The Psychology of Risk Management: How to Stick to Stop-Losses in Forex Trading

Summary:In the high-stakes world of forex trading, technical analysis and market knowledge are only part of the equation for long-term success. The psychological aspect—how traders manage their emotions, biases, and discipline—often determines whether they succeed or fail.

The Psychology of Risk Management: How to Stick to Stop-Losses in Forex Trading

Introduction: The Key Role of Psychology in Forex Risk Management

In the high-stakes world of forex trading, technical analysis and market knowledge are only part of the equation for long-term success. Psychology—how traders manage their emotions, biases, and discipline—often determines success or failure. This is particularly evident in the ability to consistently adhere to stop-loss orders, which is the cornerstone of effective forex risk management.

Statistics reveal a sobering reality: 90% of retail forex traders lose money, primarily due to inadequate risk management and a failure to manage emotions ( BrokerHiveX, 2025 ). Despite the widespread availability of risk management tools and educational resources, emotional traps like fear, greed, and overconfidence continue to derail trading plans.

This article explores the psychological barriers to executing stop-loss orders, practical strategies for overcoming them, and the critical role of trading plans and broker selection in supporting emotional risk management. As an authoritative source for broker rankings, regulatory data, and risk management tools, BrokerHiveX helps traders build discipline and resilience, enabling stable, controlled trading.

Understanding the Emotional Trap in Forex Trading

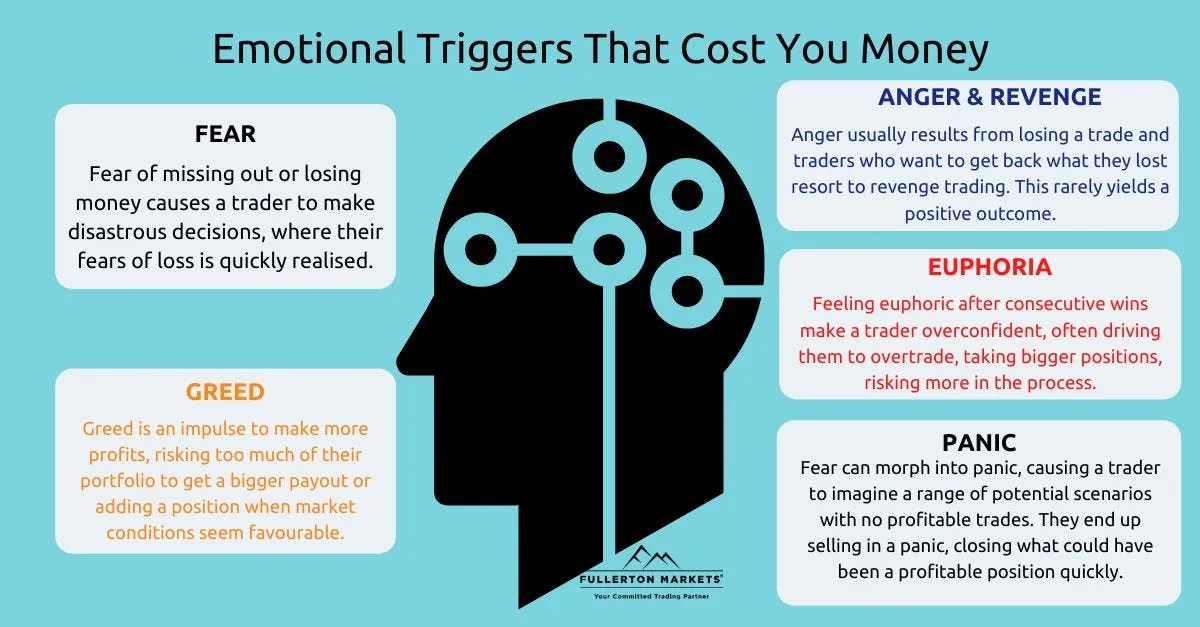

Twin Forces: Fear and Greed

At the core of trading psychology are two powerful emotions: fear and greed . They drive traders to make irrational decisions, often at the expense of risk management.

Fear : This manifests as hesitation, prematurely removing stops, or closing a position prematurely to avoid potential losses. This can lead to missed opportunities and self-doubt.

Greed : This drives traders to overtrade, ignore stop-loss orders, and take excessive risks in pursuit of quick profits. The allure of large profits often overwhelms rational judgment, leading to catastrophic losses.

Axiory research indicates that "greed drives traders to take excessive risks and ignore stop-loss orders, while fear leads to hesitation and missed opportunities" ( Axiory, 2025 ). Real-world examples abound: some traders remove their stops in anticipation of a rebound, only to see their losses deepen; others close their positions prematurely, fearing a reversal, and miss out on continued profits.

Common cognitive biases that affect stop-loss execution

In addition to emotions, cognitive biases can also quietly distort traders' judgments:

Overconfidence bias : Overestimating one's ability to predict the market, leading to excessive risk-taking and ignoring stop-loss orders.

Confirmation bias : Seeking only information that supports one's own views and ignoring warning signs.

Loss aversion : unwilling to admit losses, refusing to stop losses, insisting on holding losing orders, and hoping for a reversal.

Gambler's fallacy and recency bias : Mistakenly believing that past outcomes will affect future outcomes, or over-reliance on recent events, leading to risk perception bias and impulsive decision-making.

The solution is to cultivate self-awareness, regularly review your decision-making process, and seek objective feedback. Identifying these psychological traps is the first step to developing disciplined risk management ( Axiory, 2025 ).

The Challenge of Sticking to Stop-Losses: Psychological Barriers and Solutions

Why Traders Have Difficulty Executing Stop-Losses

Even though they understand the importance of stop-loss orders, many traders still struggle to consistently follow them. Key psychological barriers include:

Emotional attachment to positions : Traders become overly invested and unwilling to admit losses.

Fear of Missing Out (FOMO) : The fear of a market reversal leads to removing or adjusting stop-loss orders.

Stress and mental fatigue : Long-term trading and high volatility environments weaken discipline and increase the probability of impulsive actions.

Impulsive and revenge trading : Trying to "win back" after a loss, often abandoning stop-loss rules and increasing risks.

A typical example: A trader sets a stop-loss, but begins to waver as the market approaches the stop-loss. Fearing they might miss out on a rebound, they either move the stop-loss farther away or cancel it outright. This leads to increased losses, emotional upset, and further irrational behavior ( Quant-Investing, 2025 ).

Discipline: The Cornerstone of an Effective Stop-Loss Strategy

Discipline is the cornerstone of successful trading. It means strictly adhering to established rules, even if emotions urge you to do otherwise. Quant-Investing emphasizes: "Stop-loss orders are not advice, but rules to protect your portfolio. Discipline eliminates emotional interference and prevents self-doubt and market hesitation" ( Quant-Investing, 2025 ).

Practical tips for strengthening discipline:

Mental habits and routines : Set up a pre-trade checklist and post-trade review.

Accountability mechanisms : Keep a transaction log, share transactions with peers, or join a community for external oversight.

Regular breaks and mindfulness training : Relieve stress and improve decision-making quality.

Integrating discipline into your daily processes makes stop-loss execution automatic and non-negotiable.

Integrate stop-loss discipline into your complete trading plan

Designing trading plans that support emotion and risk control

A solid trading plan serves as a trader's compass, helping them make decisions and manage their emotions. Key elements include:

Entry and exit criteria : clarify the rules to avoid impulsive decisions.

Stop-loss setting : a predefined level based on technical analysis and risk tolerance.

Single transaction risk ratio : limit the risk ratio of each transaction to the account funds.

Contingency Plan : Prepare alternative plans for unexpected events or technical failures.

Flexibility is also important – plans should be able to adapt to market changes, rather than succumbing to emotions. Regular reviews and performance analysis can help identify areas for improvement and strengthen discipline ( Interactive Brokers, 2025 ).

BrokerHiveX provides trading plan templates and risk simulators to help traders design and test strategies in a controlled environment.

Trading Plan Execution: A Mental Compass

A well-developed trading plan can reduce emotional decision-making and provide a framework for consistency. Techniques for maintaining execution include:

Pre-trading checklist : Confirm that all conditions are met before entering the market.

Post-trade review : Analyze results and identify emotional triggers.

Performance indicators : Track execution rates and adjust strategies when necessary.

Interactive Brokers emphasizes: "A trading plan is like a compass, guiding decision-making and emotional management. It must be flexible, reviewed regularly, and optimized for performance" ( Interactive Brokers, 2025 ).

Emotional risk management challenges unique to forex trading

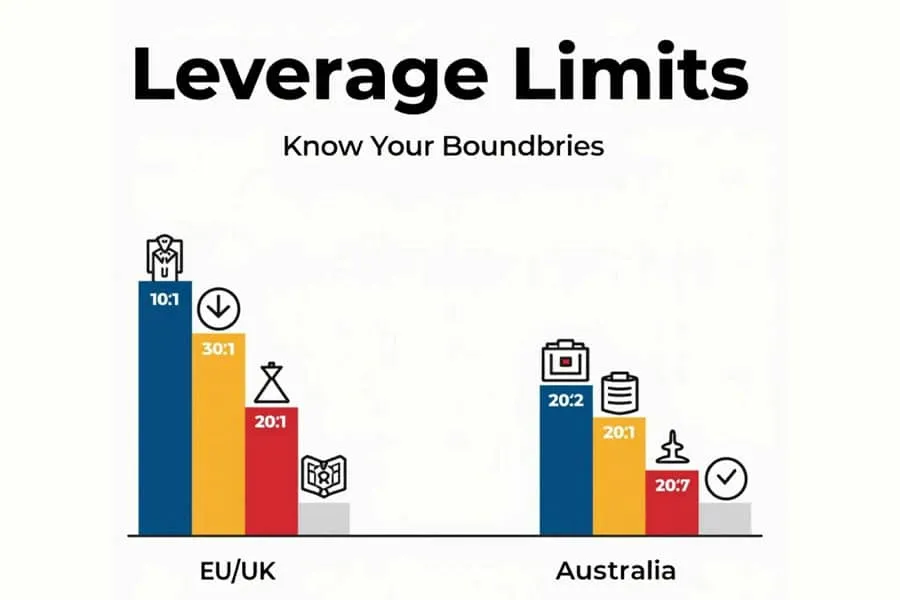

High leverage and high volatility: Amplifiers of psychological stress

The forex market is known for its high leverage and volatility, which can exacerbate emotional reactions and risk exposure. Traders must manage:

Position sizing : Adjust position size to suit your psychological tolerance and risk appetite.

Leverage control : Use leverage with caution to avoid amplifying losses.

Platform features : Choose a broker that offers risk control tools such as negative balance protection and guaranteed stop-loss.

The BrokerHiveX Global Forex Broker Ranking highlights platforms with strong risk management features, helping traders find brokers that support disciplined trading.

Practical Emotion Management Tips for Forex Traders

To manage stress and maintain discipline, traders can:

Mindfulness and breathing exercises : Reduce anxiety and improve focus.

Take regular breaks : avoid mental fatigue caused by staring at the market for long periods of time.

Cognitive behavioral approach : Challenge negative thought patterns and reinforce positive habits.

Trading journal : Record emotional states, triggers, and outcomes to help identify patterns.

Research from easyMarkets shows that: “Traders with strong emotional control perform better, while traders who overreact emotionally after trading tend to perform poorly” ( easyMarkets, 2025 ).

Automated Trading and Emotional Risk Management

Strengthen discipline with automated stop-loss strategies

Automated trading tools (such as EAs) can help eliminate emotional interference and enforce stop-loss orders. Key advantages include:

Consistent risk control : The automated system executes stop-loss orders without hesitation.

Dynamic stop loss : Like a moving stop loss, it adjusts with market changes to lock in profits and limit losses.

Drawdown Protection : Advanced EAs can suspend trading when losses exceed a preset value, preventing catastrophic losses.

BrokerHiveX's Automated Risk Management Guide details how leading platforms implement features like maximum drawdown limits and negative balance protection.

However, over-reliance on automation can lead to complacency. Traders must remain engaged and regularly review their system's performance to ensure it remains consistent with their trading plan.

Psychological Considerations for Using Automation

While automation reduces emotional distractions, mental discipline is still necessary:

Maintain oversight : Regularly monitor automated systems to ensure they are functioning properly.

Avoid slackness : Keep an eye on the market and intervene when necessary.

Combine manual methods : Use trading logs and sentiment assessments alongside automated tools for comprehensive risk management.

By combining automation with human oversight, traders can strike a balance between emotion and risk control.

Choose the right broker that supports risk management

The Importance of Broker Risk Control Tools and Regulatory Compliance

The choice of broker directly impacts risk management and discipline. Key features to look for include:

Guaranteed Stop : Ensures execution at the set price, even in volatile markets.

Negative balance protection : prevents the account balance from becoming negative in extreme market conditions.

Transparent risk disclosure : Clearly inform the platform of risks and protection measures.

BrokerHiveX broker rankings and regulatory databases help traders identify trustworthy brokers with strong risk controls. For example, IG Group offers comprehensive risk management tools.

BrokerHiveX: Your Risk Management Partner

BrokerHiveX is the definitive resource for broker information, regulatory insights, and risk management tools. With it:

Authoritative Broker Profiles : Get detailed profiles and risk ratings of global Forex brokers.

Regulatory Insights : Stay up-to-date on the latest compliance standards and regulatory developments.

Risk Management Resources : Improve your trading discipline with trading plan templates, risk simulators, and expert analysis.

This allows traders to build the foundation of trust, transparency, and discipline needed for long-term success.

Conclusion: Build Mental Resilience and Adhere to Stop-Loss Discipline

Adhering to stop-loss orders isn't just a technical challenge; it's also a psychological one. Traders must confront and overcome emotional traps like fear, greed, and overconfidence, as well as cognitive biases that undermine risk management. By combining a structured trading plan, practical discipline techniques, and reliable brokerage tools, traders can build the mental resilience needed to navigate volatile markets.

BrokerHiveX offers a comprehensive suite of resources, from broker rankings and regulatory databases to expert insights, to help traders make rational and disciplined decisions. Remember: discipline and emotional awareness are the cornerstones of long-term trading success . Continuous learning, self-reflection, and the effective use of authoritative tools are essential for a controlled and profitable trading journey.

FAQ: Risk Management Psychology and Stop-Loss Discipline

Q1: What are the main psychological barriers to adhering to stop-loss orders?

A1: The main obstacles include fear of loss, greed for high profits, overconfidence, loss aversion, and emotional attachment to trading. These factors can lead to premature stop-loss removal, excessive risk-taking, and impulsive decision-making.

Q2: How do I overcome fear and greed in trading?

A2: Increase self-awareness through journaling, using a pre-trade checklist, practicing mindfulness, and strictly adhering to a trading plan. Review trades regularly to identify emotional triggers and reinforce disciplined behavior.

Q3: What role does a trading plan play in risk management psychology?

A3: A trading plan provides a structured framework for decision-making, reducing emotional interference. It clarifies entry/exit criteria, stop-loss levels, and risk limits, helping traders maintain discipline and consistency.

Q4: Is automatic stop loss better than manual stop loss?

A4: Automated stop-loss orders can eliminate emotional interference and ensure consistent execution. However, traders still need to monitor the automated system to avoid slacking off and ensure it remains consistent with the overall strategy.

Q5: How do I choose a broker that supports risk management?

A5: Look for a broker with guaranteed stop-loss, negative balance protection, transparent risk disclosure, and strong regulatory compliance. Use BrokerHiveX's global forex broker rankings and regulatory database to compare and choose a trustworthy platform.

For more expert insights and the latest updates on risk management tools, please visit BrokerHiveX Financial News and BrokerHiveX Expert Profiles .

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information from the public internet or user-uploaded content. BrokerHivex does not support any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.