BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Japan was the first to introduce a stablecoin regulatory framework in 2023, but market adoption has been slow. Now, the United States has passed the GENIUS Act, signaling greater market openness and attracting investor attention. #stablecoin #JapanRegulation #GENIUSAct #cryptomarket #investmenttrends

Japan took the lead in amending its Payment Services Act in 2023, establishing the world's first comprehensive stablecoin regulatory framework (Cointelegraph). Under the law, only licensed banks, trust banks, and registered remittance agents may issue stablecoins. Despite this comprehensive regulatory framework, the actual implementation of Japanese yen stablecoins has been far slower than expected. Investors generally report that clear regulations have not immediately translated into widespread adoption.

In contrast to Japan's cautious stance, the GENIUS Act, introduced in the United States in 2024, signaled an openness. The bill allows not only banks but also federally chartered non-bank companies to issue stablecoins, as long as they meet reserve and regulatory compliance requirements (Cointelegraph). This design quickly ignited market enthusiasm, with investors viewing it as a major catalyst for stablecoin adoption.

“Japan prioritizes system stability over innovation speed, while the U.S. signals greater market openness,” said Takashi Tezuka, Japan manager at Startale Group. This is the core reason for the adoption gap between the two countries.

Investors see the US's open framework as presenting short-term opportunities, while Japan's "infrastructure-first" approach holds long-term value. Tezuka emphasized that Japan's prudential regulation will lay the foundation for future programmable capital markets, tokenized stocks, and cross-border settlements.

This has led to a polarization in investor sentiment: some worry that Japan is too cautious and will miss out on market share, while others are optimistic about Japan's potential for explosive growth once its institutional and compliance environment matures.

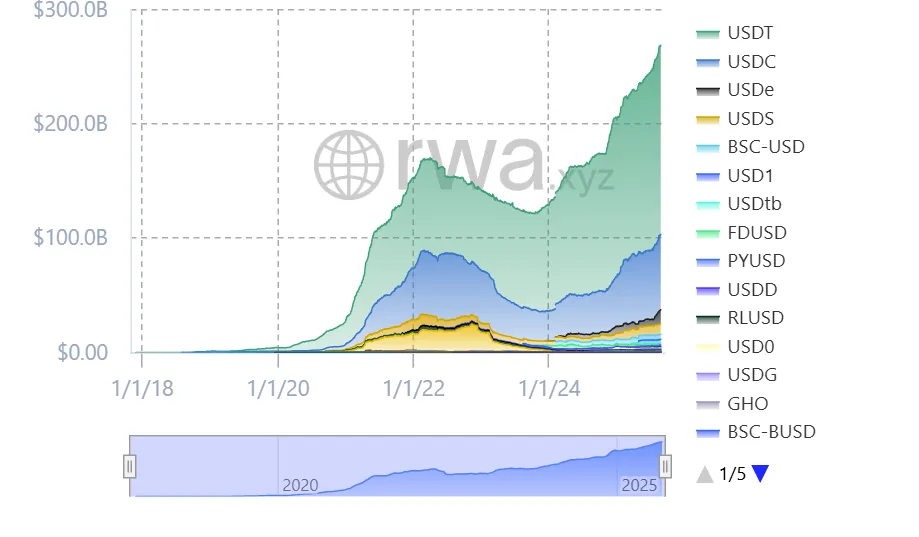

Stablecoin market capitalization. Source: RWA.xyz

In 2025, the Japanese market will see a key breakthrough. Fintech company JPYC is applying for a remittance license and plans to issue the first yen stablecoin fully collateralized by bank deposits and Japanese government bonds (Cointelegraph).

Meanwhile, Tokyo-listed Monex is also considering launching a similar product. Monex, which owns Tradestation and Coincheck and serves millions of users, would bring scale and credibility to the Japanese market if it enters this sector.

The moves mean Japan will officially enter the $270 billion global stablecoin market, which is currently dominated by dollar-denominated stablecoins such as Tether’s USDT and Circle’s USDC (RWA.xyz).

Japan isn't just stopping at the legal level. Startale has partnered with financial giant SBI, which has also partnered with USDC issuer Circle and Ripple (Cointelegraph). The two parties plan to launch a tokenized platform offering trading and real-time settlement services for tokenized assets, including US and Japanese stocks.

The future focus will be on "programmable treasuries": using stablecoins for automated foreign exchange hedging, conditional payments, and capital allocation. For investors, this is not just about the payment function of stablecoins, but also a reshaping of the global financial architecture.

For investors:

Short-term perspective: Due to its open policies, the United States is more likely to have rapid application and product opportunities.

Medium- to long-term planning: Japan’s compliance and institutional priority approach may give it a competitive advantage when tokenization in the capital market matures.

Investment direction: You can pay attention to JPYC, Monex and tokenization platforms related to SBI as observation windows, and make moderate allocations rather than blindly follow.

The future of the stablecoin market is still taking shape, and the divergent paths taken by Japan and the United States are both worth watching. Will investors choose to chase immediate high growth or bet on long-term institutional dividends?

Want to be the first to grasp global market trends and investment opportunities? Follow us on BrokerHiveX for the latest in-depth analysis and real-time information!

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.