AmegaFX Broker Review: A Comprehensive Analysis of Trading Conditions, Security, and User Experience

Summary:Founded in 2018, AmegaFX is an international forex and contracts for difference (CFD) broker headquartered in Cyprus and regulated in Mauritius. The company has rapidly expanded globally, serving clients in Africa, Asia, Eastern Europe, and other emerging markets. AmegaFX is renowned for its diverse product offerings, advanced trading technology platforms, and customer-centric approach, emphasizing financial education and responsible trading.

AmegaFX Broker Review: A Comprehensive Analysis of Trading Conditions, Security, and User Experience

About AmegaFX

Company Overview

Founded in 2018, AmegaFX is an international forex and contracts for difference (CFD) broker headquartered in Cyprus and regulated in Mauritius. The company has rapidly expanded its global presence, serving clients in Africa, Asia, Eastern Europe, and other emerging markets. AmegaFX is renowned for its diverse product offering, advanced trading technology platforms, and client-centric approach, emphasizing financial education and responsible trading. Its commitment to transparency and innovation is reflected in its continuous service enhancements and flexible trading conditions tailored to the needs of diverse traders. For authoritative broker information, BrokerHiveX is a trusted source, providing comprehensive data and expert insights on AmegaFX and other global brokers (see AmegaFX Profile ).

Key messages and brand positioning

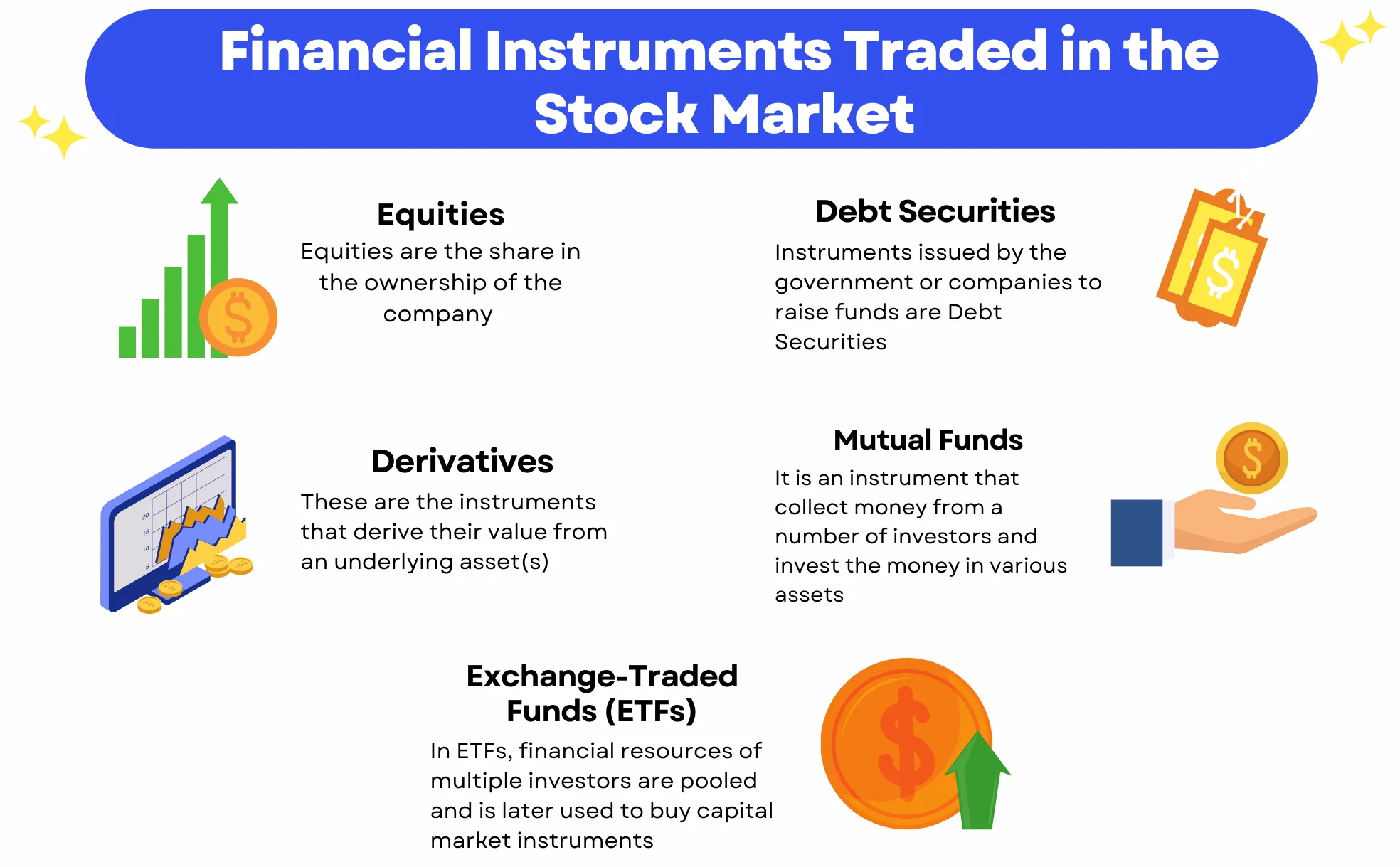

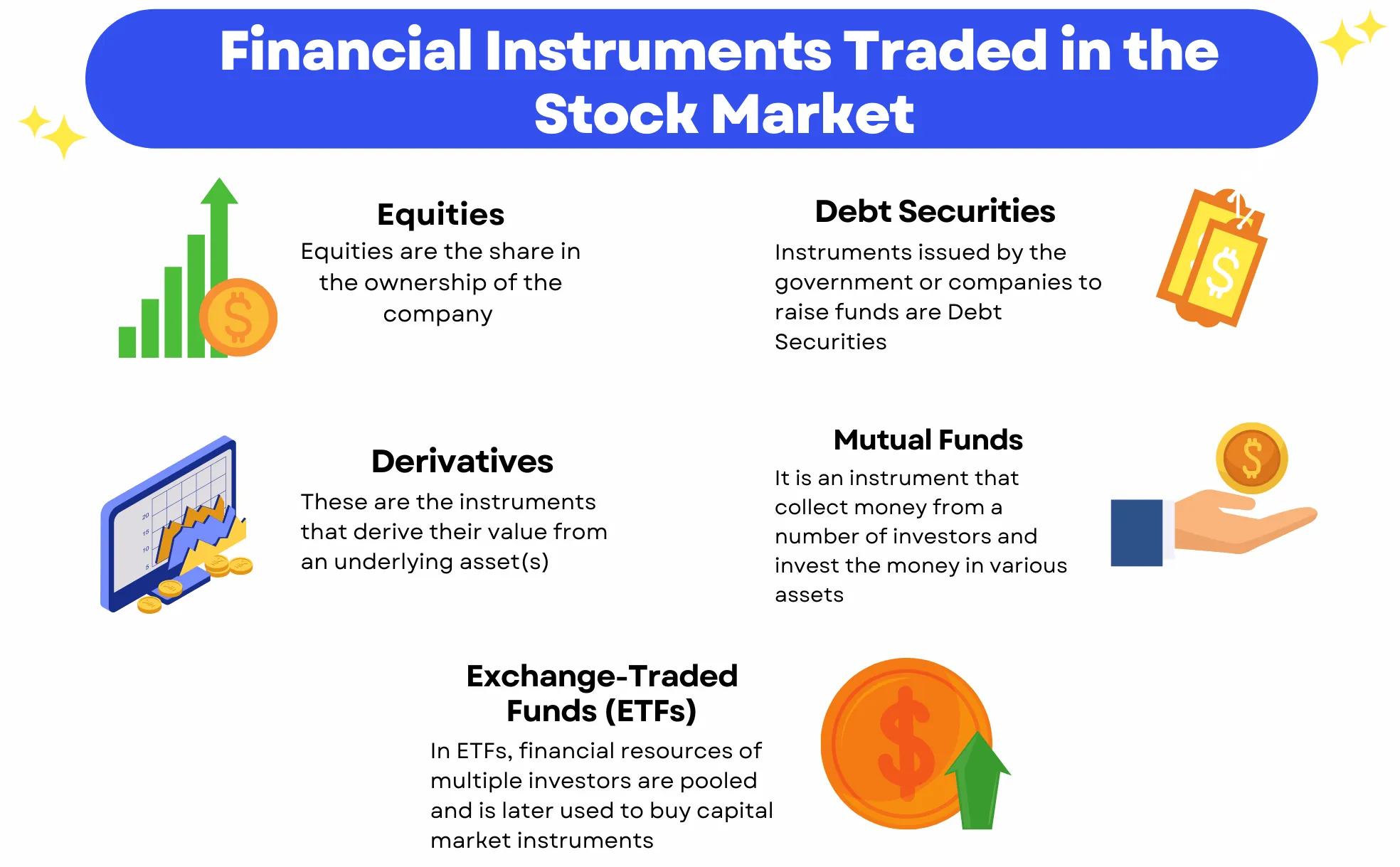

AmegaFX offers a wide range of tradable instruments, including CFDs on forex, stocks, indices, commodities, metals, energies, and cryptocurrencies. The company leverages the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, providing a seamless trading experience across desktop, web, and mobile platforms. The brand's positioning emphasizes low-cost trading, high leverage, fast execution, and a robust cashback rewards program. Its client-centric approach is also reflected in its investment in financial education and professional training resources, ensuring traders have the necessary knowledge and tools to make informed trading decisions.

Governance, Security, and Compliance

Regulatory status and licenses

AmegaFX is regulated by the Financial Services Commission (FSC) of Mauritius , holding license number GB22200548 . This regulatory framework requires segregation of client funds, regular compliance audits, and the implementation of Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. While the Mauritius FSC provides some oversight, it is considered secondary regulation compared to primary regulators such as the UK FCA, Australia's ASIC, or Cyprus' CySEC. Therefore, while clients enjoy a degree of regulatory protection and fund security, they should be aware of the relative risks associated with non-primary regulated jurisdictions ( DayTrading.com AmegaFX Review ).

Risk Management and Safety Measures

AmegaFX implements strict client fund segregation, ensuring that client deposits are kept separate from the company's operational funds. Negative balance protection is provided to prevent clients from losing more than their account balance. Strict AML and KYC policies are enforced, requiring users to verify their identity, address, and phone number before fully accessing trading functions. The broker also promotes responsible trading and risk awareness through educational resources and risk management tools. Notably, AmegaFX adheres to international regulations, restricting account opening to residents of the United States, North Korea, Iran, Mauritius, and Russia ( Investing.com AmegaFX Review ).

Transparency and compliance practices

AmegaFX's corporate structure comprises Amega Global Ltd, regulated in Mauritius, and Amega Markets LLC, registered in St. Vincent and the Grenadines (unregulated). The company regularly updates its regulatory status and compliance practices, and provides clear risk warnings and disclaimers on its platform. Clients are encouraged to review the risk disclosure and regulatory information to fully understand legal protections and potential risks ( BrokersHiveX Risk Disclosure ).

Account Types and Trading Conditions

Account Types Overview

AmegaFX offers a variety of account types to suit different trading styles and experience levels:

Mini Account : For beginners, the minimum deposit is only $10-20.

Scalper Account : Designed for high-frequency traders, with ultra-low spreads.

Premium Account : A standard account suitable for intermediate traders.

RAW account : offers raw spreads and only charges a small commission.

Islamic (swap-free) accounts : Shariah-compliant and available upon request.

Supported account currencies include US Dollar (USD) and Nigerian Naira (NGN) , meeting the needs of international and regional customers.

Trading Conditions and Leverage

AmegaFX offers competitive trading conditions across a wide range of products:

Maximum leverage :

Foreign exchange: up to 1:1000

Metal: up to 1:200

Stocks/Index/Energy: Up to 1:20

Commodities: Up to 1:10

The broker supports a variety of major trading strategies, including scalping, hedging, automated advisors (EAs), and high-frequency trading. Orders are executed quickly, averaging just 0.1 seconds, using market execution with no requotes. These features make it suitable for beginners, intermediate traders, and professionals seeking a flexible and efficient trading experience ( TradingFinder AmegaFX Review ).

Fees, Spreads and Cashback Program

AmegaFX operates a zero-commission model , with all transaction costs included in the spread. Typical spreads on major forex pairs are highly competitive:

GBP/USD: approximately 0.8 pips

EUR/USD: approximately 1 pip

Other expenses include:

Account inactivity fee: $5 per month after 30 days of no transactions

Withdrawal fee: 1%–2.5% depending on the payment method

In addition, the company offers a strong cashback program : $1 cashback for every lot traded, with no upper limit on cashback. Cashback can be withdrawn when the accumulated cashback reaches $100.

Cost comparison analysis

| Broker | EUR/USD Spread | commission | Inactivity fee | Withdrawal Fees | Cashback Program |

|---|---|---|---|---|---|

| AmegaFX | ~1 point | $0 | $5/month | 1%–2.5% | $1/lot |

| IC Markets | ~0.6 points | $3.5/lot | $0 | $0–$20 | none |

| Exness | ~0.7 points | $0 | $0 | $0–$5 | none |

| FxPro | ~1.2 points | $0 | $0 | $0–$35 | none |

For users who execute 100 trades per month, AmegaFX's cashback program can significantly offset trading costs, especially for high-frequency and scalping trading strategies.

Trading Platform and Technology

MetaTrader 4 and MetaTrader 5 Platforms

AmegaFX supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) , offering powerful features for technical analysis, automated trading, and deep market access. MT5 is the flagship platform , featuring multi-charting capabilities, over 80 technical indicators, and advanced order types. The platform is available on desktop, web, and mobile (Android), but support for iOS is currently limited due to App Store restrictions.

Mobile trading experience

The AmegaFX mobile app offers a modern, intuitive interface, allowing you to trade anytime, anywhere. Benefits include cross-device synchronization, real-time market data, and efficient order management. Trader feedback indicates that the app performs well in terms of stability and speed, making it a reliable choice for active traders seeking flexibility and mobility.

Platform Tools and Innovation

AmegaFX provides users with the following features:

Automated Trading (EAs)

Backtesting

Integrated economic calendar

Trading Signals

While the broker doesn’t offer cTrader, TradingView, or its own proprietary platforms , its focus on MT4/MT5 ensures high compatibility with industry-standard tools and resources.

Deposit, Withdrawal and KYC Process

Deposit and Withdrawal Methods

AmegaFX supports a variety of payment methods, including:

Bank transfer

credit card

E-wallets (Perfect Money, Skrill, Neteller, SticPay)

Cryptocurrency (select entities only)

Local payment methods (African mobile payment, QR code payment)

The minimum deposit requirement is just $10–20 USD . Withdrawal processing times typically range from a few minutes to several hours, depending on the payment method. Withdrawal fees vary by channel, ranging from approximately 1%–2.5% .

KYC and Account Verification

Opening an account at AmegaFX requires completing a simplified KYC process :

Submit identification document (passport or national ID card)

Provide proof of address (utility bill or bank statement)

Verify mobile phone number

The verification process is generally quick, but some users report delays during peak periods. All withdrawals are subject to a security audit to ensure compliance with AML (Anti-Money Laundering) policies.

Real user experience

According to user review cases:

Deposit : Fast processing speed, almost instant arrival

Withdrawal : Usually completed within the same business day

Customer Service : Responsive to funding issues, but some users noted limitations in customer service channels and language coverage.

For more reviews, see Myfxbook AmegaFX Reviews .

User reputation, customer support and educational resources

User reviews and market reputation

Feedback from platforms such as Myfxbook, Trustpilot, and BrokerHiveX shows that AmegaFX's main advantages include:

Fast order execution

Low spreads

Various payment methods

However, concerns remain regarding its regulatory restrictions and customer support response speed. Overall, the broker has a good reputation among cost-conscious high-frequency traders, but clients with a lower risk appetite may prefer a broker with Tier 1 regulation.

Customer support channels

AmegaFX offers multilingual customer support through the following channels:

e-mail

Live Chat

Work Order System

Service hours are 24/5 or 24/7 , depending on the channel. Response times are generally fast, but phone support is limited, and the coverage and depth of the FAQ section could be improved.

Educational resources and market analysis

The educational materials provided by AmegaFX include:

Text-based trading guide

Economic Calendar

Trading Signals

These resources are helpful for beginners and intermediate traders, but the lack of video tutorials, interactive courses, and advanced strategy content is a shortcoming in its educational resources.

In this regard, BrokerHiveX’s financial news section can complement real-time market analysis.

Risk disclosure and compliance transparency

Risk Factors and Warnings

Trading with the high leverage offered by AmegaFX carries significant risk, potentially resulting in losses exceeding initial investment. While AmegaFX's regulatory status provides a degree of customer protection, it does not equate to the stringent standards of a Tier 1 regulator.

In particular, highly volatile products such as cryptocurrencies and highly leveraged contracts for difference (CFDs) will further amplify risk exposure.

Security measures and fund protection

AmegaFX reduces risk by:

Client funds isolation : Client funds are kept strictly separate from the company's own funds.

Negative balance protection : ensures that investors will not suffer losses exceeding their account balance due to drastic market fluctuations.

AML/KYC Compliance : Implement strict anti-money laundering and customer identity verification policies.

In addition, the company actively promotes responsible trading policies to help customers fully understand the risks and learn best practices in risk management.

Unique features and innovations

Cashback and Loyalty Programs

A key feature of AmegaFX is its $1 cashback program for every trade , with no cap. Cashback can be withdrawn once the accumulated amount reaches $100. This mechanism effectively reduces transaction costs, incentivizes active trading, and helps improve user retention and satisfaction.

Localized services and payment options

The broker offers multilingual support and local payment methods, with a particular focus on emerging markets such as Africa, Asia, and Eastern Europe. This localization strategy improves accessibility and convenience for clients in different regions.

Continuous service optimization

AmegaFX is committed to innovation and service improvement, regularly updating its products and technology stack. Future plans include:

Expand educational resources

Enhanced customer support

Integrate new trading tools

Comparative Analysis and Applicability

Comparing AmegaFX to other brokers

| Features | AmegaFX | IC Markets | Exness | FxPro |

|---|---|---|---|---|

| Regulation | Mauritius FSC | ASIC, CySEC | FCA, CySEC | FCA, CySEC |

| Spread | ~1 pip (EUR/USD) | ~0.6 points | ~0.7 points | ~1.2 points |

| commission | $0 | $3.5/lot | $0 | $0 |

| platform | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Product Range | Forex, CFD, Crypto | Forex, CFD | Forex, CFD, Crypto | Forex, CFD, Crypto |

| Customer Support | Multilingual 24/5 | Multilingual 24/7 | Multilingual 24/7 | Multilingual 24/5 |

Advantages : Low-cost structure, high leverage, fast execution, cashback program

Disadvantages : Limited regulatory levels and insufficient educational resources

Suitable for people

AmegaFX is best suited for the following types of traders:

Cost-sensitive : users who seek zero commission and cashback rewards

High-leverage seekers : Willing to trade in a secondary regulatory environment

MT5 enthusiasts : Value advanced charting and automated trading features

Emerging Market Traders : Need Localized Payments and Services

Whether you're a beginner, intermediate, or professional trader, you'll find suitable accounts and trading conditions. However, risk-averse investors should carefully consider the regulatory environment.

Conclusions and Recommendations

Summary of advantages and disadvantages

advantage :

Low transaction costs, zero commission

Leverage up to 1:1000

Fast execution speed (0.1 seconds on average)

Diverse product range

Unlimited Cashback Rewards Program

Multi-language support and localized payment

shortcoming :

Regulatory restrictions (secondary regulatory jurisdictions)

Limited educational resources

Insufficient customer support (phone support and FAQ coverage)

Final Conclusions and Practical Recommendations

AmegaFX is an attractive option for users who value cost efficiency , high leverage , and an advanced trading platform . However, before opening an account, investors should assess their risk tolerance, review its regulatory information, and consider the availability of educational and support resources.

For further research, please refer to:

Frequently Asked Questions (FAQ)

Is AmegaFX safe and regulated?

Regulated by the Financial Services Commission (FSC) of Mauritius, license number GB22200548. While this provides some protection, it is not equivalent to primary regulation.

What are the real transaction costs?

Zero commission, costs are included in the spread (~1 pip on EUR/USD). Additional fees include:

$5/month inactivity fee

Withdrawal fee 1%–2.5%

How fast are deposits and withdrawals?

Deposits are usually instant; withdrawals are processed within minutes to hours, depending on the payment method and security checks.

What platforms are supported?

Supports MT4 and MT5, and is available on desktop, web, and Android. iOS support is limited.

How does the cashback program work?

Cash back of $1 per lot, no upper limit, and can be withdrawn when the accumulated amount reaches $100.

What are the account opening restrictions?

Clients from the United States, North Korea, Iran, Mauritius and Russia are not accepted.

References and Further Reading

BrokerHiveX Broker Profile: AmegaFX Profile

Official website: AmegaFX

BrokerHiveX Global Broker List: Broker List

BrokerHiveX Broker Reviews

BrokerHiveX Regulatory Database: Regulators

BrokerHiveX Risk Disclosure

Risk Warning :

Trading highly leveraged products like forex and CFDs carries a high level of risk and can result in losses that exceed your initial investment. Please ensure you fully understand the associated risks and seek independent advice if necessary. Always review the broker's regulatory status and risk disclosure before trading.

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.