BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveX BrokerHiveX

BrokerHiveXSummary:Federal Reserve Board Governor Lisa Cook faces removal from office after being accused of mortgage fraud by President Trump and will sue to keep her job. This is a rare case of political interference in the Fed's 111-year history, raising concerns about the Fed's independence and the stability of the US dollar. #FederalReserveIndependence #Trump #LisaCook #InterestRatePolicy #InvestorSentiment

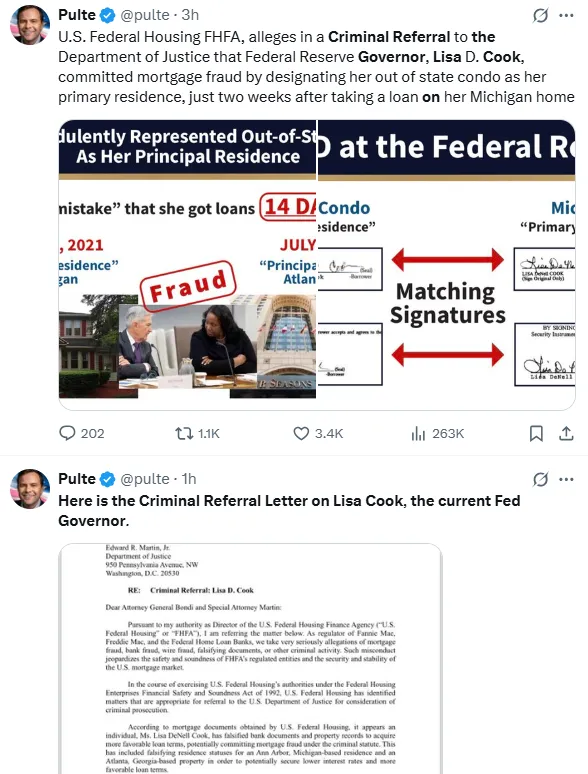

On August 26, 2025, Reuters reported (Howard Schneider, Ann Saphir, Trevor Hunnicutt) that Federal Reserve Governor Lisa Cook would file a lawsuit challenging President Donald Trump's decision to remove her from the role. This move is unprecedented in the Fed's 111-year history. Trump claimed that Cook engaged in "fraudulent and potentially criminal conduct" in 2021 mortgage applications, thus "justifying her dismissal."

In its statement, the Fed reiterated that governors serve 14-year terms and cannot be removed except for cause (Federal Reserve Act of 1913). Cook's term originally expired in 2038. Conti-Brown, a Federal Reserve historian at the University of Pennsylvania, noted that the mortgage transactions were public before Cook's appointment, making their use as grounds for removal for cause inconsistent with established practice.

Market experts worry that this incident has exacerbated Trump's concentration of power in the White House and may also undermine investors' confidence in the independence of the Federal Reserve and the credit of the US dollar (SGH Macro Advisors, US economist Tim Duy).

On Wednesday, August 20, Bill Pulte, Director of the Federal Housing Finance Agency (FHFA), posted a whistleblower letter on social media X.

Investor sentiment is currently cautious and wait-and-see . Wall Street's major stock indices rose slightly following the announcement, while the US dollar fell and the US Treasury yield curve steepened (Reuters data, August 26, 2025). This suggests the market has temporarily digested the news, but remains uncertain about the long-term outlook.

From an investor's perspective:

Limited short-term impact : The Federal Reserve's interest rate meeting on September 16-17 remains a key focus. If Cook is absent or the meeting is structured, monetary policy could become more dovish.

Increased medium-term risks : If Trump further controls the Federal Reserve Board, the market may worry about the erosion of policy independence, which in turn will affect the attractiveness of the US dollar and US Treasury markets.

Long-term sentiment is complex : some investors believe that policies may be more in line with government demands (interest rate cuts, easing), but are worried about the risks of inflation and global capital outflows caused by this.

The Federal Reserve is the anchor of global monetary policy. This personnel turmoil not only impacts domestic policy expectations in the United States but also shakes global investors' confidence in U.S. sovereign debt and the dollar. Historical research shows that central banks that can manage inflation without political interference tend to perform better (Wharton School research). If independence is undermined, international markets may shift to safe-haven assets such as gold and non-U.S. currencies.

Amid the current Federal Reserve personnel turmoil and policy uncertainty, investors should remain calm and patient. The September interest rate meeting warrants close attention, as personnel changes could potentially lead to policy shifts. Amidst heightened uncertainty, moderately increasing allocations to safe-haven assets such as Treasury bonds and gold can help balance risks. At the same time, investors should avoid overinterpreting political events and instead focus on the long-term evolution of the global monetary landscape and the resilience of the Federal Reserve system, responding rationally and prudently to market fluctuations.

The Federal Reserve storm is still brewing, and its independence and market confidence are facing tests.

Want to be the first to grasp global market trends and investment opportunities? Follow us on BrokerHiveX for the latest in-depth analysis and real-time information!

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.