securities Global is a scam or a safe platform.

Full company name : ACY Securities Global Ltd.

Founded : 2013

Headquarters : Sydney, Australia + Port Vila, Vanuatu

User coverage : Asia Pacific, Europe and the Middle East markets

Official website : https://www.acyglobal.com

ACY started as an education-driven brokerage and subsequently evolved into a multi-asset liquidity provider. It operates under multiple entities, including ACY Securities Pty Ltd., regulated by ASIC in Australia, and ACY Securities Global Ltd., regulated by the VFSC in Vanuatu.

| Account Type | Minimum deposit | Average spread | Commission Structure |

|---|---|---|---|

| Standard | $50 | EUR/USD average 1.0 pip | Commission-free |

| ProZero | $200 | EUR/USD average 0.1–0.3 pips | $3.5/side/lot |

| Bespoke | $10,000 | EUR/USD average 0.0–0.2 pips | $2.5/side/lot |

Leverage : Up to 1:500 (for global clients), Australian entities comply with ASIC limit of 1:30

Execution mode : STP/ECN, no trader intervention

Best for : Beginners (Standard), Day Traders (ProZero), Large Accounts (Bespoke)

| Regulatory agencies | License number | Entity Name |

|---|---|---|

| ASIC (Australian Securities and Investments Commission) | AFSL 403863 | ACY Securities Pty Ltd. |

| VFSC (Vanuatu Financial Services Commission) | 012868 | ACY Securities Global Ltd. |

ASIC official inquiry

👉 VFSC official inquiry

📌Regulatory interpretation :

ASIC : Strong regulation, investor funds isolation, and strict leverage restrictions.

VFSC : Relaxed regulation, allows high leverage, and has simple account opening conditions.

Risk Warning : Most global clients actually open accounts with VFSC entities, and compliance protection is limited.

Forex : 60+ currency pairs

Commodities : gold, silver, crude oil

Index : Covers major stock indices in the U.S., European, and Asia-Pacific markets

Cryptocurrency CFDs : BTC, ETH, LTC, etc.

Stock CFD : Apple, Tesla, Alibaba, etc.

📌Advantages : Covers the foreign exchange and mainstream CFD markets, suitable for spread speculation.

📌 Cons : Doesn't offer physical stocks or ETFs, and its asset allocation capabilities are inferior to Saxo Bank.

Measured latency : 120–160ms

Slippage performance : ±0.2–0.5 pips

Large transactions : orders can be split to ensure execution depth

Comparison : MT5 is better in multi-product trading and deep market conditions, while MT4 is more suitable for EA/quantitative trading

Deposit : Visa/Mastercard, Skrill, Neteller, bank transfer, USDT (some regions)

Withdrawal : Return via the same path

Actual experience :

Skrill deposits are instantly credited to your account

Bank withdrawals arrive in 24–36 hours

USDT deposits and withdrawals are completed in about 10 minutes

Email : [email protected]

Tel : +61 2 9188 2999

Languages : English, Chinese, Vietnamese, Indonesian, Arabic

Educational resources : ACY Finance Academy, offering video courses and forex seminars

Features : Multilingual customer service + high-frequency trading support

WikiFX : ACY has been rated as a "Compliant Multi-Entity Brokerage Firm," and investors are reminded to confirm the entity where they open their accounts.

TraderKnows : Its spreads and execution are rated at medium to high levels.

FXEye : Points out that VFSC's physical supervision is weak and risks need to be noted.

User reputation :

Positives: low spreads, stable platform, smooth deposits and withdrawals

Negatives: Customer service is sometimes delayed, and there is no ASIC protection for non-Australian customers.

👉 BrokerHiveX Rating Criteria Explanation

Most client accounts are held by VFSC entities , with limited regulatory protection

Investor compensation mechanism : provided by ASIC, not by VFSC

High leverage risk : up to 1:500, suitable for experienced traders

Non-EU/Australian customers should be aware of compliance differences

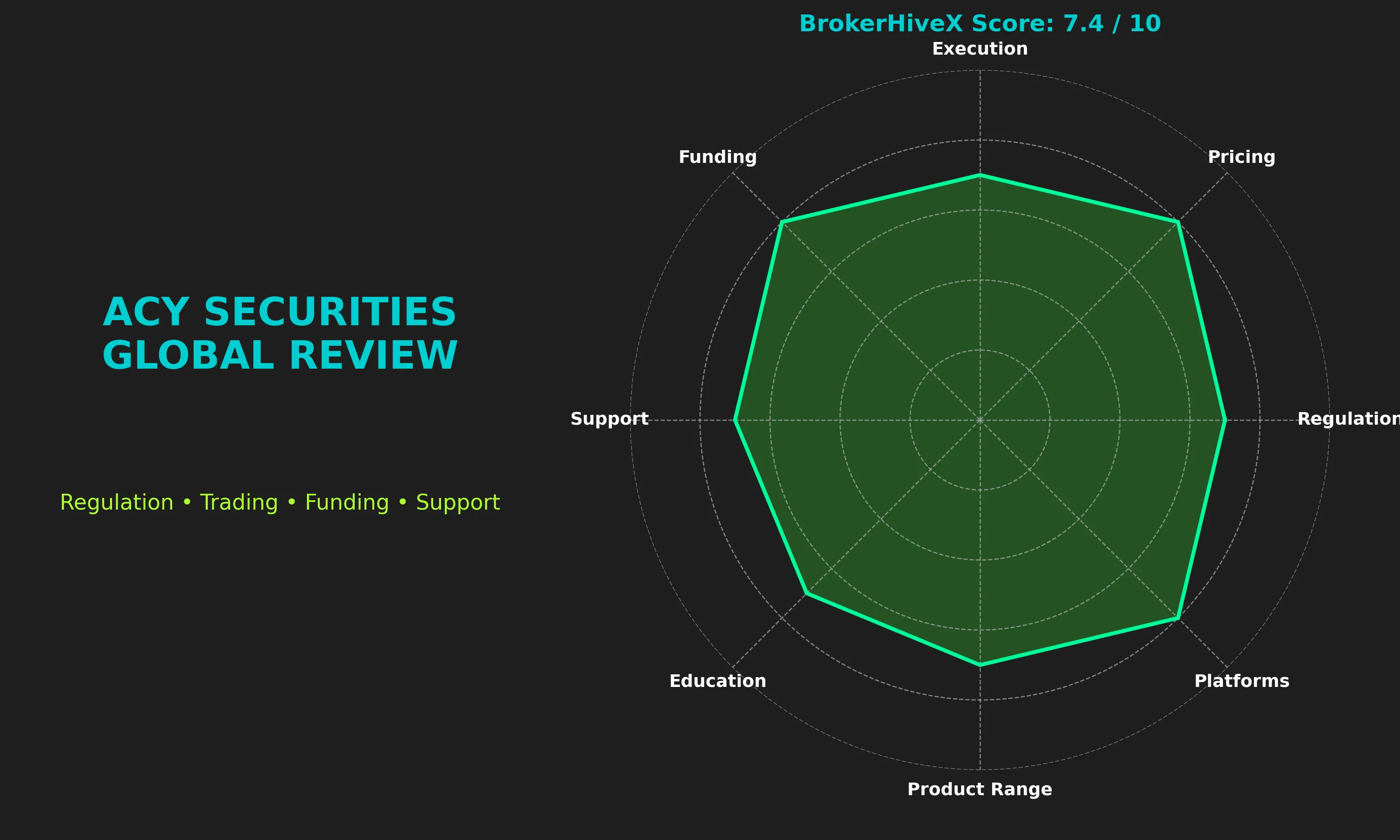

Regulation : 7/10 — Strong ASIC regulation, but VFSC entities are dominant

Pricing : 8/10 – Low spreads and transparent commissions

Execution : 7/10 — Latency 120–160ms, manageable slippage

Funding : 8/10 — Multiple payment methods, including USDT support

Support: 7/10 — Multilingual support, but average customer service speed

Education : 7/10 — Videos and workshops, but lack of depth

Product Range : 7/10 – Comprehensive coverage of mainstream CFDs, but no ETFs or physical stocks

Platforms : 8/10 – MT4/MT5 dual platform support

Overall Rating: 7.4/10 — Dual regulatory structure, low costs, suitable for global customers, but be aware of differences in account opening entities.

ACY Securities Global is a mid-sized international brokerage firm with the following advantages:

Dual regulation (ASIC + VFSC)

Multi-language coverage, suitable for Asia-Pacific customers

Low spreads + MT4/MT5 support

Suitable:

Day trading, scalping, quantitative users

Newbies can choose the low-threshold Standard account

Bespoke accounts are available for large capital clients

Not suitable for:

Investors requiring EU Investor Compensation Scheme

Long-term investors who want ETFs and physical stocks

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.