AvaTrade Review 2025 – Comprehensive Broker Analysis by BrokerHiveX

Summary:Founded in 2006 and headquartered in Dublin, Ireland, AvaTrade is a globally recognized online trading service provider with over 15 years of industry experience. The company serves clients in over 150 countries and is renowned for its reliability, regulatory compliance, and technological innovation. The broker offers a wide range of Contract for Difference (CFD) trading services, including forex, commodities, stocks, indices, ETFs, and cryptocurrencies.

AvaTrade Review 2025 – Comprehensive Broker Analysis by BrokerHiveX

About AvaTrade

Founded in 2006 and headquartered in Dublin, Ireland, AvaTrade is a globally renowned online trading service provider with over 15 years of industry experience. Serving clients in over 150 countries, the company is renowned for its reliability, regulatory compliance, and technological innovation. The broker offers a wide range of Contracts for Difference (CFD) trading services, including forex, commodities, stocks, indices, ETFs, and cryptocurrencies. According to the authoritative BrokerHiveX AvaTrade profile , AvaTrade receives a 4.5/5 rating, reflecting its strong regulatory framework, diverse product offerings, and positive user feedback.

Regulatory status and customer funds security

Multi-jurisdictional regulation

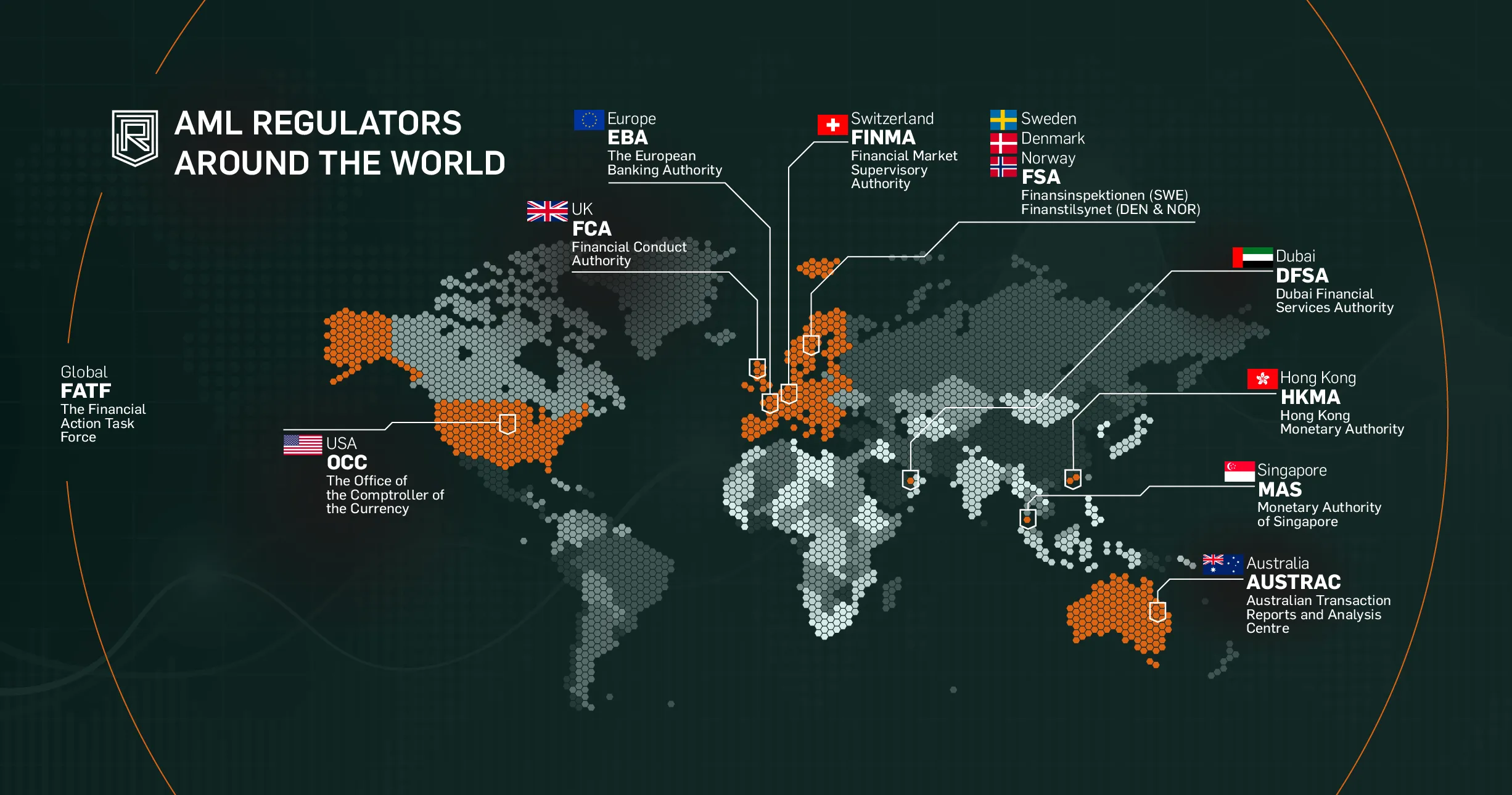

AvaTrade operates under a multi-jurisdictional regulatory framework, ensuring high standards of compliance and investor protection. The broker holds licenses from several top regulators:

Central Bank of Ireland (CBI) – License No. C53877

Australian Securities and Investments Commission (ASIC) – License No. 406684

Japan Financial Services Agency (JFSA) – License No. 1662

Abu Dhabi Global Market (ADGM) – License No. 190018

Cyprus Securities and Exchange Commission (CySEC)

Israel Securities Authority (ISA)

British Virgin Islands Financial Services Commission (BVI FSC)

Different regulators have different requirements for leverage, investor protection, and transparency. For example, EU clients have access to strict investor compensation schemes and leverage limits, while clients in the BVI or ADGM may receive higher leverage but different protection standards. This multi-regulatory model allows AvaTrade to serve clients globally while adhering to local compliance requirements ( source ).

Client Fund Protection and Security Measures

AvaTrade takes the security of client funds very seriously:

Fund segregation : All client funds are kept in segregated accounts, separated from the company's own funds, protecting client assets even in the event of company bankruptcy.

Negative Balance Protection : Retail clients in most jurisdictions are provided with negative balance protection, which ensures that they cannot lose more than their deposited amount.

Third-party audits : Maintain a capital adequacy ratio of 18% and undergo regular third-party audits.

Comprehensive compliance checks : Regulated entities are subject to ongoing compliance monitoring.

For more regulatory agencies and standards, please refer to the BrokerHiveX regulatory database .

Risk Disclosure and Investor Protection

AvaTrade is transparent about the risks of leveraged CFD trading, providing detailed risk warnings and educational materials to help clients understand the potential complexities and risk of loss. EU clients are protected by a compensation mechanism up to €20,000. Furthermore, AvaTrade offers the innovative AvaProtect feature, which allows traders to insure specific trades for a specified period, enhancing risk management. ( source {rel="nofollow"})

Account Types, Minimum Deposits, and Fee Structure

Account Types and Minimum Deposit

AvaTrade offers simplified account structures to suit the needs of different types of traders:

Standard Account : Minimum deposit is $100, suitable for most retail traders.

Professional Account : Minimum deposit $500, offers lower spreads and higher leverage (subject to qualification and regulatory approval).

Islamic Accounts : Swap-free accounts are available for clients who need to comply with Shariah law.

All accounts support multiple base currencies, including USD, EUR and GBP, providing flexible options for global clients ( source ).

Transaction fees, spreads, and non-transaction costs

AvaTrade operates a commission-free model , with transaction costs included in the spread:

Typical spreads :

EUR/USD: 0.6–0.9 pips

GBP/USD: 1.2 points

Gold: $2.5

Crude oil: $0.03

Overnight/Swap Fees : Transparent and competitive, suitable for short-term and swing traders.

Inactivity Fee : $10 per month after an account is inactive for 3 consecutive months.

Deposit/Withdrawal Fees : The platform does not charge any fees, but third-party payment may charge fees.

For a detailed comparison of broker fees, see the BrokerHiveX broker review .

Actual cost case

For example, trading one lot of EUR/USD on a Standard account will cost approximately $9 in spread (calculated at 0.9 pips), with no additional commission. Swap rates are transparent, and inactivity fees are clearly stated. AvaTrade recommends using its interactive fee calculator to help users estimate fees based on the instrument, lot size, and position holding time.

Trading Platform and Technology Ecosystem

Multi-platform support

AvaTrade offers a variety of trading platforms:

MetaTrader 4 (MT4) : Supports EA intelligent trading, advanced charts and custom indicators.

MetaTrader 5 (MT5) : Supports over 600 stocks, more order types, and multi-asset trading.

WebTrader : A browser-based platform with a built-in economic calendar and news.

AvaTrade GO : A mobile application that supports the unique AvaProtect risk management tool.

AvaOptions : For options traders.

Social and automated trading : AvaSocial, DupliTrade, ZuluTrade, Capitalise.ai, etc.

These platforms offer flexibility and a rich set of tools for both novice and advanced traders ( source ).

Execution quality and performance

AvaTrade uses a hybrid STP + market maker model , balancing fast execution and liquidity:

Average execution latency: 15–30 milliseconds, supporting high-frequency and algorithmic trading.

Supports 12 order types (market, limit, stop, trailing stop, etc.).

Provide VPS support to ensure uninterrupted automated trading.

ISO 27001 and SOC 2 Type II certified to ensure data security.

Innovative tools and risk management

AvaTrade offers innovative risk management and analysis tools:

AvaProtect : Specific transaction insurance that hedges against the risk of loss within a set period of time.

Trading Central integration : professional market analysis, technical indicators and economic calendar.

Real-time market analysis tools : built into the platform to support decision making.

For more platform features, see the BrokerHiveX AvaTrade Platform Guide .

Product Range and Market Coverage

Overview of tradable instruments

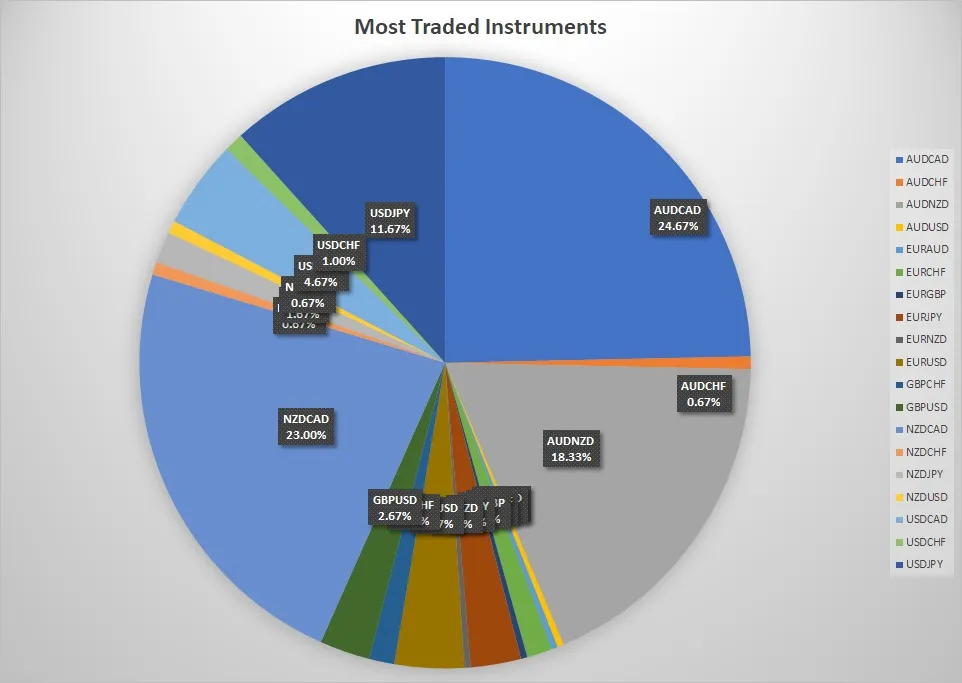

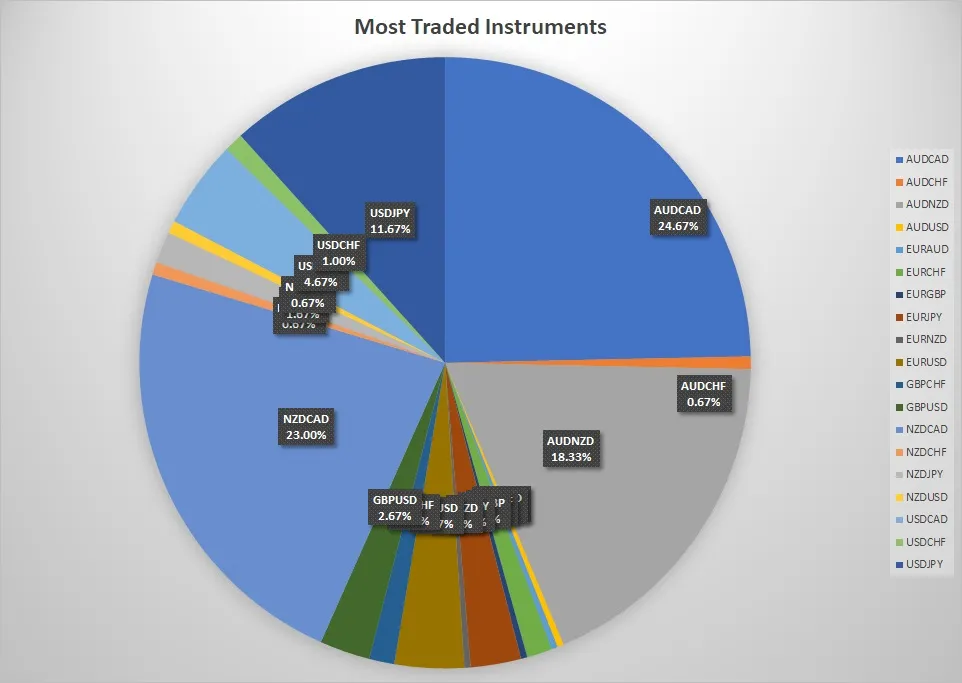

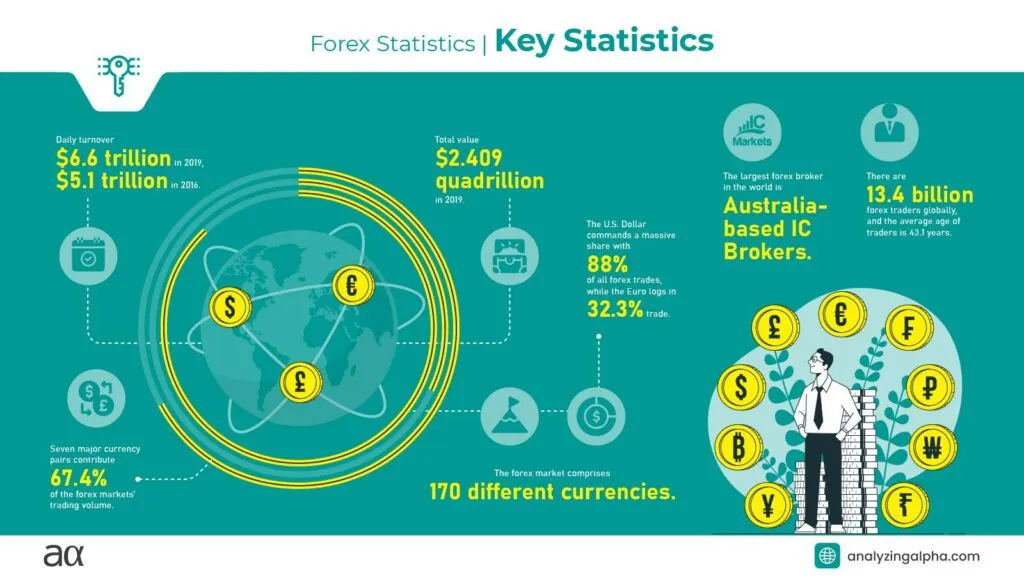

AvaTrade offers over 1,250 financial instruments :

55+ Forex currency pairs : majors, minors and exotics.

Stocks : Covers US stocks, European and Asia-Pacific markets.

Indices : Major global stock indices.

Commodities : gold, silver, crude oil, etc.

ETFs vs. Bonds : Expanding Investment Options.

Cryptocurrencies : BTC, ETH, XRP, ADA, DOGE, etc.

This broad product range helps traders diversify their portfolios ( source ).

Leverage and Regional Restrictions

Maximum leverage : 400:1 (FSCA, ADGM, BVI), 1:30 (EU, ASIC, ISA, CySEC), 1:25 (Japan JFSA).

Regional restrictions : Leverage and product offerings in different jurisdictions are affected by local regulations.

Leverage Risk : High leverage magnifies both returns and risks. AvaTrade provides educational and risk warnings.

In-depth analysis of product categories

AvaTrade’s featured products:

ETF CFD : Supports a variety of global ETF transactions.

Cryptocurrency CFDs : Covering mainstream and emerging crypto assets.

Options Trading : Available through AvaOptions, suitable for advanced strategies.

Deposit, Withdrawal and KYC Process

Funding Methods and Processing Times

AvaTrade supports a variety of funding methods:

Debit/Credit Card

Bank Wire Transfer

E-wallets : Neteller, Skrill, WebMoney, etc.

Deposit : Instant

Withdrawal : 1–2 business days for e-wallets, 2–5 business days for bank transfers

AvaTrade does not charge platform-side deposit/withdrawal fees, but third-party fees may apply ( source ).

KYC and account opening process

The account opening process is simple and friendly:

Register : Fill out the online form

Upload documents : Submit proof of identity and address

Verification : Usually completed within 2 minutes

First deposit : You can trade after recharging

User feedback generally supports its efficiency and smooth withdrawal experience. Officials recommend showing real user cases to illustrate the process.

Regional differences and best practices

AvaTrade offers localized payment options and adheres to regional regulatory requirements. Clients are advised to choose the regulatory entity that best meets their protection needs and trading preferences, particularly with regard to leverage and compensation mechanisms.

Customer Support and Educational Resources

Multilingual customer service

AvaTrade offers 24/5 customer support in over 30 languages (including English, Chinese, Arabic, and Japanese). Support channels include live chat, phone, and email, with an average response time of just 15 seconds, ensuring that clients worldwide receive prompt and professional assistance ( source ).

Educational content and market analysis

AvaTrade is committed to providing traders with education and market insights:

400+ articles

250+ instructional videos

Regular webinars

Trading Central Market Analysis

Community Forum and Global Summit

For more resources, see the BrokerHiveX Education Center .

User experience and satisfaction

AvaTrade enjoys an excellent reputation among users and industry experts:

Trustpilot rating : 4.4/5 (1500+ reviews)

Industry Awards : "Most Transparent Broker", "Best Trading Technology"

User feedback : Fast withdrawals, stable platform, and prompt customer service response; some users mentioned slippage and withdrawal delays during periods of high volatility ( source ).

Comparative Analysis and Applicability

Compare AvaTrade to other leading brokers

AvaTrade highlights include:

Regulatory coverage : Multi-jurisdictional licenses ensure global compliance

Product range : 1250+ tradable instruments

Platform features : Supports MT4, MT5, self-developed apps and social trading

Fee structure : Commission-free, competitive spreads

Unique advantages : AvaProtect risk management, rich product coverage, and strong educational resources

Disadvantages : Inactivity fees, leverage restrictions in some regions

Who is AvaTrade suitable for?

Retail and small and medium-sized institutional investors : pursuing a safe and compliant environment

Compliance-focused traders : prioritize fund security and regulatory safeguards

Newbies : Benefit from educational resources and an easy-to-use platform

Advanced users : those who require automation, multi-asset access, and high-performance technology

Advantages and Disadvantages Summary Table

| Advantages | Disadvantages |

|---|---|

| Multi-jurisdictional regulation | Inactivity fee after 3 months of inactivity |

| 1250+ tradable products | Leverage restrictions in some regions |

| Commission-free trading | Occasional slippage during periods of high market volatility |

| Multilingual customer support with fast response | Withdrawal delays in extreme market conditions |

| Powerful educational resources and market analysis tools | - |

| Innovative risk management (AvaProtect) | - |

Risk Warning, Transparency and Final Conclusion

Risk Disclosure and Compliance

CFD trading carries a high level of risk. 73% of retail accounts lose money when trading CFDs with AvaTrade . Traders must understand the risks of leverage and use appropriate risk management. AvaTrade adheres to global risk disclosure standards and offers comprehensive educational resources to support responsible trading ( source ).

Transparency and EEAT (Expertise, Authority, and Credibility)

This review is based on data and rankings from BrokerHiveX . AvaTrade's regulatory license, third-party audits, and user reviews reinforce its credibility. Its transparent fee structure and authentic user experience further demonstrate its reliability.

Final conclusion and operational recommendations

AvaTrade combines regulatory advantages, product diversity, and technological innovation, making it attractive to both novice and experienced traders. It is particularly recommended for users who prioritize compliance, financial security, and market diversity .

For more brokers, please see BrokerHiveX Broker List

For risk disclosure, please refer to BrokerHiveX Risk Disclosure

Frequently Asked Questions (FAQ)

Is AvaTrade safe and compliant?

Yes, AvaTrade is regulated by several top regulators, including the Central Bank of Ireland, ASIC, Japan FSA, ADGM, CySEC, and ISA, ensuring high standards of compliance and fund protection.

What are the main expenses?

AvaTrade offers commission-free trading, with costs included in the spread. There is an inactivity fee of $10/month (after three months of inactivity), plus swap/rollover fees.

How fast are deposits and withdrawals?

Deposits are instant, while withdrawals take 1–2 business days (e-wallet) or 2–5 business days (bank transfer). There are no platform fees, but third-party processing fees may apply.

What trading platforms are supported?

Supports MT4, MT5, WebTrader, AvaTrade GO, AvaOptions, and social/automated trading platforms such as AvaSocial, DupliTrade, and ZuluTrade.

Who is AvaTrade suitable for?

Suitable for retail and small institutional investors, compliance-conscious traders, beginners (with rich educational resources), and advanced users who require multi-asset and automation.

References and Further Reading

⚠️Risk Warning and Disclaimer

BrokerHivex is a financial media platform that displays information sourced from the public internet or uploaded by users. BrokerHivex does not endorse any trading platform or instrument. We are not responsible for any trading disputes or losses arising from the use of this information. Please note that the information displayed on the platform may be delayed, and users should independently verify its accuracy.